Question

Packo Company acquired all the voting stock of Sennett Corporation on January 1, 2014 for $90,000 when Sennett had Capital Stock of $50,000 and Retained

Packo Company acquired all the voting stock of Sennett Corporation on January 1, 2014 for $90,000 when Sennett had Capital Stock of $50,000 and Retained Earnings of $8,000. The excess of fair value over book value was allocated as follows: (1) $5,000 to inventories (sold in 2014), (2) $16,000 to equipment with a 4-year remaining useful life (straight-line method of depreciation) and (3) the remainder to goodwill.

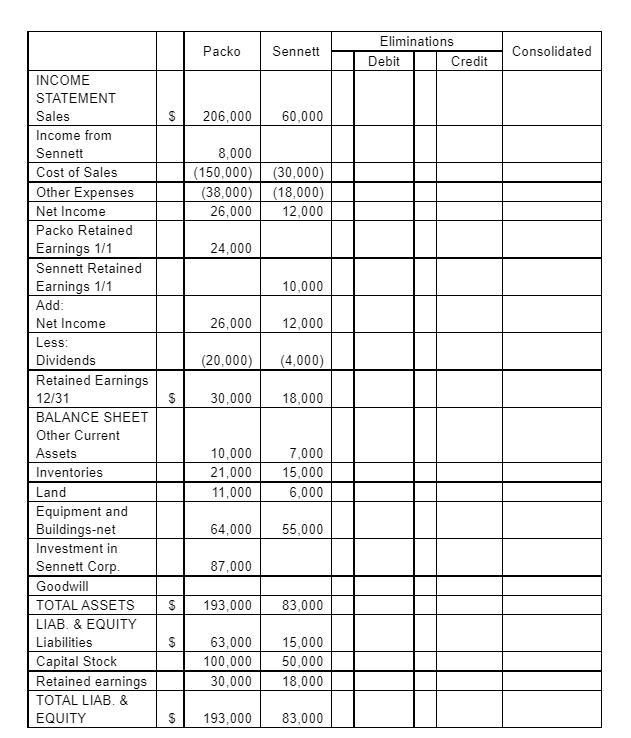

Financial statements for Packo and Sennett at the end of the fiscal year ended December 31, 2015 (two years after acquisition) appear in the first two columns of the partially completed consolidation working papers. Packo has accounted for its investment in Sennett using the equity method of accounting.

Complete the consolidation working papers for Packo Company and Subsidiary for the year ending December 31, 2015.

Eliminations Packo Sennett Consolidated Debit Credit INCOME STATEMENT Sales 206,000 60,000 Income from Sennett 8,000 (150,000) (30,000) (38,000) (18,000) Cost of Sales Other Expenses Net Income 26,000 12,000 Packo Retained Earnings 1/1 24,000 Sennett Retained Earnings 1/1 10,000 Add: Net Income 26,000 12,000 Less: Dividends (20,000) (4,000) Retained Earnings 12/31 30,000 18,000 BALANCE SHEET Other Current Assets 10,000 7,000 Inventories 21,000 15,000 Land 11,000 6,000 Equipment and Buildings-net 64,000 55,000 Investment in Sennett Corp. 87,000 Goodwill TOTAL ASSETS 193,000 83,000 LIAB. & EQUITY Liabilities 63,000 15,000 Capital Stock Retained earnings 100,000 50,000 30,000 18,000 TOTAL LIAB. & EQUITY 193,000 83,000 %24 %24 24

Step by Step Solution

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Packo is a manufacturer of stainless steel components It offers products such as industrial pumps and equipment for electropolishing pickling p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started