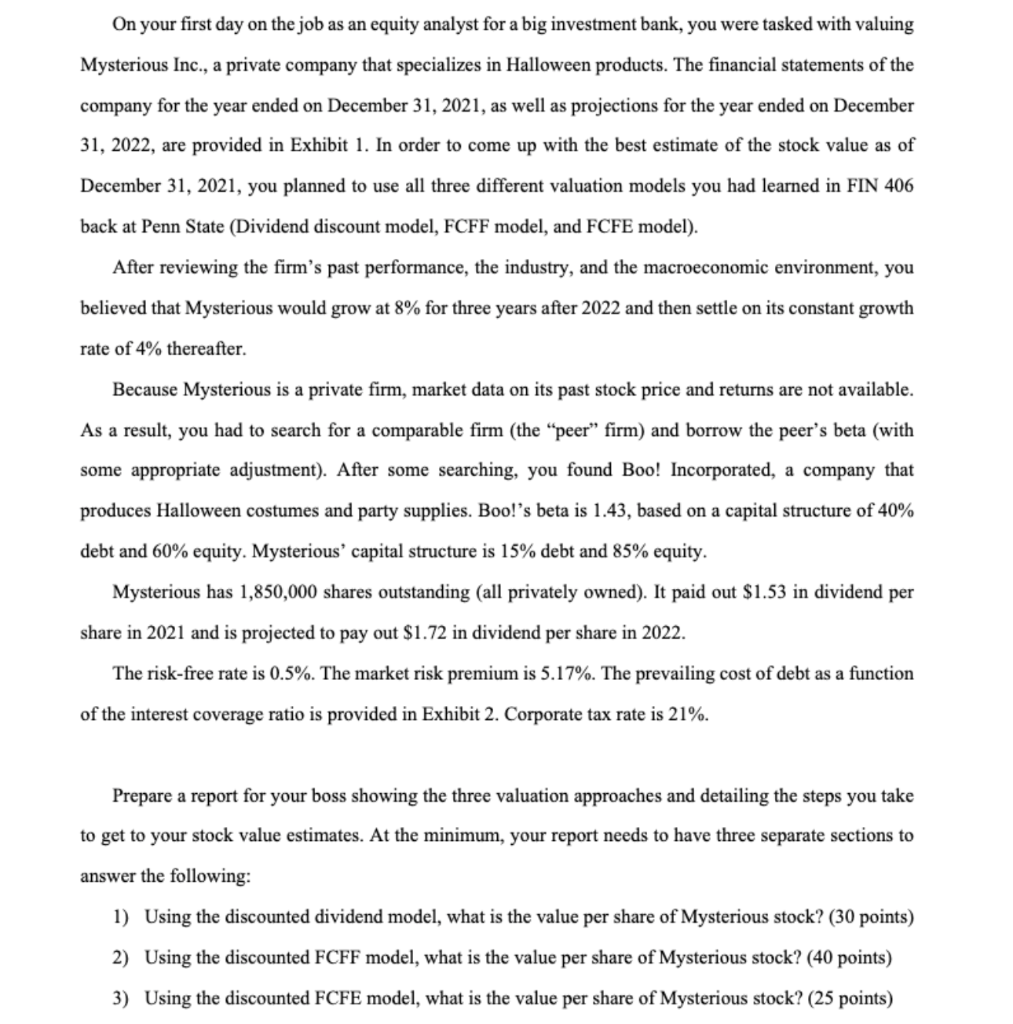

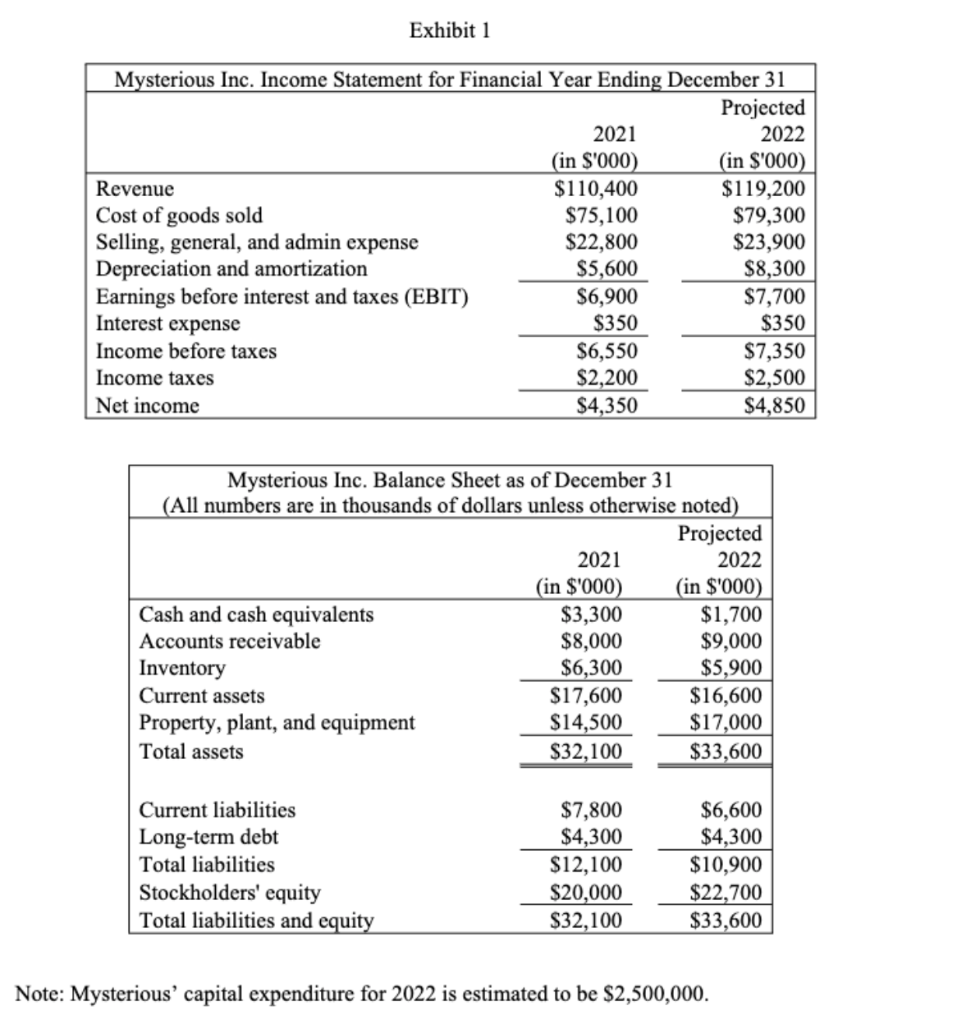

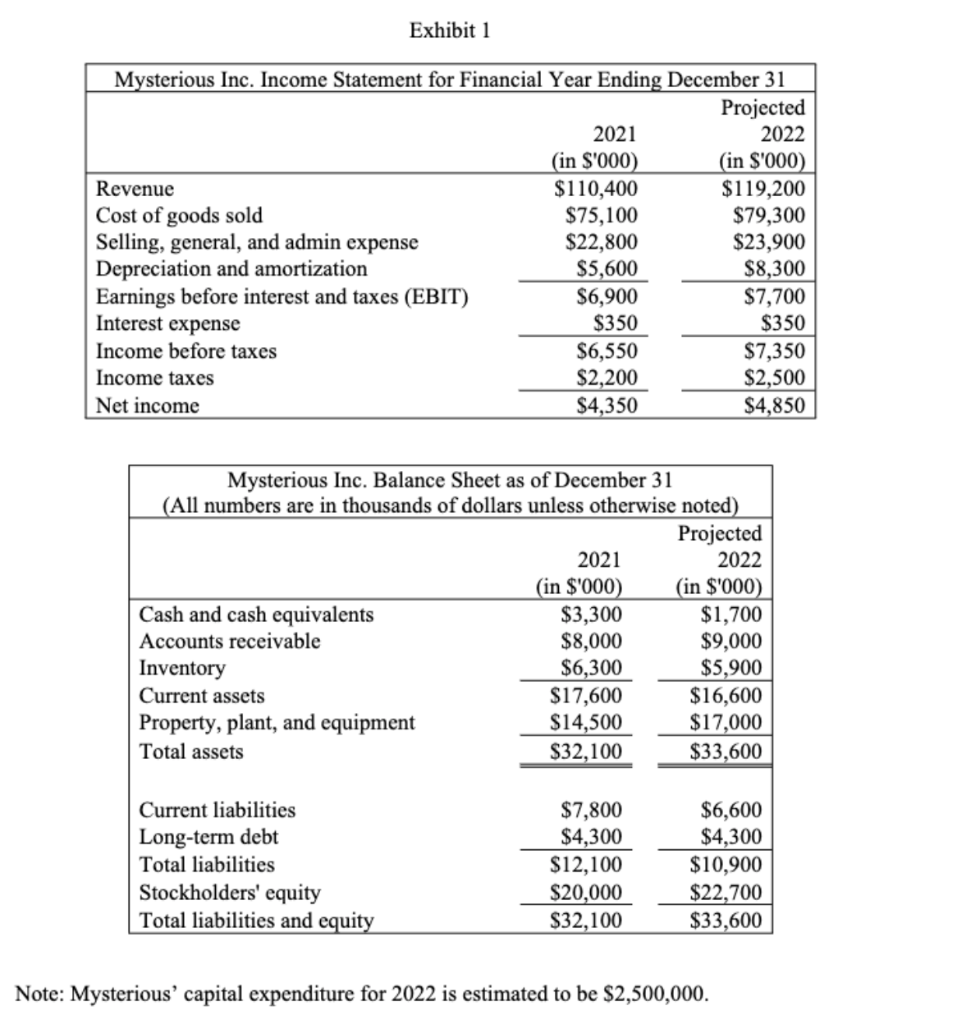

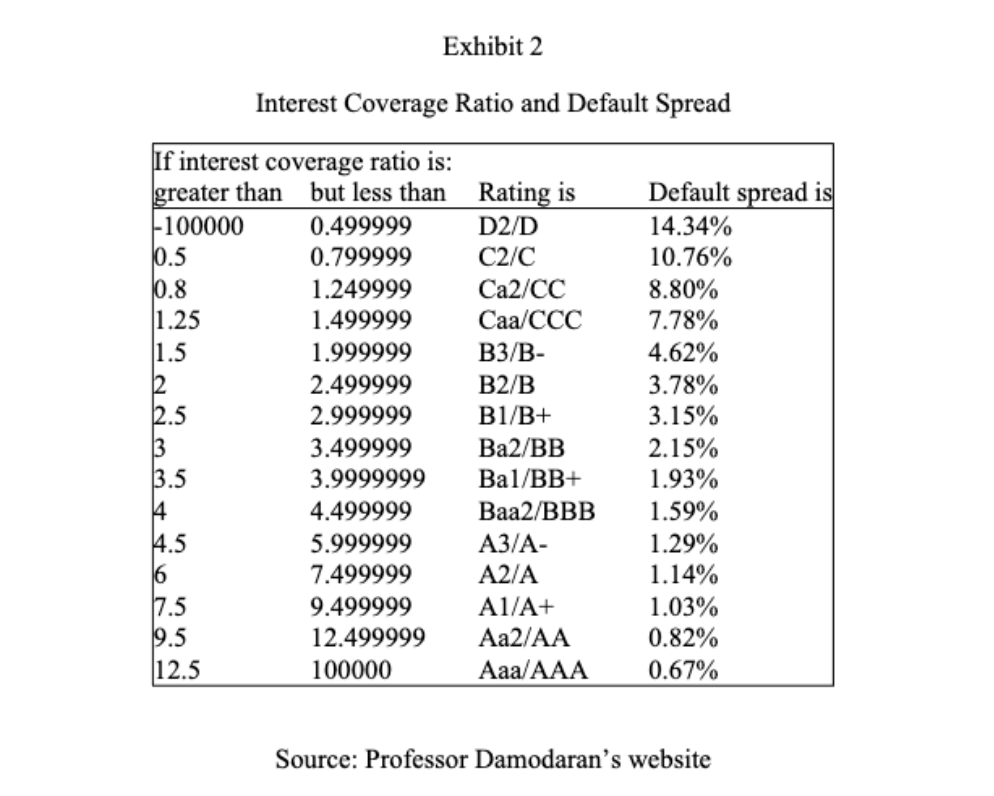

On your first day on the job as an equity analyst for a big investment bank, you were tasked with valuing Mysterious Inc., a private company that specializes in Halloween products. The financial statements of the company for the year ended on December 31, 2021, as well as projections for the year ended on December 31, 2022, are provided in Exhibit 1. In order to come up with the best estimate of the stock value as of December 31, 2021, you planned to use all three different valuation models you had learned in FIN 406 back at Penn State (Dividend discount model, FCFF model, and FCFE model). After reviewing the firm's past performance, the industry, and the macroeconomic environment, you believed that Mysterious would grow at 8% for three years after 2022 and then settle on its constant growth rate of 4% thereafter. Because Mysterious is a private firm, market data on its past stock price and returns are not available. As a result, you had to search for a comparable firm (the "peer" firm) and borrow the peer's beta (with some appropriate adjustment). After some searching, you found Boo! Incorporated, a company that produces Halloween costumes and party supplies. Boo!'s beta is 1.43, based on a capital structure of 40% debt and 60% equity. Mysterious' capital structure is 15% debt and 85% equity. Mysterious has 1,850,000 shares outstanding (all privately owned). It paid out $1.53 