One of the most discussed topics in finance recently is the global economic crisis that is said to have begun in the 2000s. Your professor instructed your team to write an article for the college newspaper. Your friend has written the first draft of the article, which captures the essence of the global economic crisis. She has left some important points for you to review and has asked you to check the summary. Which statements belong in the summary? Check all that apply.

One of the most discussed topics in finance recently is the global economic crisis that is said to have begun in the 2000s. Your professor instructed your team to write an article for the college newspaper. Your friend has written the first draft of the article, which captures the essence of the global economic crisis. She has left some important points for you to review and has asked you to check the summary. Which statements belong in the summary? Check all that apply.

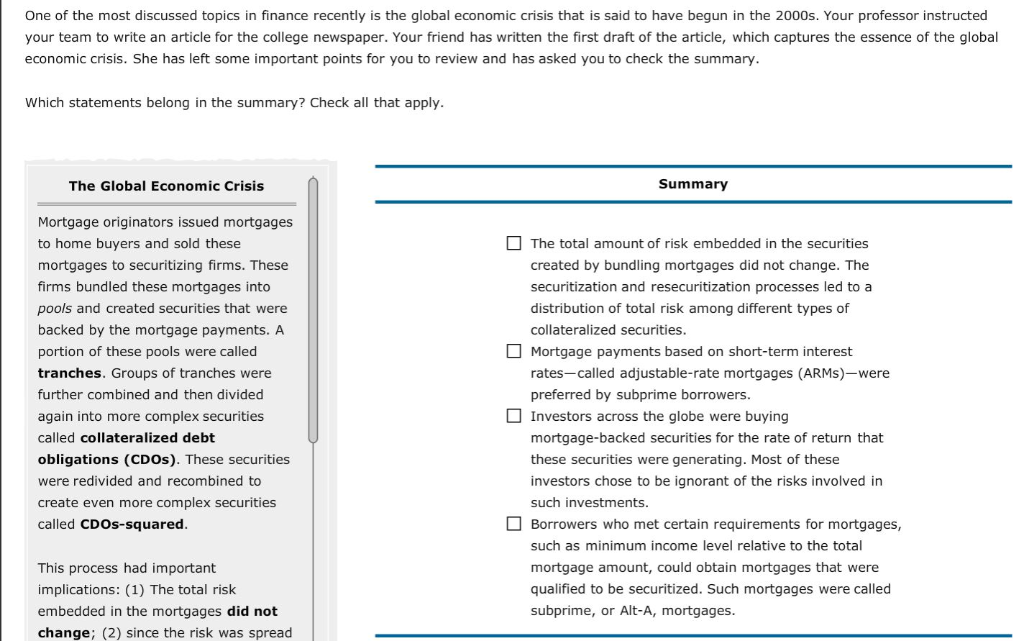

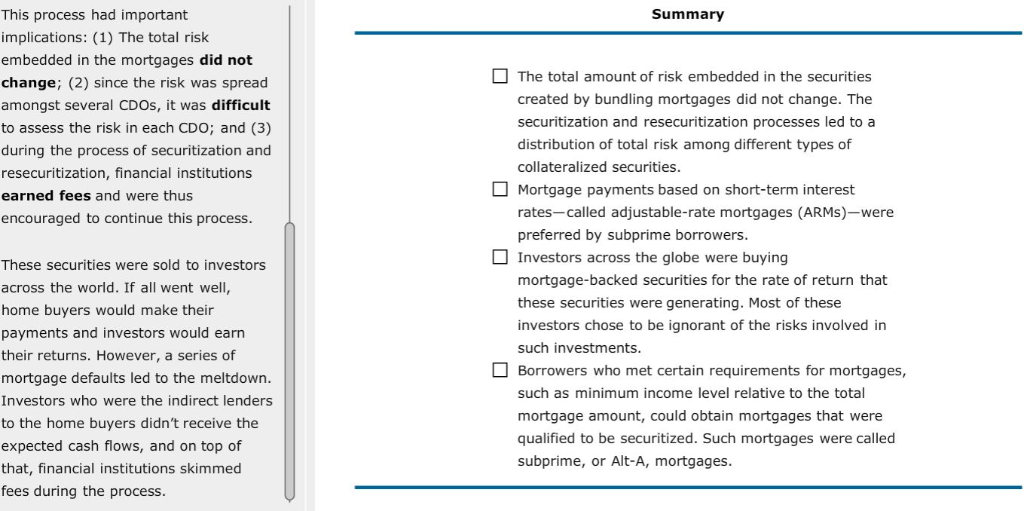

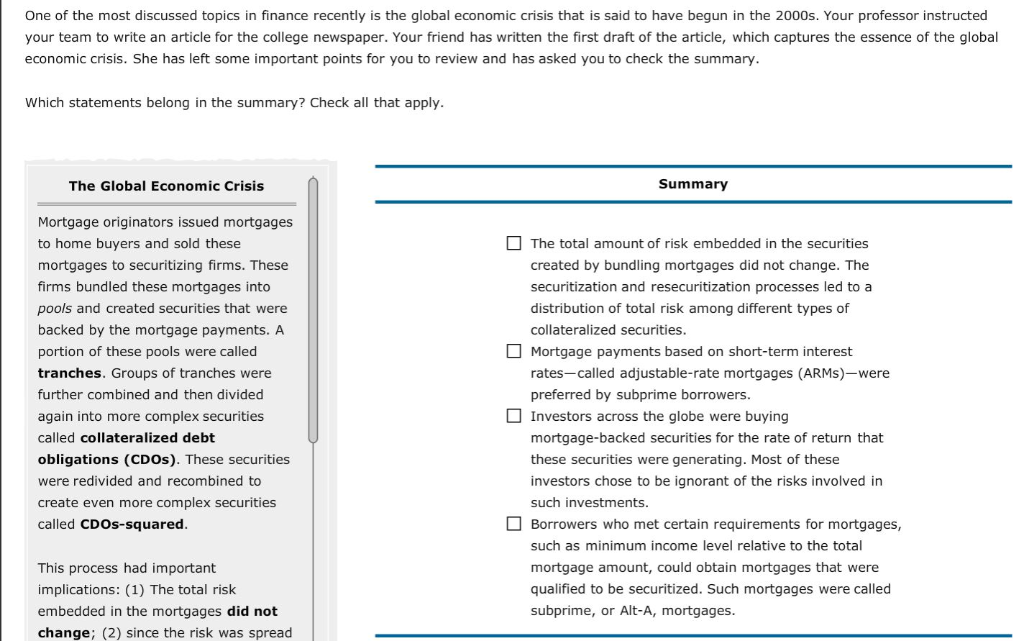

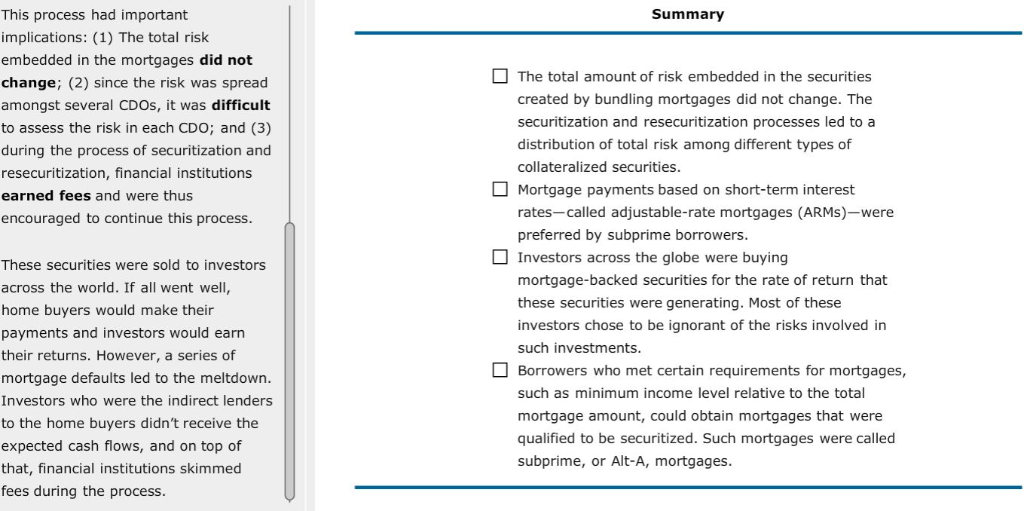

One of the most discussed topics in finance recently is the global economic crisis that is said to have begun in the 2000s. Your professor instructed your team to write an article for the college newspaper. Your friend has written the first draft of the article, which captures the essence of the global economic crisis. She has left some important points for you to review and has asked you to check the summary Which statements belong in the summary? Check all that apply The Global Economic Crisis Summary Mortgage originators issued mortgages to home buyers and sold these mortgages to securitizing firms. These firms bundled these mortgages into pools and created securities that were backed by the mortgage payments portion of these pools were called tranches. Groups of tranches were further combined and then divided again into more complex securities called collateralized debt obligations (CDOs). These securities were redivided and recombined to create even more complex securities called CDOs-squared [ ] The total amount of risk embedded in the securities created by bundling mortgages did not change. The securitization and resecuritization processes led to a distribution of total risk among different types of collateralized securities Mortgage payments based on short-term interest rates-called adjustable-rate mortgages (ARMs)-were preferred by subprime borrowers. . A Investors across the globe were buying mortgage-backed securities for the rate of return that these securities were generating. Most of these investors chose to be ignorant of the risks involved in such investments. Borrowers who met certain requirements for mortgages such as minimum income level relative to the total mortgage amount, could obtain mortgages that were qualified to be securitized. Such mortgages were called subprime, or Alt-A, mortgages This process had important implications: (1) The total risk embedded in the mortgages did