Question

****ONLY NEED MANUFACTURING OVERHEAD BUDGET AND EVERYTHING BELOW IT PLEASE. EVERYTHING ABOVE THE MANUFACTURING OVERHEAD BUDGET HAS ALREADY BEEN ANSWERED**** The company is preparing its

****ONLY NEED MANUFACTURING OVERHEAD BUDGET AND EVERYTHING BELOW IT PLEASE. EVERYTHING ABOVE THE MANUFACTURING OVERHEAD BUDGET HAS ALREADY BEEN ANSWERED****

| The company is preparing its budget for the coming year, 2022. The first step is to plan for the first quarter of that coming year. The following information has been gathered from their managers. | ||

| November 2021 | 103,000 Actual | |

| December 2021 | 92,000 Actual | |

| January 2022 | 101,000 Planned | |

| February 2022 | 102,000 Planned | |

| March 2022 | 104,000 Planned | |

| April 2022 | 113,000 Planned | |

| May 2022 | 124,000 Planned | |

| Unit selling price | $18.22 | |

| Finished Goods Inventory Planning | ||

| The company likes to keep 15% of the next quarters unit sales in finished goods ending inventory. | ||

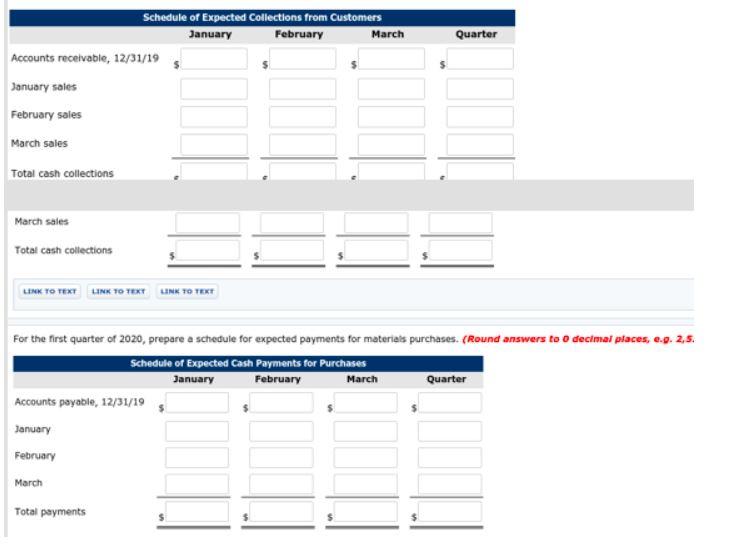

| Accounts Receivable and Collections | ||

| Sales on Account 100% Collections Activity Month of Sale 80% Month after Sale 20% Balance at 12/31/21 $185,000 | ||

| Materials Inventory Costs & Planning | ||

| Direct Materials | Amount Used per Unit | |

| Ingredient | 2 Ib | |

| The company likes to keep 12% of the material needed for the next month's production in raw materials ending inventory. | ||

