Question

The following chart is taken from the Australian National Accounts: Finance and Wealth , March 2020, published by the Australian Bureau of Statistics (ABS) on

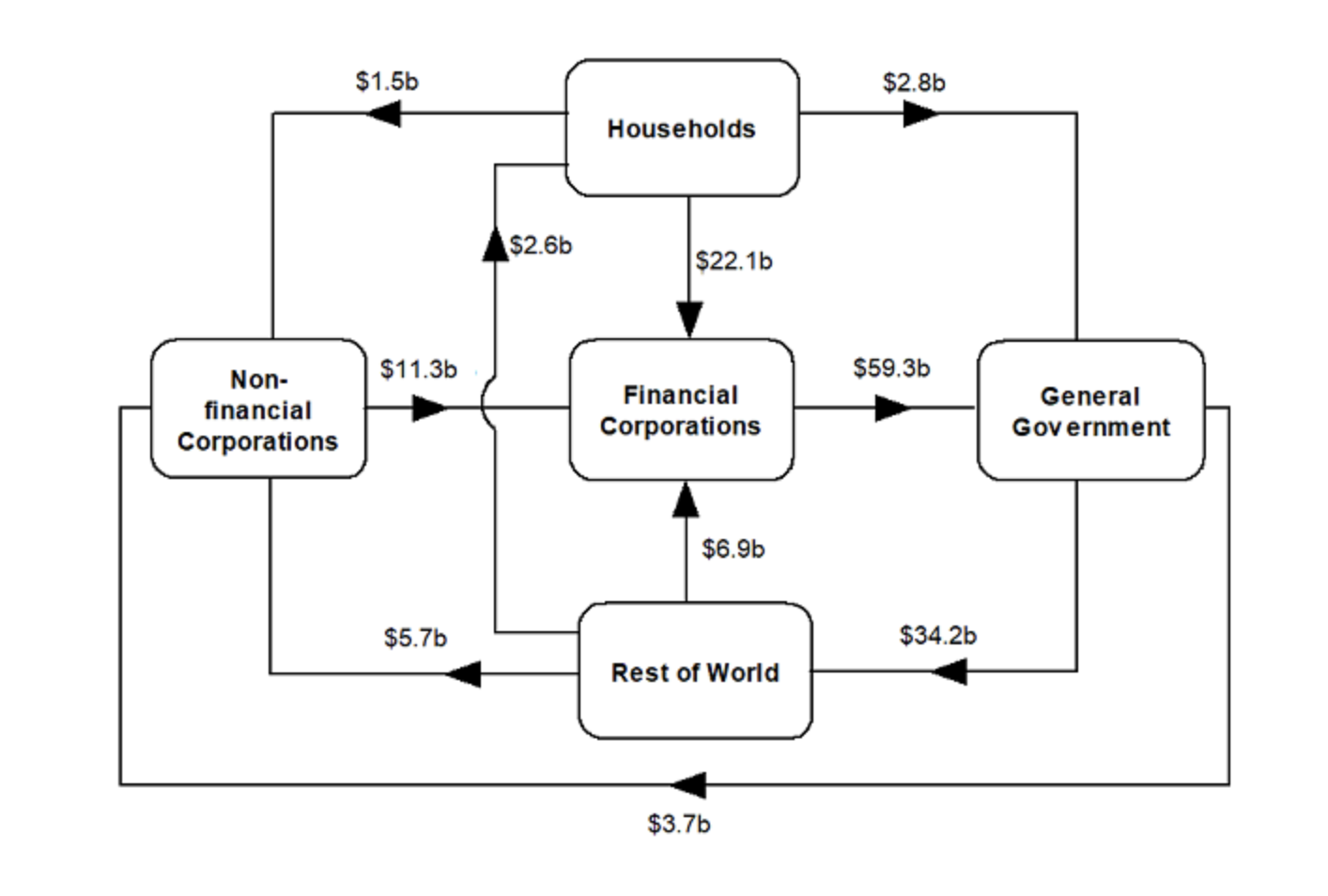

The following chart is taken from the Australian National Accounts: Finance and Wealth, March 2020, published by the Australian Bureau of Statistics (ABS) on June 25th, 2020.

The chart describes the net claims across the five sectors of Australias financial system, at the end of March 2020. To help you to interpret the chart, I will interpret one of the figures on it. The $6.9bn figure above the arrow going to Financial Corporations (banks and other institutions) from the Rest of the World indicates that Australian financial corporations owed a net amount of $6.9bn to investors from outside Australia at that point in time

Each sector has four arrows going from it or to it. Arrows going from a sector involve that sector having a net claim on another sector. Arrows going to a sector involve that sector net debt to another sector.

If a sector has net overall claims on other sectors, then the sector has positive net financial assets. If a sector is in net overall debt to other sectors, then the sector has net financial liabilities.

- Excluding the General Government sector, which of the other sectors had net financial assets and which of the other sectors had net financial liabilities, and how big were the net financial assets or net financial liabilities of each of these other sectors? (4 marks)

- An individual household has net financial liabilities of $150,000, and yet net assets of $300,000. Explain precisely how this is possible. (1 mark)

- How is it possible for an individual household to have net financial liabilities, while at the same time the Households sector has net financial assets? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started