not change; (2) since the risk was spread This process had important implications: (1) The total risk embedded in the mortgages did not change; (2) since the risk was spread amongst several CDOs, it was difficult to assess the risk in each CDO; and (3) during the process of securitization and resecuritization, financial institutions earned fees and were thus encouraged to continue this process Summary The total amount of risk embedded in the securities These securities were sold to investors across the world. If all went well, home buyers would make their payments and investors would earn their returns. However, a series of mortgage defaults led to the meltdown Investors who were the indirect lenders to the home buyers didn't receive the expected cash flows, and on top of that, financial institutions skimmed fees during the process created by bundling mortgages did not change. The securitization and resecuritization processes led to a distribution of total risk among different types of collateralized securities Mortgage payments based on short-term interest rates-called adjustable-rate mortgages (ARMs)-were preferred by subprime borrowers Investors across the globe were buying mortgage-backed securities for the rate of return that these securities were generating. Most of these investors chose to be ignorant of the risks involved in such investments Borrowers who met certain requirements for mortgages such as minimum income level relative to the total mortgage amount, could obtain mortgages that were qualified to be securitized. Such mortgages were called subprime, or Alt-A, mortgages One of the most discussed topics in finance recently is the global economic crisis that is said to have begun in the 2000s. Your professor instructed your team to write an article for the college newspaper. Your friend has written the first draft of the article, which captures the essence of the global economic crisis. She has left some important points for you to review and has asked you to check the summary Which statements belong in the summary? Check all that apply The Global Economic Crisis Summary Mortgage originators issued mortgages to home buyers and sold these mortgages to securitizing firms. These firms bundled these mortgages into pools and created securities that were backed by the mortgage payments portion of these pools were called tranches. Groups of tranches were further combined and then divided again into more complex securities called collateralized debt obligations (CDOs). These securities were redivided and recombined to create even more complex securities called CDOs-squared [ ] The total amount of risk embedded in the securities created by bundling mortgages did not change. The securitization and resecuritization processes led to a distribution of total risk among different types of collateralized securities Mortgage payments based on short-term interest rates-called adjustable-rate mortgages (ARMs)-were preferred by subprime borrowers. . A Investors across the globe were buying mortgage-backed