Only do (d), where the profit reports are shown. Especially the wrong (red) answers.

Only do (d), where the profit reports are shown. Especially the wrong (red) answers.

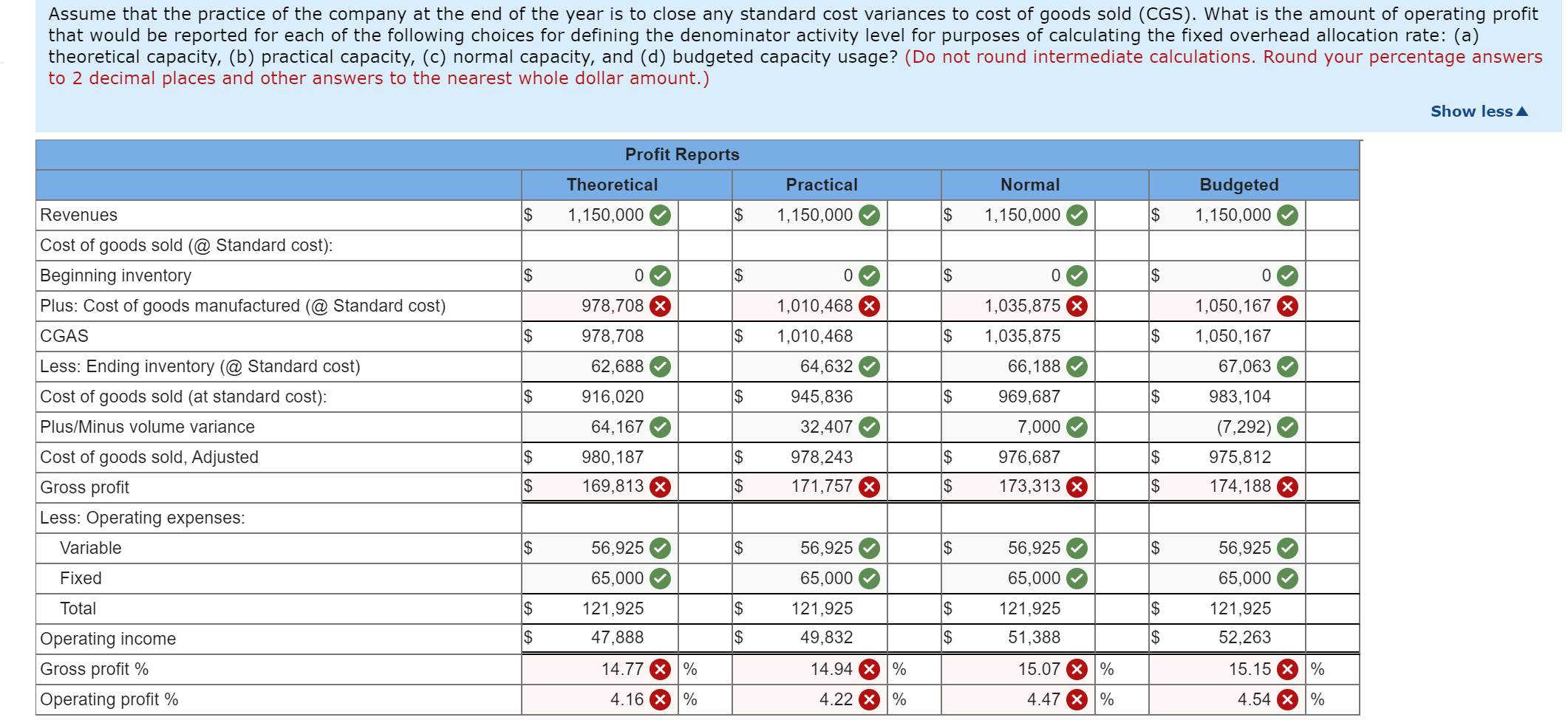

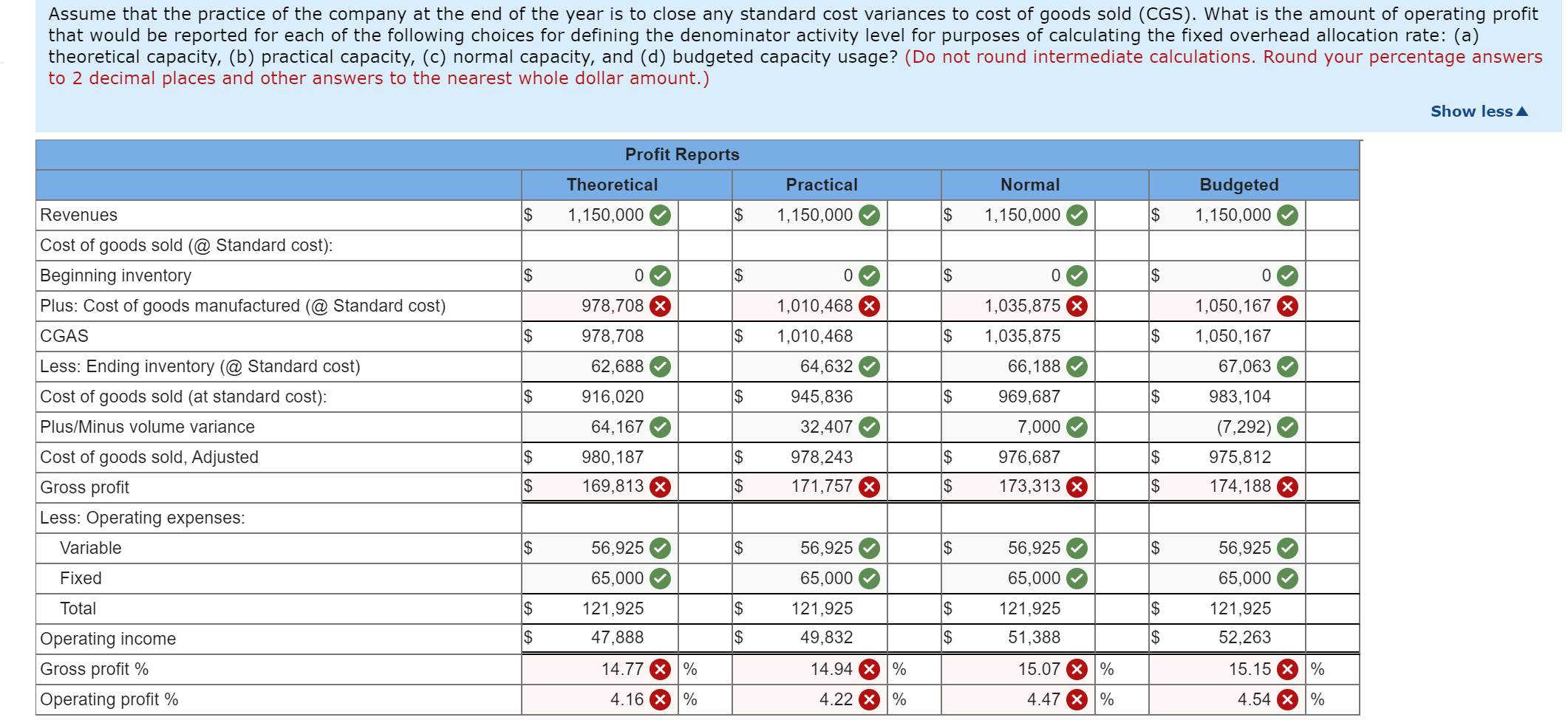

At a recent board meeting of the Grayson Manufacturing Company, several individuals in attendance expressed concern that they could not understand how the choice of an activity level for determining overhead application rates for the company could affect reported operating profits. The controller, Susanna Wu, told members of the board that, in fact, companies have some latitude in how overhead application rates are set. For example, she told members of the board that companies can spread budgeted fixed overhead for the period over budgeted (forecasted) activity, normal capacity, practical capacity, or even theoretical (maximum) capacity. All of this didn't resonate well with members of the board, who basically saw the discussion as just another example of how accounting can be used to manage income (i.e., cook the books). The chair of the finance committee of the board asked Susanna to generate a concise report that would illustrate, in concrete terms, the issues involved. In turn, you have been asked to prepare this report, which will be distributed to attendees at the next meeting of the finance committee. These committee members are adept at using spreadsheets and therefore have requested that your report be distributed to them electronically. Based on your subsequent discussions with the controller, you have come up with the following information that is pertinent to your task: a. Basis for applying factory overhead costs to units produced = Standard machine hours. b. Budgeted fixed overhead (total) = $350,000 per year. c. Standard number of machine hours per unit produced = 2.0. d. Sales data: Units sold = 11,500; unit selling price = $100. e. Standard variable manufacturing cost per unit produced = $60.25. f. Beginning inventory of finished goods = 0 units. g. Budgeted