Question

Optimal Portfolio: Edgar has three assets he can invest in: A risky stock with an expected return of 11% and a standard deviation of

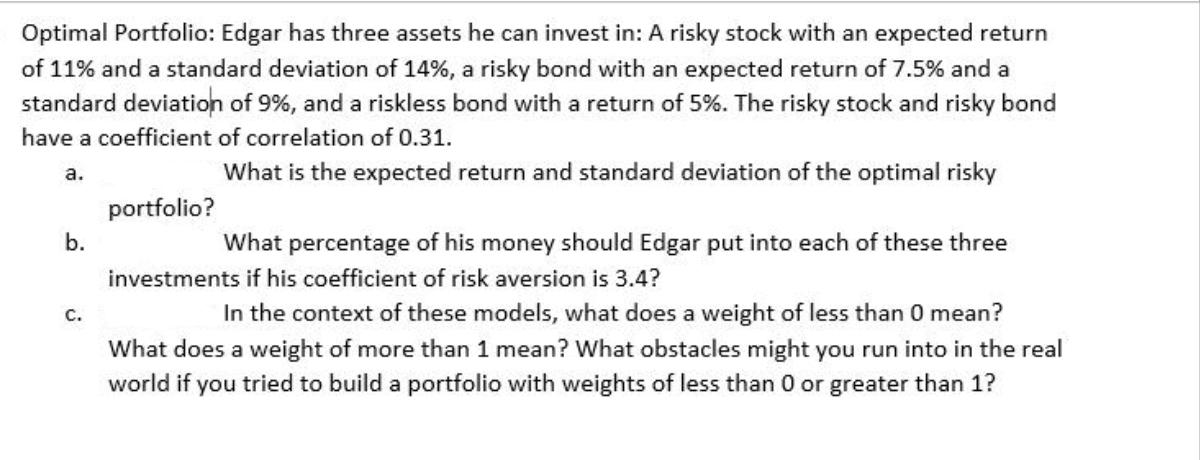

Optimal Portfolio: Edgar has three assets he can invest in: A risky stock with an expected return of 11% and a standard deviation of 14%, a risky bond with an expected return of 7.5% and a standard deviation of 9%, and a riskless bond with a return of 5%. The risky stock and risky bond have a coefficient of correlation of 0.31. a. b. C. portfolio? What is the expected return and standard deviation of the optimal risky What percentage of his money should Edgar put into each of these three investments if his coefficient of risk aversion is 3.4? In the context of these models, what does a weight of less than 0 mean? What does a weight of more than 1 mean? What obstacles might you run into in the real world if you tried to build a portfolio with weights of less than 0 or greater than 1?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

13th International Edition

1265533199, 978-1265533199

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App