securities for the rate of return that these securities were generating. Most of these investors chose to be ignorant of the risks involved in such investments. Borrowers who met certain requirements for mortgages such as minimum income level relative to the total mortgage amount, could obtain mortgages that were qualified to be securitized. Such mortgages were called subprime, or Alt-A, mortgages This process had important implications: (1) The total risk embedded in the mortgages did not change; (2) since the risk was spread This process had important implications: (1) The total risk embedded in the mortgages did not change; (2) since the risk was spread amongst several CDOs, it was difficult to assess the risk in each CDO; and (3) during the process of securitization and resecuritization, financial institutions earned fees and were thus encouraged to continue this process Summary The total amount of risk embedded in the securities These securities were sold to investors across the world. If all went well, home buyers would make their payments and investors would earn their returns. However, a series of mortgage defaults led to the meltdown Investors who were the indirect lenders to the home buyers didn't receive the expected cash flows, and on top of that, financial institutions skimmed fees during the process created by bundling mortgages did not change. The securitization and resecuritization processes led to a distribution of total risk among different types of collateralized securities Mortgage payments based on short-term interest rates-called adjustable-rate mortgages (ARMs)-were preferred by subprime borrowers Investors across the globe were buying mortgage-backed securities for the rate of return that these securities were generating. Most of these investors chose to be ignorant of the risks involved in such investments Borrowers who met certain requirements for mortgages such as minimum income level relative to the total mortgage amount, could obtain mortgages that were qualified to be securitized. Such mortgages were called subprime, or Alt-A, mortgages

One of the most discussed topics in finance recently is the global economic crisis that is said to have begun in the 2000s. Your professor instructed your team to write an article for the college newspaper. Your friend has written the first draft of the article, which captures the essence of the global economic crisis. She has left some important points for you to review and has asked you to check the summary. Which statements belong in the summary? Check all that apply.

One of the most discussed topics in finance recently is the global economic crisis that is said to have begun in the 2000s. Your professor instructed your team to write an article for the college newspaper. Your friend has written the first draft of the article, which captures the essence of the global economic crisis. She has left some important points for you to review and has asked you to check the summary. Which statements belong in the summary? Check all that apply.