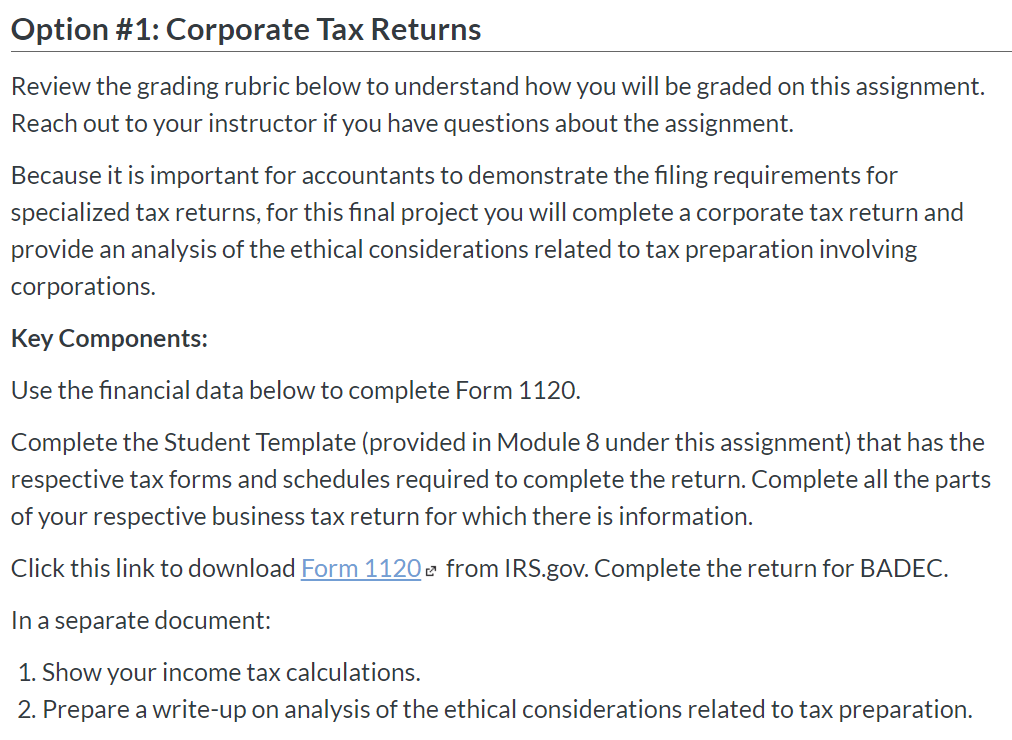

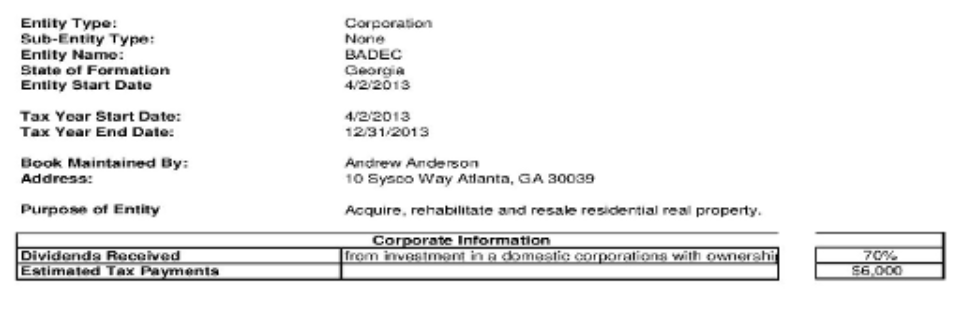

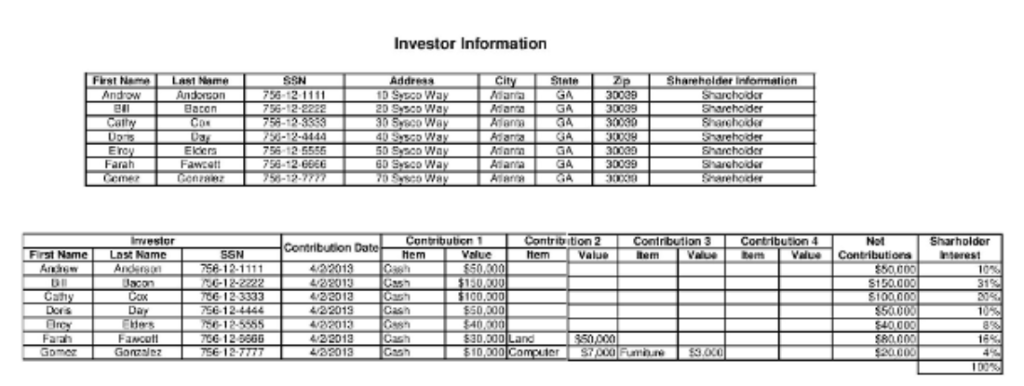

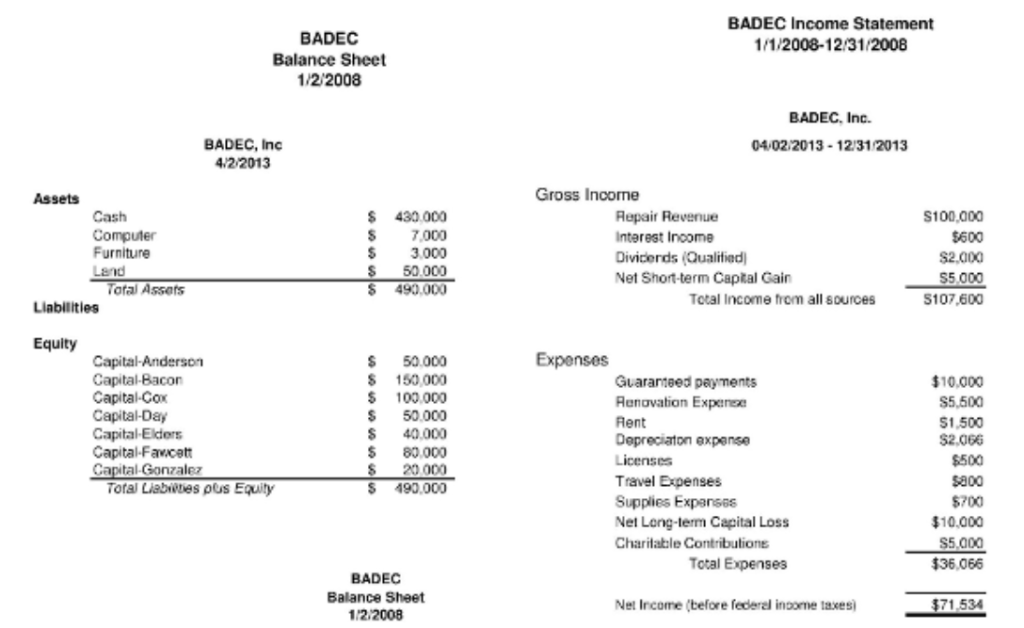

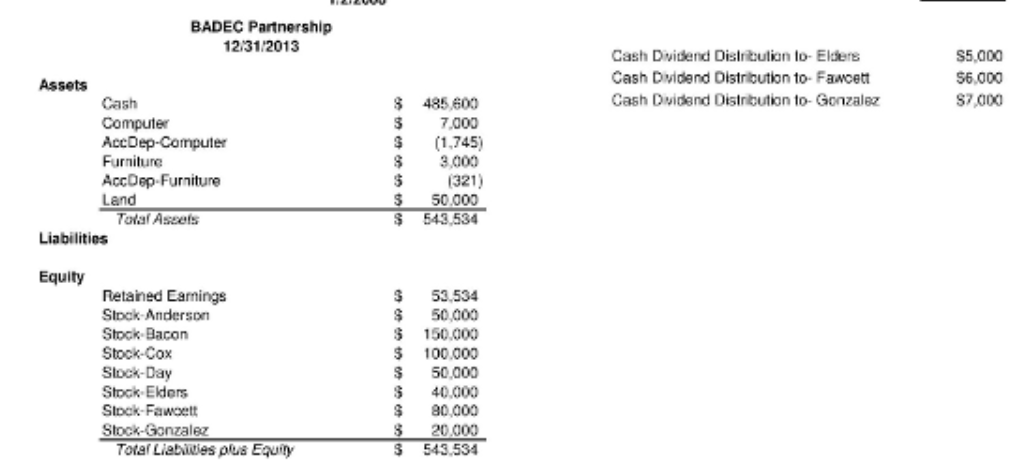

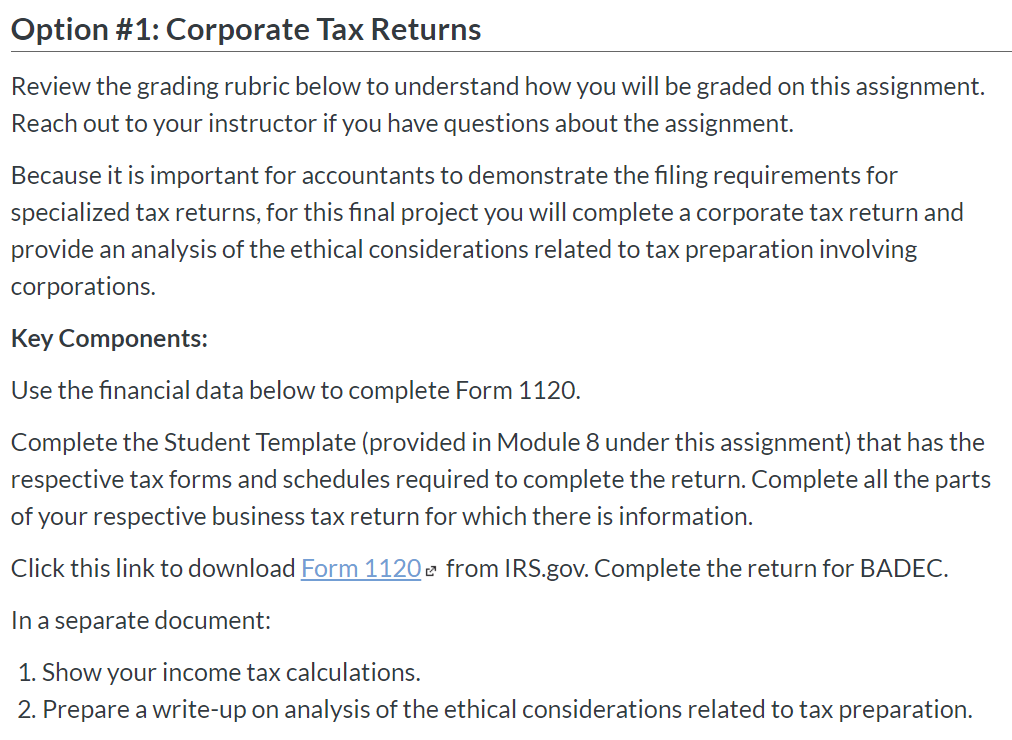

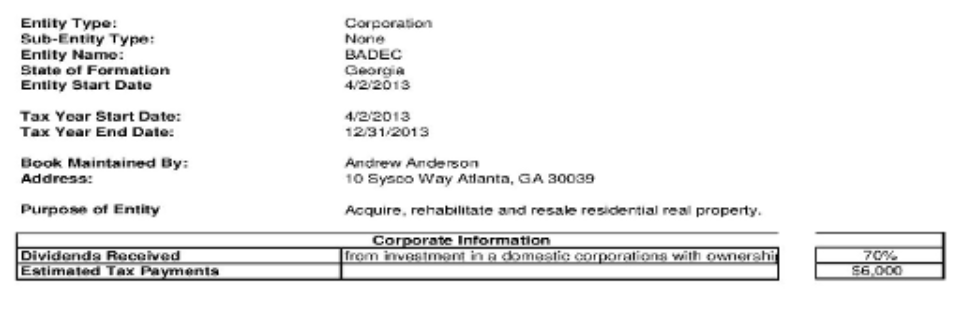

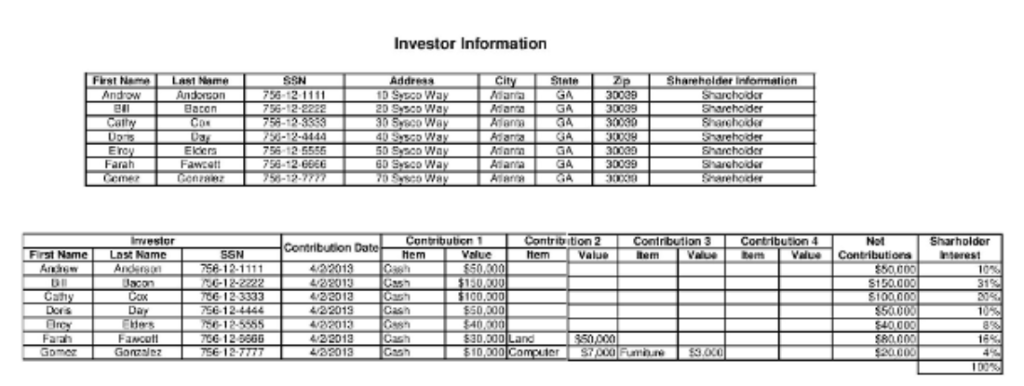

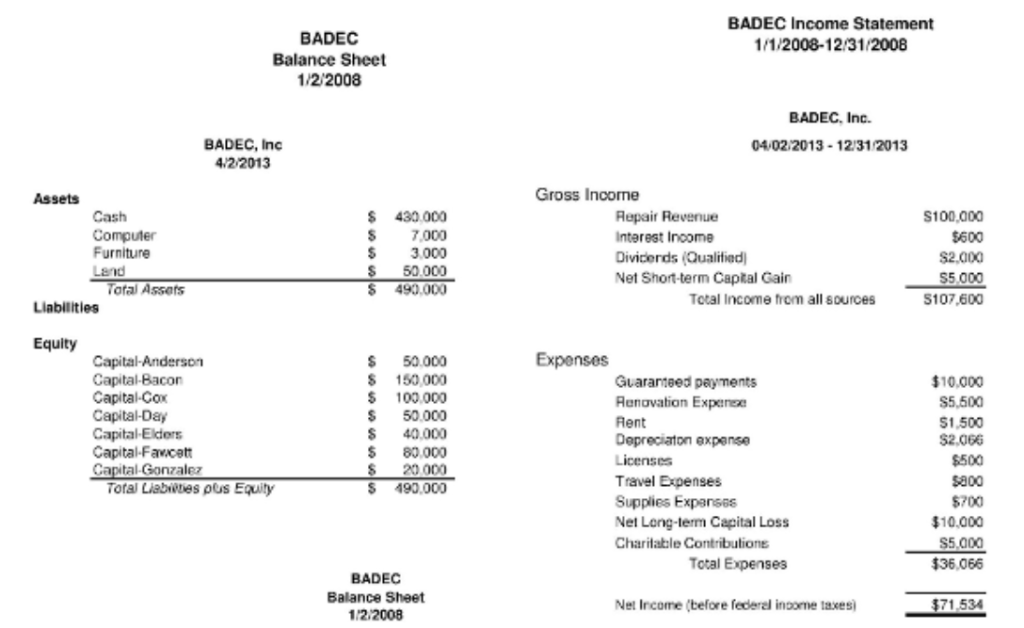

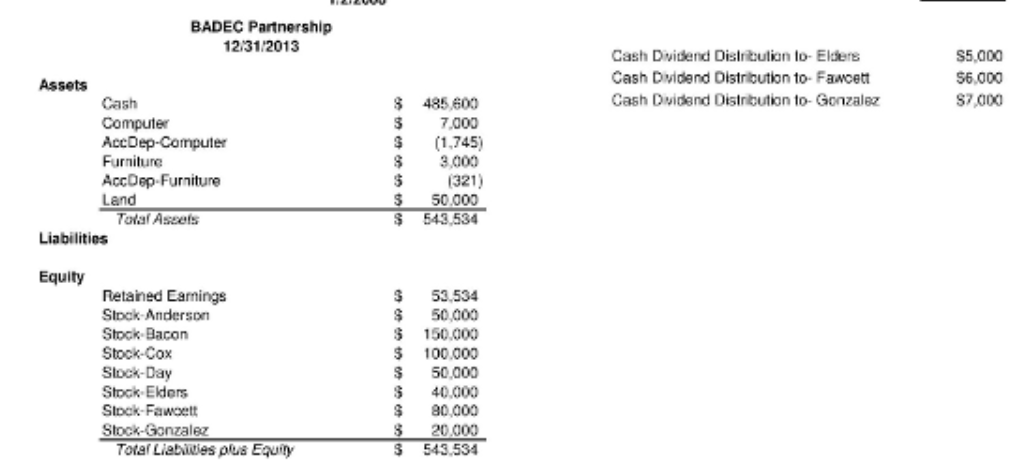

Option #1: Corporate Tax Returns Review the grading rubric below to understand how you will be graded on this assignment. Reach out to your instructor if you have questions about the assignment. Because it is important for accountants to demonstrate the filing requirements for specialized tax returns, for this final project you will complete a corporate tax return and provide an analysis of the ethical considerations related to tax preparation involving corporations. Key Components: Use the financial data below to complete Form 1120. Complete the Student Template (provided in Module 8 under this assignment) that has the respective tax forms and schedules required to complete the return. Complete all the parts of your respective business tax return for which there is information. Click this link to download Form 1120c from IRS.gov. Complete the return for BADEC. In a separate document: 1. Show your income tax calculations. 