Answered step by step

Verified Expert Solution

Question

1 Approved Answer

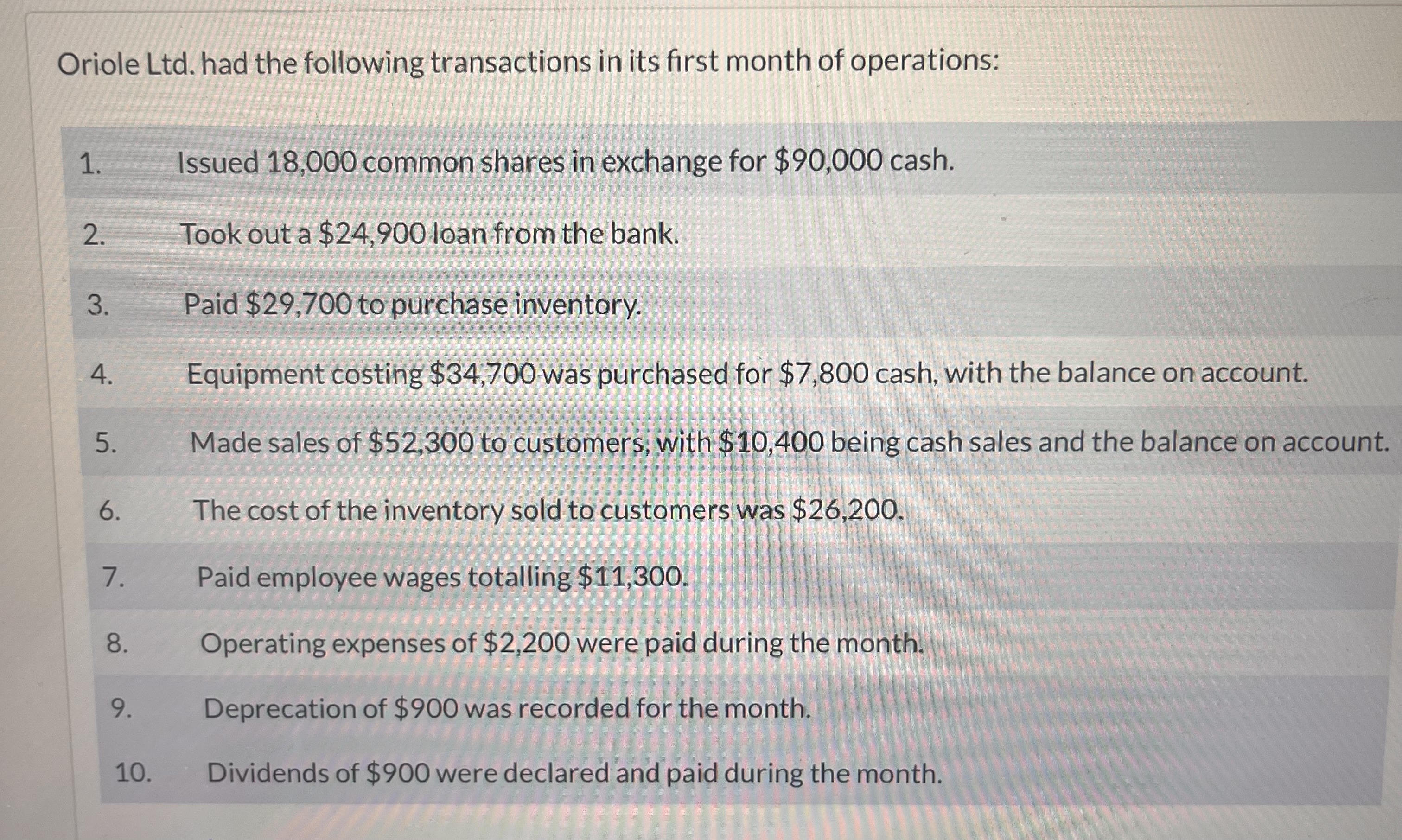

Oriole Ltd. had the following transactions in its first month of operations: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Issued 18,000

