Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On the surface, it seems that a firm would want to hold high levels of current assets to stay liquid and ensure that it can

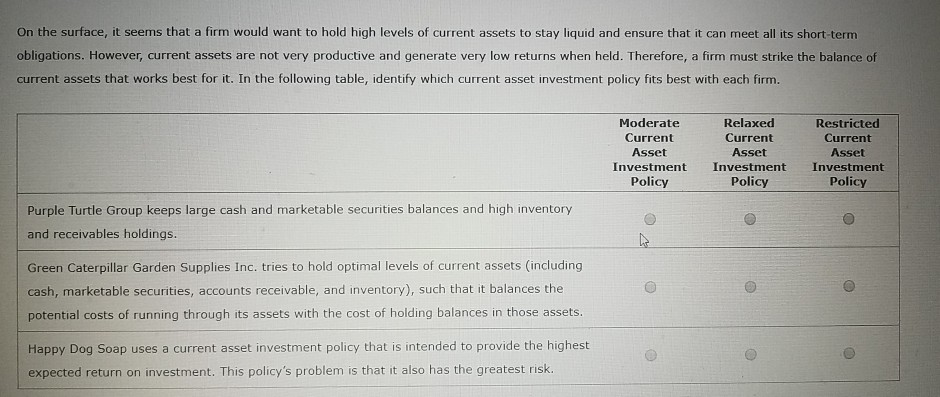

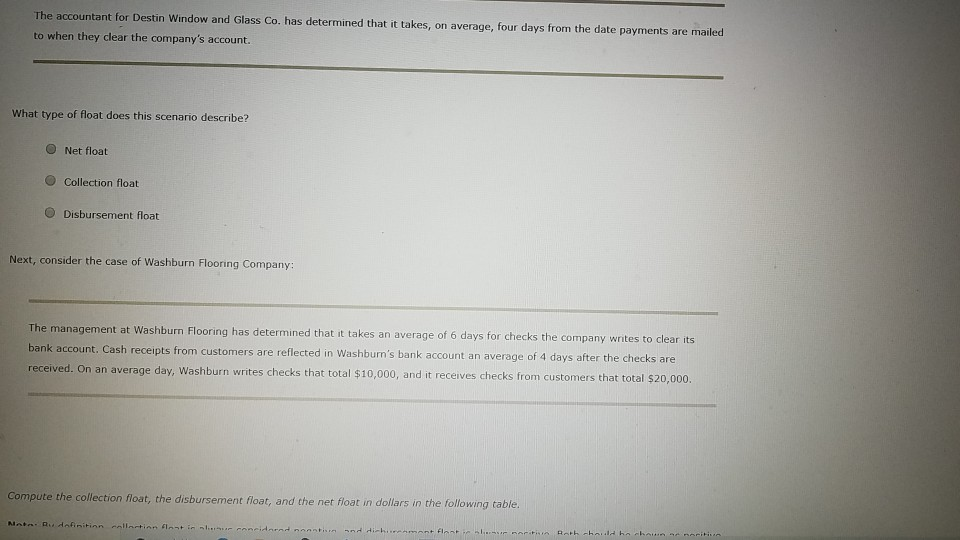

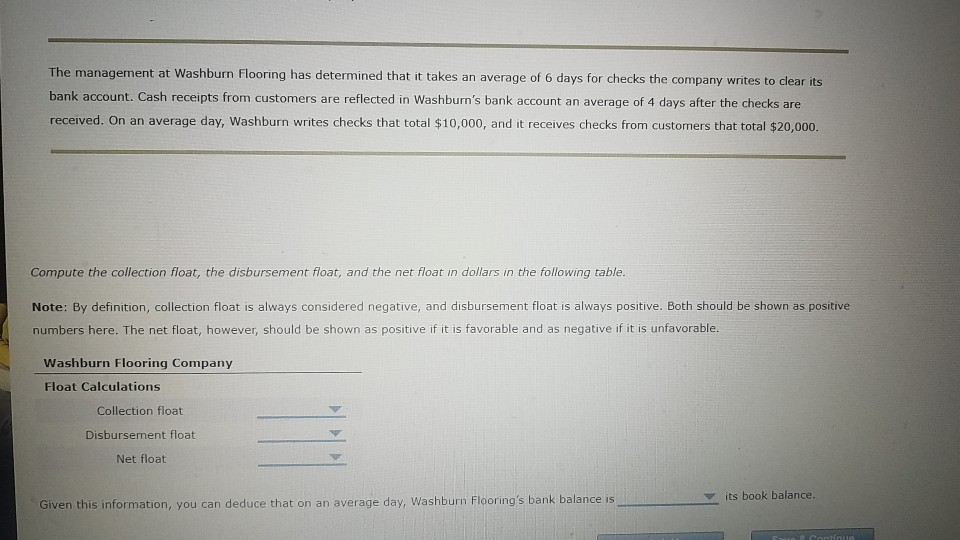

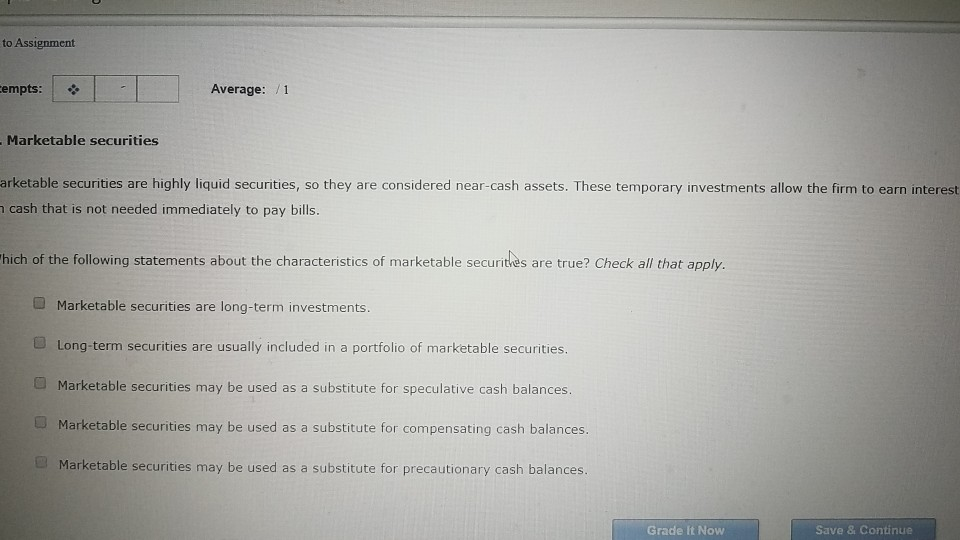

On the surface, it seems that a firm would want to hold high levels of current assets to stay liquid and ensure that it can meet all its short-term obligations. However, current assets are not very productive and generate very low returns when held. Therefore, a firm must strike the balance of current assets that works best for it. In the following table, identify which current asset investment policy fits best with each firm. Moderate Current Asset Investment Policy Relaxed Current Asset Investment Policy Restricted Current Asset Investment Policy Purple Turtle Group keeps large cash and marketable securities balances and high inventory and receivables holdings. Green Caterpillar Garden Supplies Inc. tries to hold optimal levels of current assets (including cash, marketable securities, accounts receivable, and inventory), such that it balances the potential costs of running through its assets with the cost of holding balances in those assets. Happy Dog Soap uses a current asset investment policy that is intended to provide the highest expected return on investment. This policy's problem is that it also has the greatest risk. The accountant for Destin Window and Glass Co. has determined that it takes, on average, four days from the date payments are mailed to when they clear the company's account. What type of float does this scenario describe? Net float Collection float Disbursement float Next, consider the case of Washburn Flooring Company The management at Washburn Flooring has determined that it takes an average of 6 days for checks the company writes to clear its bank account. Cash receipts from customers are reflected in Washburn's bank account an average of 4 days