2. Prepare a write-up on analysis of the ethical considerations related to tax preparation. Entity Type: Sub-Entity Type: Entity Name: State of Formation Entity Start Date Corporation None BADEC Georgia 4/2/2013 Tax Year Start Date: Tax Year End Date: 4/2/2013 1231/2013 Book Maintained By: Address: Andrew Anderson 10 Sysco Way Atlanta, GA 30039 Purpose of Entity Acquire, rehabilitate and resale residential real property. Corporate Information from investment in A domestic corporations with ownershi Dividenda Received Estimated Tax Payments 70% $6.000 Investor Information SON First N Androw Bu Cathy LART Meme Andon Bacon COR STRIA GA GA 756-12-2222 Address 10 So Way 20 Seco Way 30 Sysco Way 40 So Way 50 5.200 Way GD Ssco Way 70 No Way City Ananta Asarna Alanna Afana Anton GIA Zp S hareholder information 30039 Sharcho der 300091 Sharcho der 30X30 Shanghaider W Shwehoder 30039 Sharchoder 30039 Siuarchoder Share h er EROV Farah CCP Ekers Fawn CARR 756 12 5555 758-12 GDEE GA GA ATAR T Investor First Name Last Name SSN ANI Anderson1756-12-1111 Contribution 4 tem V alue Caty Ders COK Day 706 12 3333 756 12 4444 10-12-5-55 706 12 5866 75 12.7777 Contribution 1 Contribution 2 Contribution 3 Contribution Date Hem Value Hem Value Item Value 4 22013 Ch 50.200 4/22013C $150.000 22013 $100.000 4/22019 Cash $50.000 4220013 C4 $40,000 422013 C $20.000 Land s son 422013 Cash $10,000 Computer