| Accounts Payable & Disbursements | ||

| Purchases on Account | 100% | |

| Payment Activity | ||

| Month of Purchase | 40% | |

| Month after Purchase | 60% | |

| Balance at 12/31/21 | $120,000 | |

| Direct Labor & Costs | ||

| Time per Unit Production | 20 minutes | |

| Pay Rate/Hour | $20.00 | |

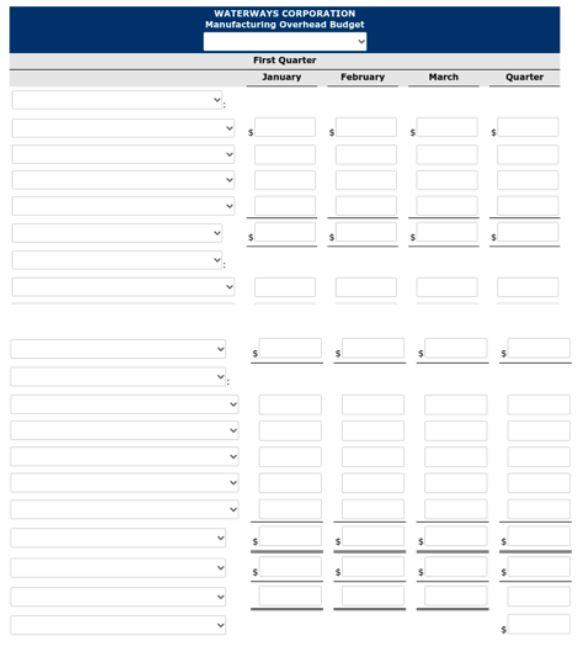

| Manufacturing Overhead Costs | ||

| Variable costs per direct labor hour | ||

| Indirect materials | $0.25 | |

| Indirect labor | 0.40 | |

| Utilities | 0.45 | |

| Maintenance | 0.25 | |

| Fixed costs per month | ||

| Salaries | $42,000 | |

| Depreciation | 16,800 | |

| Property taxes | 2,675 | |

| Insurance | 1,200 | |

| Janitorial | 1,300 | |

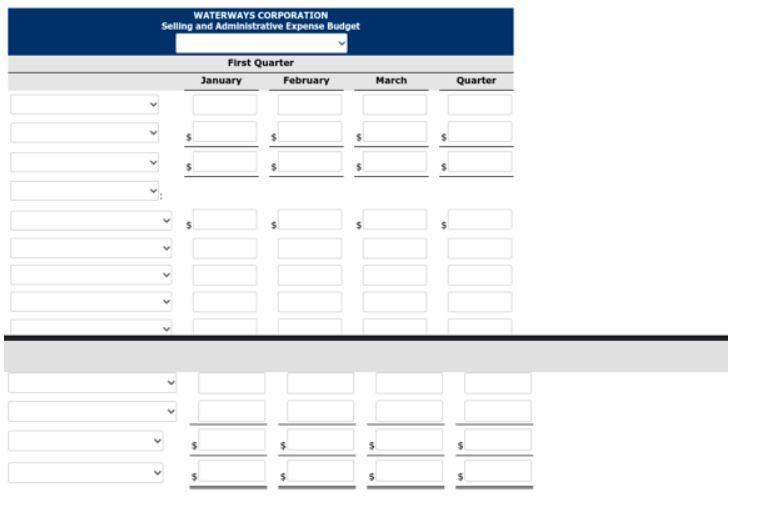

| Selling and Administrative Costs | ||

| Variable costs per unit sold | $1.30 | |

| Fixed costs per month | ||

| Advertising | $15,000 | |

| Insurance | $14,000 | |

| Salaries | $72,000 | |

| Depreciation | 25,000 | |

| Other fixed costs | 3,000 | |

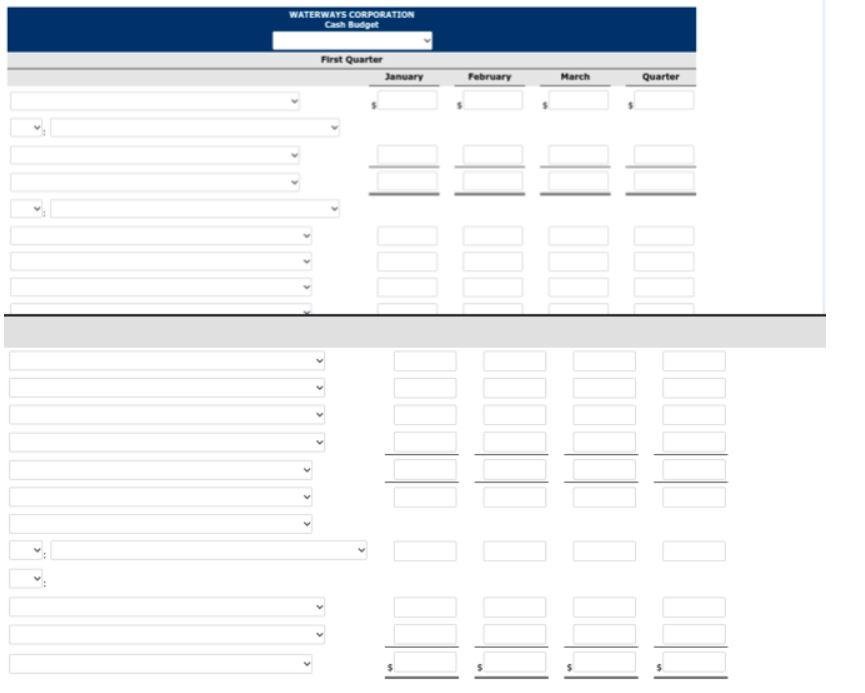

| Income Taxes | ||

| Accrued on Monthly Net Income | 40% rounded to the nearest dollar | |

| Amounts Accrued Q4 2021 paid January 2022 | $200,000 | |

| Cash and Financing Matters | ||

| Cash Balance, 12/31/2021 | $120,000 | |

| 2022 Minimum Balance Required | 770,000 | |

| Monthly Dividends | $2.00 per share | |

| Outstanding Shares | 5,000 | |

| Line of Credit | ||

| Limit | $1,200,000 | |

| Borrowing Increment Required | $1,000 | |

| Annual Interest Rate | 7% | |

| Borrowings occur on the | First of Month | |

| Repayments occur on the | Last of Month | |

| Interest accrues on the loan balance from the date of borrowing. Interest accrued is paid first with each repayment. | ||

| Additional Item | ||

| Fixed Asset Purchase | $405,000 | |

| Month | February | |

Would appreciate a breakdown of these sections on excel, Thank You!

WATERWAYS CORPORATION Manufacturing Overhead Budget First Quarter January C February March Quarter WATERWAYS CORPORATION Selling and Administrative Expense Budget First Quarter January February March Quarter Schedule of Expected Collections from Customers January February March Quarter Accounts receivable, 12/31/19 January sales February sales March sales Total cash collections March sales Total cash collections LINK TO TEXT LINK TO TEXT LINK TO TEXT For the first quarter of 2020, prepare a schedule for expected payments for materials purchases. (Round answers to 0 decimal places, e.g. 2,5. Schedule of Expected Cash Payments for Purchases January February March Quarter Accounts payable, 12/31/19 January February March Total payments WATERWAYS CORPORATION Cash Budget First Quarter January 3 > February March Quarter 1000 2333Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started