after the checks are received. On an average day, Washburn writes checks that total $10,000, and it receives checks from customers that total $20,000. Compute the collection float, the disbursement float, and the net float in dollars in the following table. The management at Washburn Flooring has determined that it takes an average of 6 days for checks the company writes to clear its bank account. Cash receipts from customers are reflected in Washburn's bank account an average of 4 days after the checks are received. On an average day, Washburn writes checks that total $10,000, and it receives checks from customers that total $20,000. Compute the collection float, the disbursement float, and the net float in dollars in the following table. Note: By definition, collection float is always considered negative, and disbursement float is always positive. Both should be shown as positive numbers here. The net float, however, should be shown as positive if it is favorable and as negative if it is unfavorable. Washburn Flooring Company Float Calculations Collection float Disbursement float Net float its book balance. Given this information, you can deduce that on an average day, Washburn Flooring's bank balance is to Assignment empts: Average: /1 Marketable securities arketable securities are highly liquid securities, so they are considered near-cash assets. These temporary investments allow the firm to earn interest cash that is not needed immediately to pay bills. Which of the following statements about the characteristics of marketable securities are true? Check all that apply. Marketable securities are long-term investments. Long-term securities are usually included in a portfolio of marketable securities Marketable securities may be used as a substitute for speculative cash balances. Marketable securities may be used as a substitute for compensating cash balances. Marketable securities may be used as a substitute for precautionary cash balances. Grade It Now Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started