in dividend per share in 2021 and is projected to pay out $1.72 in dividend per share in 2022. The risk-free rate is 0.5%. The market risk premium is 5.17%. The prevailing cost of debt as a function of the interest coverage ratio is provided in Exhibit 2. Corporate tax rate is 21%. Prepare a report for your boss showing the three valuation approaches and detailing the steps you take to get to your stock value estimates. At the minimum, your report needs to have three separate sections to answer the following: 1) Using the discounted dividend model, what is the value per share of Mysterious stock? (30 points) 2) Using the discounted FCFF model, what is the value per share of Mysterious stock? (40 points) 3) Using the discounted FCFE model, what is the value per share of Mysterious stock? (25 points) Exhibit 1 Mysterious Inc. Income Statement for Financial Year Ending December 31 Projected 2021 2022 (in $'000) (in $'000) Revenue $110,400 $119,200 Cost of goods sold $75,100 $79,300 Selling, general, and admin expense $22,800 $23,900 Depreciation and amortization $5,600 $8,300 Earnings before interest and taxes (EBIT) $6,900 $7,700 Interest expense $350 $350 Income before taxes $6,550 $7,350 Income taxes $2,200 $2,500 Net income $4,350 $4,850 Mysterious Inc. Balance Sheet as of December 31 (All numbers are in thousands of dollars unless otherwise noted) Projected 2021 2022 (in $'000) (in $'000) Cash and cash equivalents $3,300 $1,700 Accounts receivable $8,000 $9,000 Inventory $6,300 $5,900 Current assets $17,600 $16,600 Property, plant, and equipment $14,500 $17,000 Total assets $32,100 $33,600 Current liabilities Long-term debt Total liabilities Stockholders' equity Total liabilities and equity $7,800 $4,300 $12,100 $20,000 $32,100 $6,600 $4,300 $10,900 $22,700 $33,600 Note: Mysterious' capital expenditure for 2022 is estimated to be $2,500,000. Exhibit 2 0.8 Interest Coverage Ratio and Default Spread If interest coverage ratio is: greater than but less than Rating is Default spread is | 100000 0.499999 D2/D 14.34% 0.5 0.799999 C2/C 10.76% 1.249999 Ca2/CC 8.80% 1.25 1.499999 Caa/CCC 7.78% 1.5 1.999999 B3/B- 4.62% 2 2.499999 B2/B 3.78% 2.5 2.999999 B1/B+ 3.15% 3 3.499999 Ba2/BB 2.15% 3.5 3.9999999 Bal/BB+ 1.93% 4 4.499999 Baa2/BBB 1.59% 4.5 5.999999 A3/A- 1.29% 16 7.499999 A2/A 1.14% 7.5 9.499999 A1/A+ 1.03% 12.499999 Aa2/AA 0.82% 12.5 100000 Aaa/AAA 0.67% 9.5 Source: Professor Damodaran's website On your first day on the job as an equity analyst for a big investment bank, you were tasked with valuing Mysterious Inc., a private company that specializes in Halloween products. The financial statements of the company for the year ended on December 31, 2021, as well as projections for the year ended on December 31, 2022, are provided in Exhibit 1. In order to come up with the best estimate of the stock value as of December 31, 2021, you planned to use all three different valuation models you had learned in FIN 406 back at Penn State (Dividend discount model, FCFF model, and FCFE model). After reviewing the firm's past performance, the industry, and the macroeconomic environment, you believed