ONLY 16-18

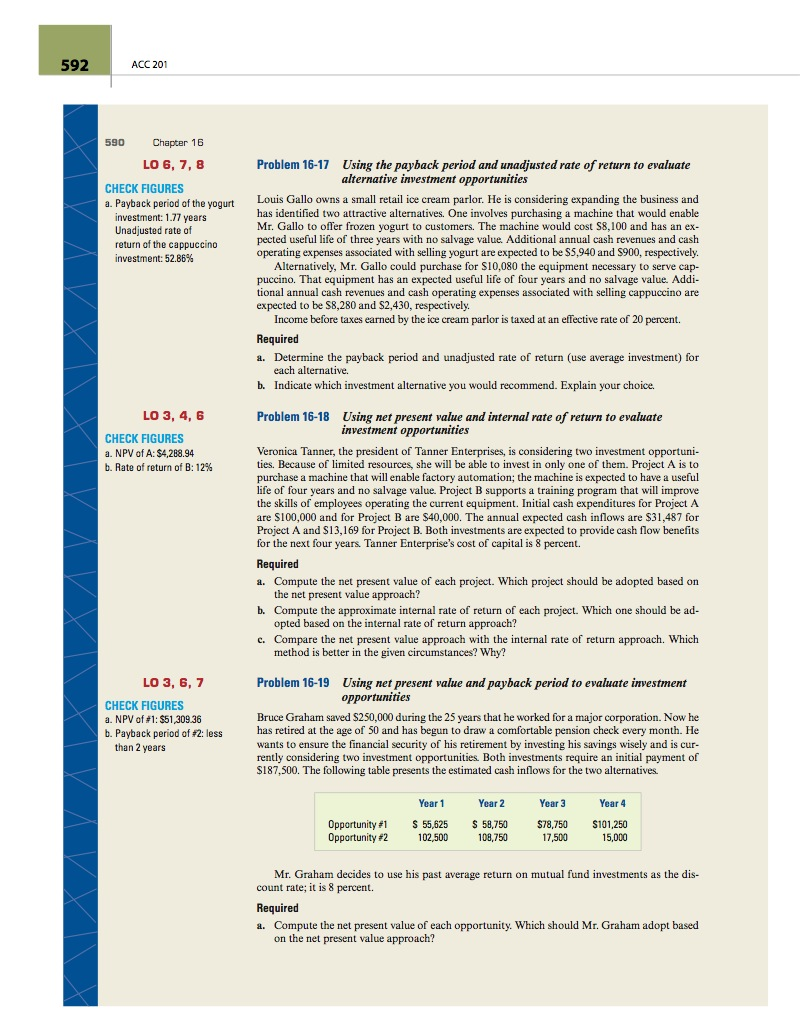

Louis Gallo owns a small retail ice cream parlor. He is considering expanding the bUsingss and has identified two attractive alternatives. One involves purchasing a machine that would enable Mr. Gallo to offer frozen yogurt to customers. The machine would cost S8.100 and has an expected useful life of three years with no salvage value Additional annual cash revenues and cash operating expenses associated with selling yogurt are expected to be $5.940 and S900. respectively. Alternatively. Mr. Gallo could purchase for $10.080 the equipment necessary to serve cappuccino. That equipment has an expected useful life of four years and no salvage value. Additional annual cash revenues and cash operating expenses associated with selling cappuccino are expected to be $8.280 and $2.430, respectively. Income before taxes earned by the ice cream parlor is taxed at an effective rate of 20 percent. Determine the payback period and unadjusted rate of return (use average investment) for each alternative. Indicate which investment alternative you would recommend. Explain your choice. Veronica Tanner, the president of Tanner Enterprises, is considering two investment opportunities. Because of limited resources, she will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of four years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are S100.000 and for Project B are $40.000. The annual expected cash inflows are $31,487 for Project A and $13,169 for Project B. Both investments are expected to provide cash flow benefits for the next four years. Tanner Enterprise's cost of capital is 8 percent. Compute the net present value of each project. Which project should be adopted based on the net present value approach? Compute the approximate internal rate of return of each project. Which one should be ad-opted based on the internal rate of return approach? Compare the net present value approach with the internal rate of return approach. Which method is belter in the given circumstances? Why? Bruce Graham saved $250.000 during the 25 years that he worked for a major corporation. Now he has retired at the age of 50 and has begun to draw a comfortable pension check every month. He wants to ensure the financial security of his retirement by investing his savings wisely and is currently considering two investment opportunities. Both investments require an initial payment of $187,500. The following table presents the estimated cash inflows for the two alternatives. Mr. Graham decides to use his past average return on mutual fund investments as the discount rate; it is 8 percent. Compute the net present value of each opportunity Which should Mr. Graham adopt based on the net present value approach