pa help po salamat

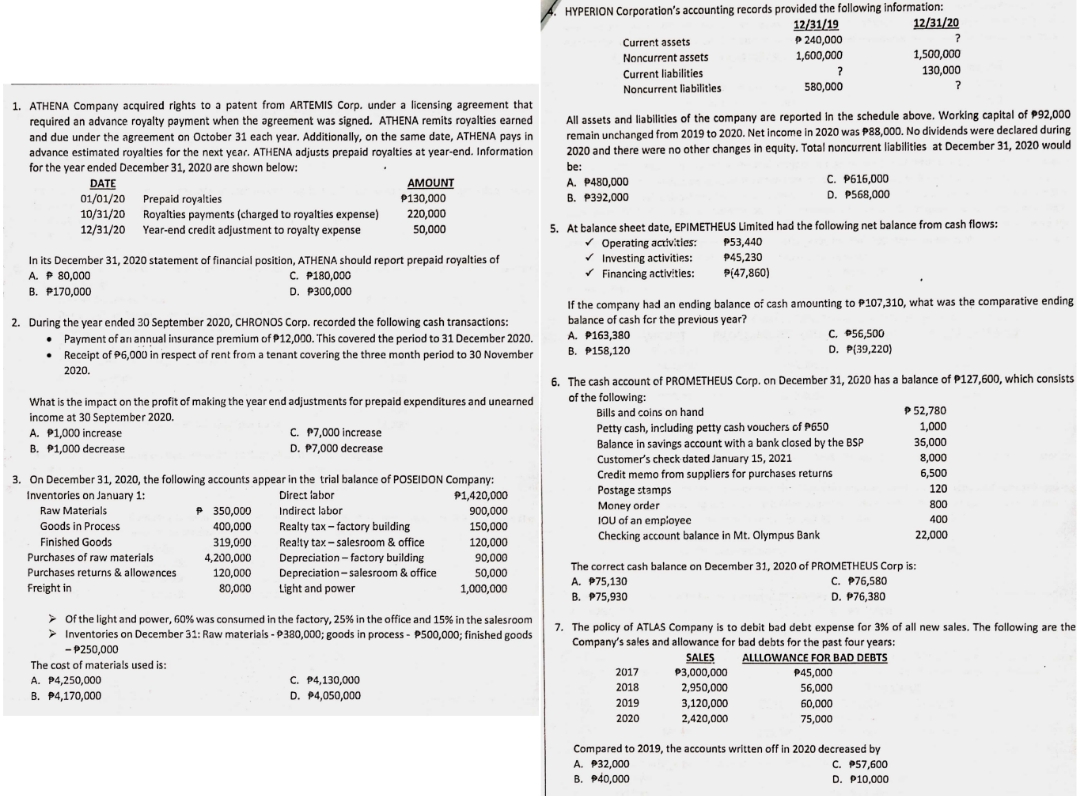

HYPERION Corporation's accounting records provided the following information: 12/31/19 12/31/20 Current assets 240,000 Noncurrent assets 1,600,000 1,500,000 Current liabilities 130,000 Noncurrent liabilities 580,000 1. ATHENA Company acquired rights to a patent from ARTEMIS Corp. under a licensing agreement that required an advance royalty payment when the agreement was signed. ATHENA remits royalties earned All assets and liabilities of the company are reported in the schedule above. Working capital of $92,000 and due under the agreement on October 31 each year. Additionally, on the same date, ATHENA pays in remain unchanged from 2019 to 2020. Net income in 2020 was P88,000. No dividends were declared during advance estimated royalties for the next year. ATHENA adjusts prepaid royalties at year-end. Information 2020 and there were no other changes in equity. Total noncurrent liabilities at December 31, 2020 would for the year ended December 31, 2020 are shown below: be DATE AMOUNT A. P480,000 C. P616,000 01/01/20 Prepaid royalties P130,000 B. P392,000 D. P568,000 10/31/20 Royalties payments (charged to royalties expense) 220,000 12/31/20 Year-end credit adjustment to royalty expense 50,000 5. At balance sheet date, EPIMETHEUS Limited had the following net balance from cash flows: Operating activities: P53,440 In its December 31, 2020 statement of financial position, ATHENA should report prepaid royalties of Investing activities: P45,230 A. # 80,000 C. P180,000 Financing activities: P(47,860) B. P170,000 D. P300,000 If the company had an ending balance of cash amounting to P107,310, what was the comparative ending 2. During the year ended 30 September 2020, CHRONOS Corp. recorded the following cash transactions: balance of cash for the previous year? Payment of an annual insurance premium of P12,000. This covered the period to 31 December 2020. A. P163,38 C. #56,500 Receipt of P6,000 in respect of rent from a tenant covering the three month period to 30 November B. P158,120 D. P(39,220) 2020. 6. The cash account of PROMETHEUS Corp. on December 31, 2020 has a balance of P127,600, which consists What is the impact on the profit of making the year end adjustments for prepaid expenditures and unearned of the following: income at 30 September 2020. Bills and coins on hand P 52,780 A. P1,000 increase C. P7,000 increase Petty cash, including petty cash vouchers of P650 1,000 B. $1,000 decrease D. P7,000 decrease Balance in savings account with a bank closed by the BSP 35,000 Customer's check dated January 15, 2021 8,000 Credit memo from suppliers for purchases returns 6.500 3. On December 31, 2020, the following accounts appear in the trial balance of POSEIDON Company: Inventories on January 1: Direct labor P1,420,000 Postage stamps 120 # 350,000 Indirect labor 900,000 Money order 800 Raw Materials Goods in Process 400,000 400 Realty tax - factory building 150,000 OU of an employee 22,000 Finished Goods 319,000 Realty tax - salesroom & office 120,000 Checking account balance in Mt. Olympus Bank Purchases of raw materials 4,200,000 Depreciation - factory building 90,000 Purchases returns & allowances 120,000 Depreciation - salesroom & office 50,000 The correct cash balance on December 31, 2020 of PROMETHEUS Corp is: Freight in 80,000 A. P75,130 Light and power 1,000,000 C. P76,580 B. P75,930 D. P76,380 >Of the light and power, 60% was consumed in the factory, 25% in the office and 15% in the salesroom > Inventories on December 31: Raw materials - P380,000; goods in process - P500,000; finished goods 7. The policy of ATLAS Company is to debit bad debt expense for 3% of all new sales. The following are the - P250,000 Company's sales and allowance for bad debts for the past four years: The cost of materials used is: SALES ALLLOWANCE FOR BAD DEBTS 2017 P3,000,000 P45,00 A. P4,250,000 C. P4,130,000 2018 D. P4,050,000 2,950,000 56,000 B. P4,170,000 2019 3,120,000 60,000 2020 2,420,000 75,000 Compared to 2019, the accounts written off in 2020 decreased by A. P32,000 C. P57,600 B. P40,000 D. P10,000