that Mysterious would grow at 8% for three years after 2022 and then settle on its constant growth rate of 4% thereafter. Because Mysterious is a private firm, market data on its past stock price and returns are not available. As a result, you had to search for a comparable firm (the "peer" firm) and borrow the peer's beta (with some appropriate adjustment). After some searching, you found Boo! Incorporated, a company that produces Halloween costumes and party supplies. Boo!'s beta is 1.43, based on a capital structure of 40% debt and 60% equity. Mysterious' capital structure is 15% debt and 85% equity. Mysterious has 1,850,000 shares outstanding (all privately owned). It paid out $1.53 in dividend per share in 2021 and is projected to pay out $1.72 in dividend per share in 2022. The risk-free rate is 0.5%. The market risk premium is 5.17%. The prevailing cost of debt as a function of the interest coverage ratio is provided in Exhibit 2. Corporate tax rate is 21%. Prepare a report for your boss showing the three valuation approaches and detailing the steps you take to get to your stock value estimates. At the minimum, your report needs to have three separate sections to answer the following: 1) Using the discounted dividend model, what is the value per share of Mysterious stock? (30 points) 2) Using the discounted FCFF model, what is the value per share of Mysterious stock? (40 points) 3) Using the discounted FCFE model, what is the value per share of Mysterious stock? (25 points) Exhibit 1 Mysterious Inc. Income Statement for Financial