Answered step by step

Verified Expert Solution

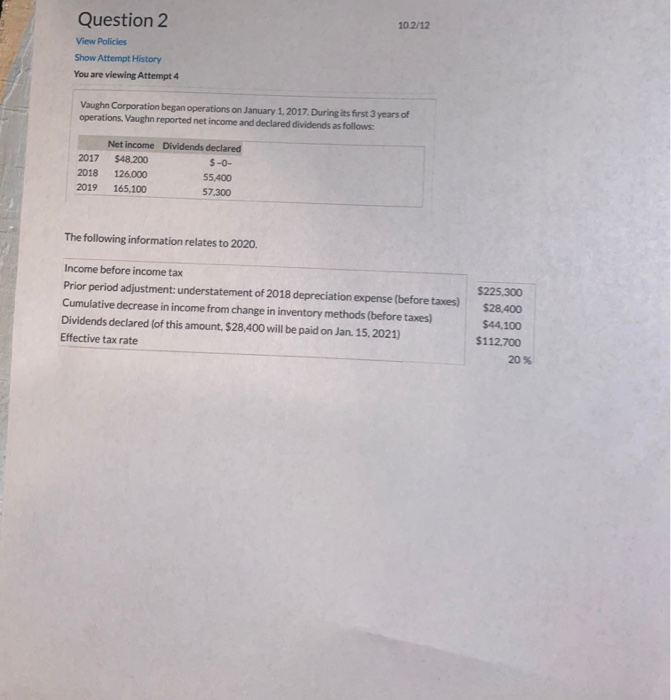

Question

1 Approved Answer

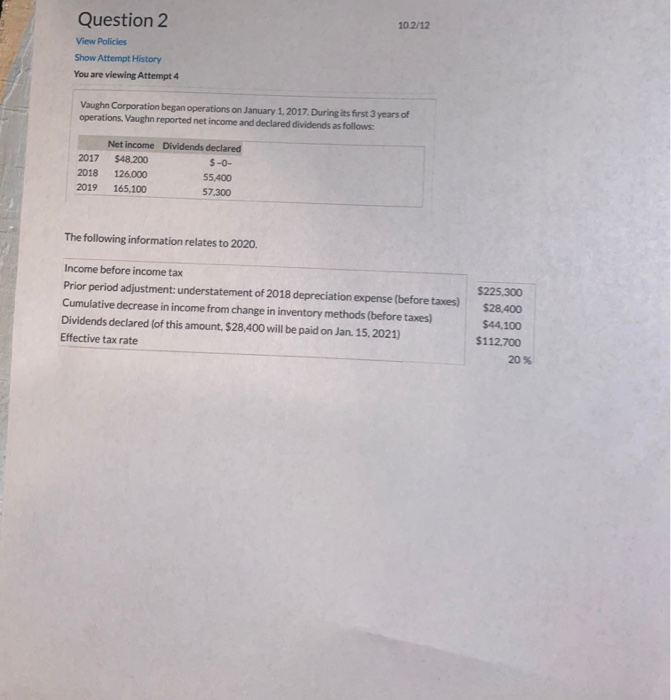

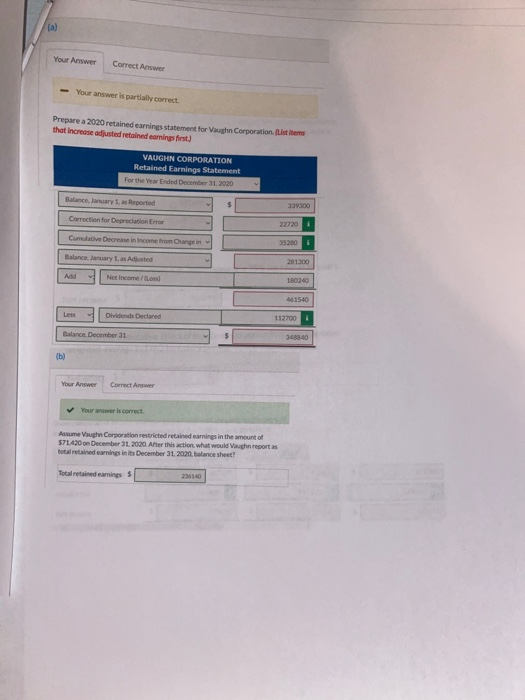

on the second picture there are a bunch of answers that the edges are highlighted red. Those answers are wrong and if you can tell

on the second picture there are a bunch of answers that the edges are highlighted red. Those answers are wrong and if you can tell me the righr answers and how you got those answers, that will be great. Also, for net income/ loss i got the correct answer of 180240. i cant remeber the steps to get that answer, so if you can go over that also then that will be a real help. thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started