S7000 Fumare Not Sharholder Contributions Interest $80.000 10 S150.000 31 $100,000 S5401 $40.000 SAL0001 $20 CDI 1000 Fara GO Fanco Gorcz BADEC Income Statement 1/1/2008-12/31/2008 BADEC Balance Sheet 1/2/2008 BADEC, Inc. 04.02.2013 - 12/31/2013 BADEC, Inc 4/2/2013 $ Assets Cash Computer Furniture Lend Toral Assets Liabilities 430 000 7,000 3.000 50.000 490.000 Gross Income Repair Revenue Interest Income Dividerds (Qualitied Net Short-term Captal Gain Total Income from all sources S100,000 $600 $2.000 $5.000 5107,600 Equity Capital Anderson Capital-Bacon Capital-Cox Capital-Day Capital Elders Capital-Fawcett Capital Gonzalez Toral Liabities pus Equity 50.000 150 000 100.000 50.000 40.000 80.000 20 000 190,000 Expenses Guaranteed payments Renovation Expense Rent Depreciaton expense Licenses Travel Expenses Supplies Expenses Nel Long-term Capital Loss Charitable Contributione Total Expenses $10.000 $5,500 $1,500 $2.066 $500 5800 $700 $10.000 S5.000 $36.066 $ BADEC Balance Sheet 12.2008 Net Income (before federal income taxes $71.534 ZIZVOU BADEC Partnership 12/31/2013 Cash Dividend Distribution to-Elders Cash Dividend Distriction to Fawcett Cash Dividend Distribution to Gonzalez S5.000 56.000 $7.000 $ $ $ Assets Cash Computer Accep-Computer Furniture Accep Furniture Land Total Aseets Liabilities 485,600 7.000 (1,745) 3,000 1321) 50.000 543,534 $ $ Equity 3 $ $ $ Retained Earnings Stock Anderson Stock Bacon Stock-Cox Stock-Day Stock Elders Stock-Fawcett Stock-Gonzalez Total Liabides plus Equily 53.534 50,000 150.000 100.000 50,000 40.000 80.000 20.000 543.534 $ 8 $ Option #1: Corporate Tax Returns Review the grading rubric below to understand how you will be graded on this assignment. Reach out to your instructor if you have questions about the assignment. Because it is important for accountants to demonstrate the filing requirements for specialized tax returns, for this final project you will complete a corporate tax return and provide an analysis of the ethical considerations related to tax preparation involving corporations. Key Components: Use the financial data below to complete Form 1120. Complete the Student Template (provided in Module 8 under this assignment) that has the respective tax forms and schedules required to complete the return. Complete all the parts of your respective business tax return for which there is information. Click this link to download Form 1120c from IRS.gov. Complete the return for BADEC. In a separate document: 1. Show your income tax calculations. 2. Prepare a write-up on analysis of the ethical considerations related to tax preparation. Entity Type: Sub-Entity Type: Entity Name: State of Formation Entity Start Date Corporation None BADEC Georgia 4/2/2013 Tax Year Start Date: Tax Year End Date: 4/2/2013 1231/2013 Book Maintained By: Address: Andrew Anderson 10 Sysco Way Atlanta, GA 30039 Purpose of Entity Acquire, rehabilitate and resale residential real property. Corporate Information from investment in A domestic corporations with ownershi Dividenda Received Estimated Tax Payments 70% $6.000 Investor Information SON First N Androw Bu Cathy LART Meme Andon Bacon COR STRIA GA GA 756-12-2222 Address 10 So Way 20 Seco Way 30 Sysco Way 40 So Way 50 5.200 Way GD Ssco Way 70 No Way City Ananta Asarna Alanna Afana Anton GIA Zp S hareholder information 30039 Sharcho der 300091 Sharcho der 30X30 Shanghaider W Shwehoder 30039 Sharchoder 30039 Siuarchoder Share h er EROV Farah CCP Ekers Fawn CARR 756 12 5555 758-12 GDEE GA GA ATAR T Investor First Name Last Name SSN ANI Anderson1756-12-1111 Contribution 4 tem V alue Caty Ders COK Day 706 12 3333 756 12 4444 10-12-5-55 706 12 5866 75 12.7777 Contribution 1 Contribution 2 Contribution 3 Contribution Date Hem Value Hem Value Item Value 4 22013 Ch 50.200 4/22013C $150.000 22013 $100.000 4/22019 Cash $50.000 4220013 C4 $40,000 422013 C $20.000 Land s son 422013 Cash $10,000 Computer S7000 Fumare Not Sharholder Contributions Interest $80.000 10 S150.000 31 $100,000 S5401 $40.000 SAL0001 $20 CDI 1000 Fara GO Fanco Gorcz BADEC Income Statement 1/1/2008-12/31/2008 BADEC Balance Sheet 1/2/2008 