operating costs: Variable = $4.95 per unit sold; fixed = $65,000 per year. h. Actual number of units produced during the year = 12,250. i. Capacity levels (in machine hours): Theoretical capacity = 30,000 hours; practical capacity = 27,000 hours; normal capacity = 25,000 hours; budgeted (forecasted) usage = 24,000 hours. Assume that the practice of the company at the end of the year is to close any standard cost variances to cost of goods sold (CGS). What is the amount of operating profit that would be reported for each of the following choices for defining the denominator activity level for purposes of calculating the fixed overhead allocation rate: (a) theoretical capacity, (b) practical capacity, (c) normal capacity, and (d) budgeted capacity usage? (Do not round intermediate calculations. Round your percentage answers to 2 decimal places and other answers to the nearest whole dollar amount.) Show less Profit Reports Theoretical 1,150,000 | $ Practical 1,150,000 Normal 1,150,000 $ Budgeted 1,150,000 $ $ Revenues Cost of goods sold (@ Standard cost): Beginning inventory Plus: Cost of goods manufactured (@ Standard cost) $ $ CGAS $ Less: Ending inventory (@. Standard cost) 0 978,708 X 978,708 62,688 916,020 64,167 980,187 169,813 X o 1,010,468 % 1,010,468 64,632 945,836 32,407 978,243 171,757 $ 0 1,035,875 X 1,035,875 66,188 969,687 7,000 976,687 173,313 0 1,050,167 X 1,050,167 67,063 983,104 (7,292) 975,812 174,188 X Cost of goods sold (at standard cost): Plus/Minus volume variance Cost of goods sold, Adjusted Gross profit Less: Operating expenses: $ $ $ $ $ 100 101 Variable Fixed Total 56,925 65,000 121,925 47,888 14.77 X 4.16 $ $ A 56,925 65,000 121,925 49,832 49,832 14.94 X 56,925 65,000 121,925 52,263 $ $ 56,925 65,000 121,925 51,388 15.07 X 4.47 $ $ $ A Operating income Gross profit % Operating profit % % % % 15.15 X 4.54 X 4.22 X % %

Only do (d), where the profit reports are shown. Especially the wrong (red) answers.

Only do (d), where the profit reports are shown. Especially the wrong (red) answers.