Question

P5.6 Consolidation and analytical check on non-controlling interests On 1 January 20x3, P Co acquired 90% ownership interest of Y Co for $2,000,000. At that

P5.6 Consolidation and analytical check on non-controlling interests

On 1 January 20x3, P Co acquired 90% ownership interest of Y Co for $2,000,000. At that date, the following relate to Y Co:

Book value of net assets on 1 January 20x3...........................$1,500,000

Excess of fair value over book value of intellectual property...$ 100,000

It was estimated that the intellectual property had a remaining useful life of five years from 1 January 20x3. The fair value of non-controlling interests of Y Co as at the date of acquisition was $200,000. There was no changed in the share capital of Y Co since the acquisition date. There were no other items in equity other than share capital and retained earnings.

On 1 July 20x4, Y Co transferred its equipment to P Co at a transfer price of $120,000. The equipment was purchased from external vendors on 1 July 20x1 at a price of $140,000. Its estimated useful life was five years from the date of purchase and it had no residual value. The original estimates remained unchanged at the date of transfer.

Y Co sold inventory on the following dates:

| Date of Transfer | 1 October 20x4 | 1 June 20x5 |

|---|---|---|

| Invoice Price | $150,000 | $350,000 |

| Original cost | 100,000 | 400,000 |

| In P's warehouse at end 20x4 | 40% of original batch | |

| In P's warehouse at end 20x5 | 10% of original batch | 30% of original batch |

Losses on transfers are indicative of impairment loss in the underlying asset. Tax rate was 20%. Tax effects are to be recognised.

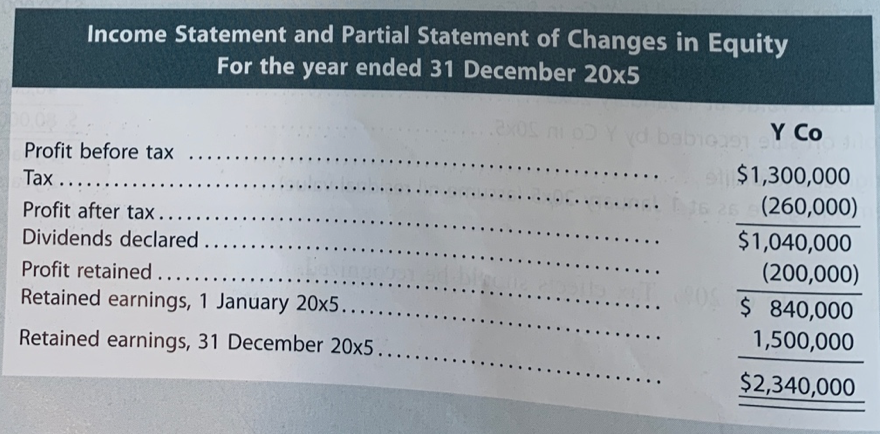

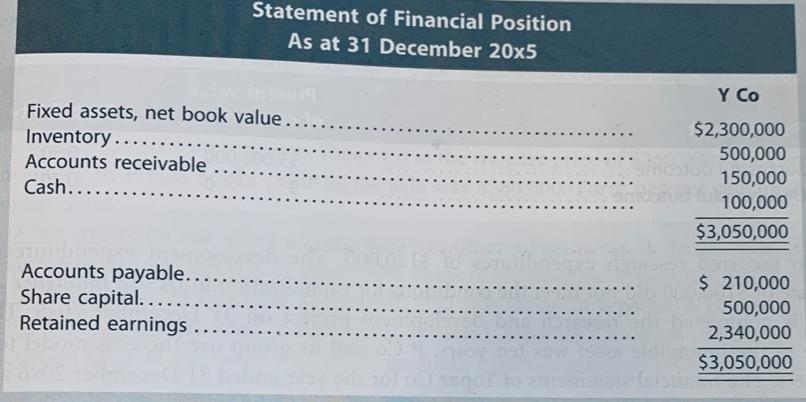

Extracts of Y Co's Financial Statements for the Year ended 31 December 20x5 are shown below:

Required:

1. Prepare the necessary consolidation adjustments for the year ended December 20x5

2. Perform an analytical check on non-controlling interests as at 31 December 20x5

3. If P Co measures non-controlling interests as a proportion of identifiable net assets as at acquisition date, prepare the consolidation adjustment(s) that differs from part 1, and perform an analytical check on non-controlling interests' balance as at 31 December 20x5

Income Statement and Partial Statement of Changes in Equity For the year ended 31 December 20x5 Y Co Profit before tax st $1,300,000 (260,000) .... Tax ..... Profit after tax....... $1,040,000 (200,000) Dividends declared .... Profit retained..... $ 840,000 1,500,000 Retained earnings, 1 January 20x5... Retained earnings, 31 December 20x5. $2,340,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

NCI 100 2200000 500000 10 90 NCI at acq 200000 50000 2000000 450000 1 Share capital 2 RE 1000000 100...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started