BADEC, Inc. 04.02.2013 - 12/31/2013 BADEC, Inc 4/2/2013 $ Assets Cash Computer Furniture Lend Toral Assets Liabilities 430 000 7,000 3.000 50.000 490.000 Gross Income Repair Revenue Interest Income Dividerds (Qualitied Net Short-term Captal Gain Total Income from all sources S100,000 $600 $2.000 $5.000 5107,600 Equity Capital Anderson Capital-Bacon Capital-Cox Capital-Day Capital Elders Capital-Fawcett Capital Gonzalez Toral Liabities pus Equity 50.000 150 000 100.000 50.000 40.000 80.000 20 000 190,000 Expenses Guaranteed payments Renovation Expense Rent Depreciaton expense Licenses Travel Expenses Supplies Expenses Nel Long-term Capital Loss Charitable Contributione Total Expenses $10.000 $5,500 $1,500 $2.066 $500 5800 $700 $10.000 S5.000 $36.066 $ BADEC Balance Sheet 12.2008 Net Income (before federal income taxes $71.534 ZIZVOU BADEC Partnership 12/31/2013 Cash Dividend Distribution to-Elders Cash Dividend Distriction to Fawcett Cash Dividend Distribution to Gonzalez S5.000 56.000 $7.000 $ $ $ Assets Cash Computer Accep-Computer Furniture Accep Furniture Land Total Aseets Liabilities 485,600 7.000 (1,745) 3,000 1321) 50.000 543,534 $ $ Equity 3 $ $ $ Retained Earnings Stock Anderson Stock Bacon Stock-Cox Stock-Day Stock Elders Stock-Fawcett Stock-Gonzalez Total Liabides plus Equily 53.534 50,000 150.000 100.000 50,000 40.000 80.000 20.000 543.534 $ 8 $