Year Ending December 31 Projected 2021 2022 (in $'000) (in $'000) Revenue $110,400 $119,200 Cost of goods sold $75,100 $79,300 Selling, general, and admin expense $22,800 $23,900 Depreciation and amortization $5,600 $8,300 Earnings before interest and taxes (EBIT) $6,900 $7,700 Interest expense $350 $350 Income before taxes $6,550 $7,350 Income taxes $2,200 $2,500 Net income $4,350 $4,850 Mysterious Inc. Balance Sheet as of December 31 (All numbers are in thousands of dollars unless otherwise noted) Projected 2021 2022 (in $'000) (in $'000) Cash and cash equivalents $3,300 $1,700 Accounts receivable $8,000 $9,000 Inventory $6,300 $5,900 Current assets $17,600 $16,600 Property, plant, and equipment $14,500 $17,000 Total assets $32,100 $33,600 Current liabilities Long-term debt Total liabilities Stockholders' equity Total liabilities and equity $7,800 $4,300 $12,100 $20,000 $32,100 $6,600 $4,300 $10,900 $22,700 $33,600 Note: Mysterious' capital expenditure for 2022 is estimated to be $2,500,000. Exhibit 2 0.8 Interest Coverage Ratio and Default Spread If interest coverage ratio is: greater than but less than Rating is Default spread is | 100000 0.499999 D2/D 14.34% 0.5 0.799999 C2/C 10.76% 1.249999 Ca2/CC 8.80% 1.25 1.499999 Caa/CCC 7.78% 1.5 1.999999 B3/B- 4.62% 2 2.499999 B2/B 3.78% 2.5 2.999999 B1/B+ 3.15% 3 3.499999 Ba2/BB 2.15% 3.5 3.9999999 Bal/BB+ 1.93% 4 4.499999 Baa2/BBB 1.59% 4.5 5.999999 A3/A- 1.29% 16 7.499999 A2/A 1.14% 7.5 9.499999 A1/A+ 1.03% 12.499999 Aa2/AA 0.82% 12.5 100000 Aaa/AAA 0.67% 9.5 Source: Professor Damodaran's website