Answered step by step

Verified Expert Solution

Question

1 Approved Answer

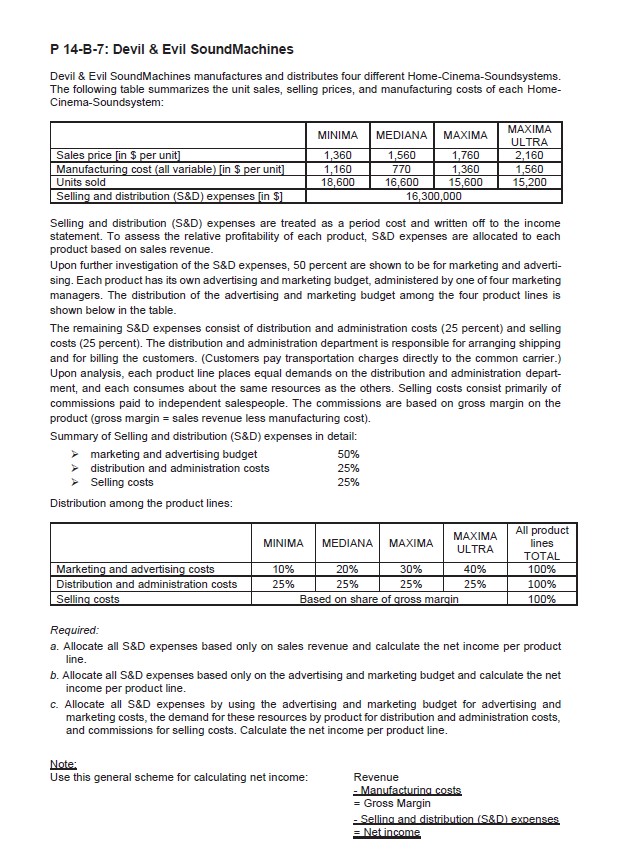

P 14-B-7: Devil & Evil SoundMachines Devil & Evil SoundMachines manufactures and distributes four different Home-Cinema-Soundsystems. The following table summarizes the unit sales, selling prices,

P 14-B-7: Devil \& Evil SoundMachines Devil \& Evil SoundMachines manufactures and distributes four different Home-Cinema-Soundsystems. The following table summarizes the unit sales, selling prices, and manufacturing costs of each HomeCinema-Soundsystem: Selling and distribution (S\&D) expenses are treated as a period cost and written off to the income statement. To assess the relative profitability of each product, S\&D expenses are allocated to each product based on sales revenue. Upon further investigation of the S\&D expenses, 50 percent are shown to be for marketing and advertising. Each product has its own advertising and marketing budget, administered by one of four marketing managers. The distribution of the advertising and marketing budget among the four product lines is shown below in the table. The remaining S\&D expenses consist of distribution and administration costs ( 25 percent) and selling costs (25 percent). The distribution and administration department is responsible for arranging shipping and for billing the customers. (Customers pay transportation charges directly to the common carrier.) Upon analysis, each product line places equal demands on the distribution and administration department, and each consumes about the same resources as the others. Selling costs consist primarily of commissions paid to independent salespeople. The commissions are based on gross margin on the product (gross margin = sales revenue less manufacturing cost). Summary of Selling and distribution (S\&D) expenses in detail: Distribution among the product lines: Required: a. Allocate all S\&D expenses based only on sales revenue and calculate the net income per product line. b. Allocate all S\&D expenses based only on the advertising and marketing budget and calculate the net income per product line. c. Allocate all S\&D expenses by using the advertising and marketing budget for advertising and marketing costs, the demand for these resources by product for distribution and administration costs, and commissions for selling costs. Calculate the net income per product line

P 14-B-7: Devil \& Evil SoundMachines Devil \& Evil SoundMachines manufactures and distributes four different Home-Cinema-Soundsystems. The following table summarizes the unit sales, selling prices, and manufacturing costs of each HomeCinema-Soundsystem: Selling and distribution (S\&D) expenses are treated as a period cost and written off to the income statement. To assess the relative profitability of each product, S\&D expenses are allocated to each product based on sales revenue. Upon further investigation of the S\&D expenses, 50 percent are shown to be for marketing and advertising. Each product has its own advertising and marketing budget, administered by one of four marketing managers. The distribution of the advertising and marketing budget among the four product lines is shown below in the table. The remaining S\&D expenses consist of distribution and administration costs ( 25 percent) and selling costs (25 percent). The distribution and administration department is responsible for arranging shipping and for billing the customers. (Customers pay transportation charges directly to the common carrier.) Upon analysis, each product line places equal demands on the distribution and administration department, and each consumes about the same resources as the others. Selling costs consist primarily of commissions paid to independent salespeople. The commissions are based on gross margin on the product (gross margin = sales revenue less manufacturing cost). Summary of Selling and distribution (S\&D) expenses in detail: Distribution among the product lines: Required: a. Allocate all S\&D expenses based only on sales revenue and calculate the net income per product line. b. Allocate all S\&D expenses based only on the advertising and marketing budget and calculate the net income per product line. c. Allocate all S\&D expenses by using the advertising and marketing budget for advertising and marketing costs, the demand for these resources by product for distribution and administration costs, and commissions for selling costs. Calculate the net income per product line Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started