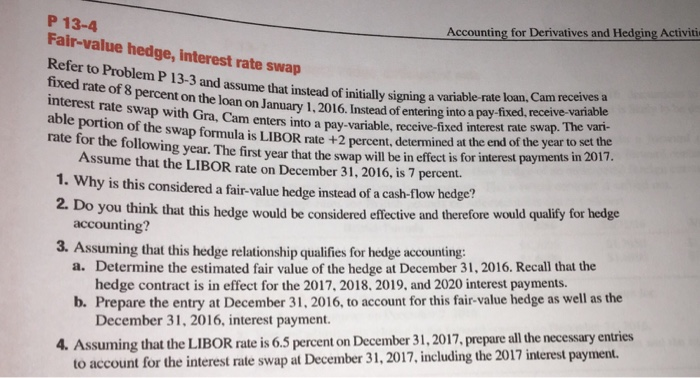

P 13-4 Fair-value hedge, interest rate swap Refer to Problem P 13-3 and assume that instead of initially signing a vari interest rate able portion of the swap formula is rate for the following year. The first year that the swap will be in effect is for interest payments in Accounting for Derivatives and Hedging Activiti percent on the loan on January 1, 2016. Instead of entering into a pay-fixed, receive swap with Gra, Cam enters into a pay-variable, receive-fixed interest rate swap. The vari- LIBOR rate +2 percent, determined at the end of the year to set the Assume that the LIBOR rate on December 31, 2016, is 7 percent. 1. Why is this considered a fair-value hedge instead of a cash-flow hedge? 2. Do you think that this hedge would be considered effective and therefore would qualify for hedge accounting? 3. Assuming that this hedge relationship qualifies for hedge accounting: Determine the estimated fair value of the hedge at December 31, 2016. Recall that the hedge contract is in effect for the 2017, 2018. 2019, and 2020 interest payments. Prepare the entry at December 31, 2016, to account for this fair-value hedge as well as the December 31,2016, interest payment. a. b. 4. Assuming that the LIBOR rate is 6.5 percent on December 31,2017. prepare all he necessary entries to account for the interest rate swap at December 31,2017, including the 2017 interest payment. P 13-4 Fair-value hedge, interest rate swap Refer to Problem P 13-3 and assume that instead of initially signing a vari interest rate able portion of the swap formula is rate for the following year. The first year that the swap will be in effect is for interest payments in Accounting for Derivatives and Hedging Activiti percent on the loan on January 1, 2016. Instead of entering into a pay-fixed, receive swap with Gra, Cam enters into a pay-variable, receive-fixed interest rate swap. The vari- LIBOR rate +2 percent, determined at the end of the year to set the Assume that the LIBOR rate on December 31, 2016, is 7 percent. 1. Why is this considered a fair-value hedge instead of a cash-flow hedge? 2. Do you think that this hedge would be considered effective and therefore would qualify for hedge accounting? 3. Assuming that this hedge relationship qualifies for hedge accounting: Determine the estimated fair value of the hedge at December 31, 2016. Recall that the hedge contract is in effect for the 2017, 2018. 2019, and 2020 interest payments. Prepare the entry at December 31, 2016, to account for this fair-value hedge as well as the December 31,2016, interest payment. a. b. 4. Assuming that the LIBOR rate is 6.5 percent on December 31,2017. prepare all he necessary entries to account for the interest rate swap at December 31,2017, including the 2017 interest payment