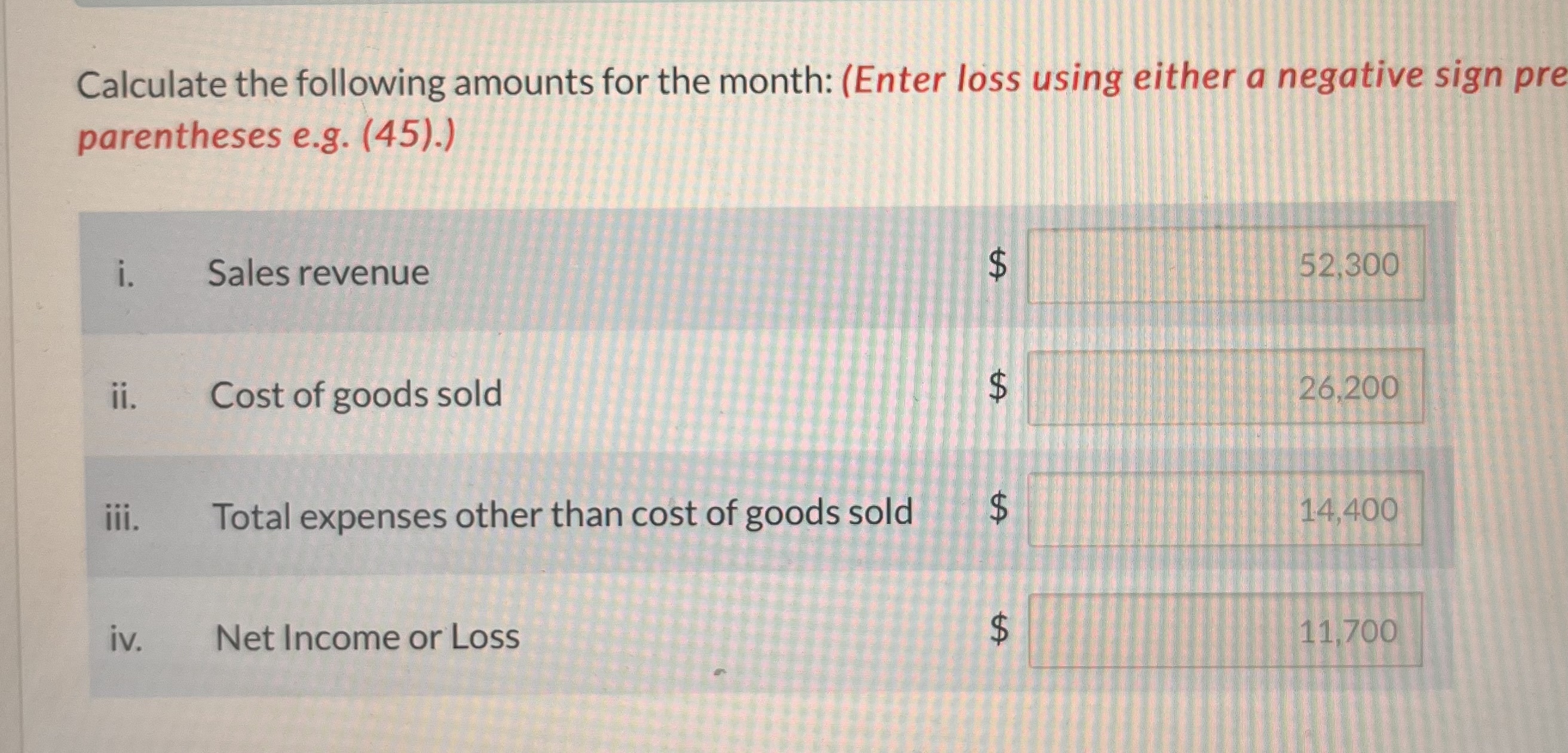

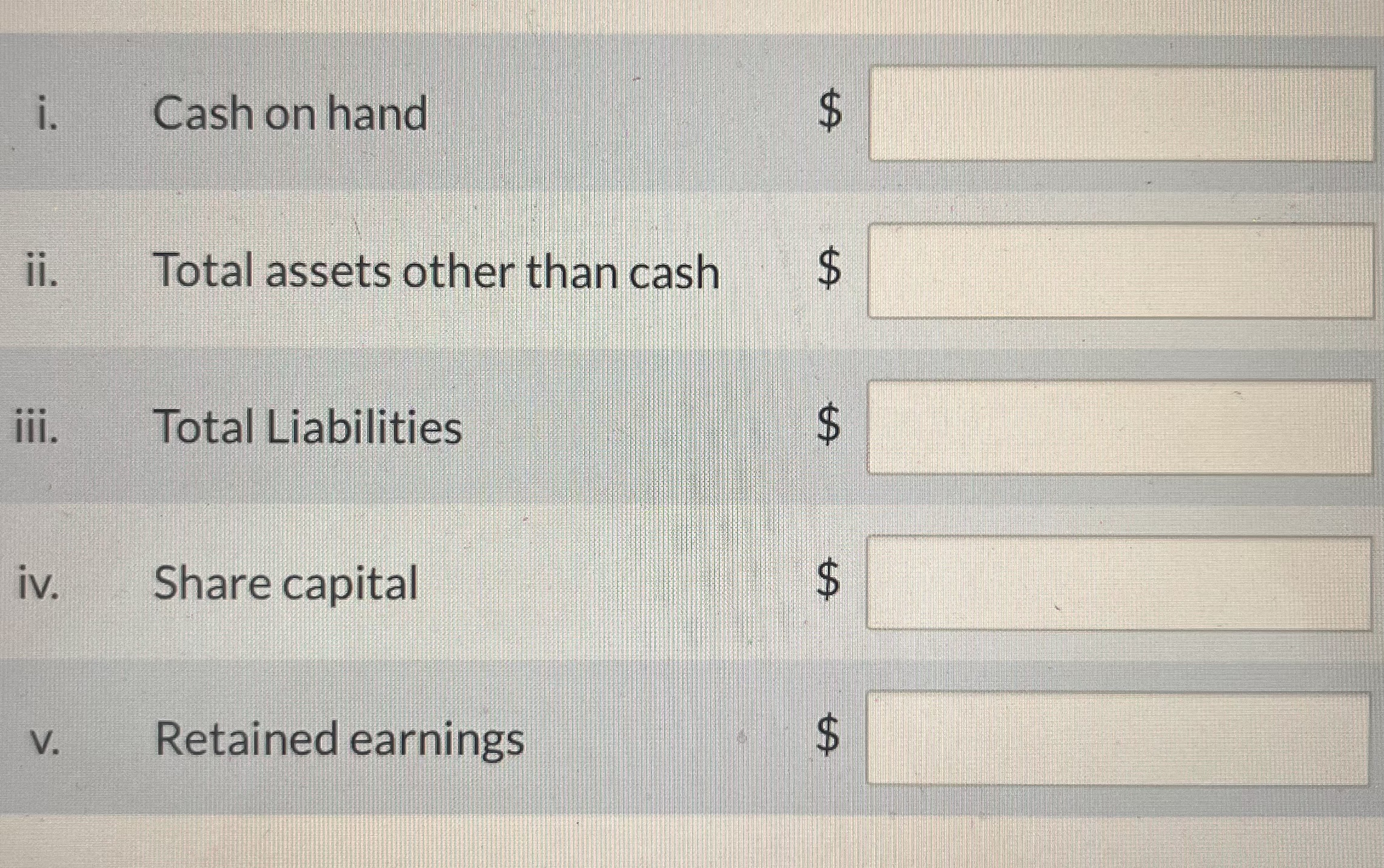

Oriole Ltd. had the following transactions in its first month of operations: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Issued 18,000 common shares in exchange for $90,000 cash. Took out a $24,900 loan from the bank. Paid $29,700 to purchase inventory. Equipment costing $34,700 was purchased for $7,800 cash, with the balance on account. Made sales of $52,300 to customers, with $10,400 being cash sales and the balance on account. The cost of the inventory sold to customers was $26,200. Paid employee wages totalling $11,300. Operating expenses of $2,200 were paid during the month. Deprecation of $900 was recorded for the month. Dividends of $900 were declared and paid during the month. Calculate the following amounts for the month: (Enter loss using either a negative sign pre parentheses e.g. (45).) i. ii. iii. iv. Sales revenue Cost of goods sold Total expenses other than cost of goods sold Net Income or Loss LA $ $ LA LA $ LA 52,300 26,200 14,400 11,700 i. ii. iii. iv. V. Cash on hand Total assets other than cash Total Liabilities Share capital Retained earnings $ LA $ $ $

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

i Sales Total Sales Cash Sales Sales on Account Total Sales 10400 52300 Total Sales 62700 ii Cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started