Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Page 1 6 of 3 0 Question 1 6 ( 9 points ) Joey is a successful salesman and sold for $ 4 , 7

Page of

Question points

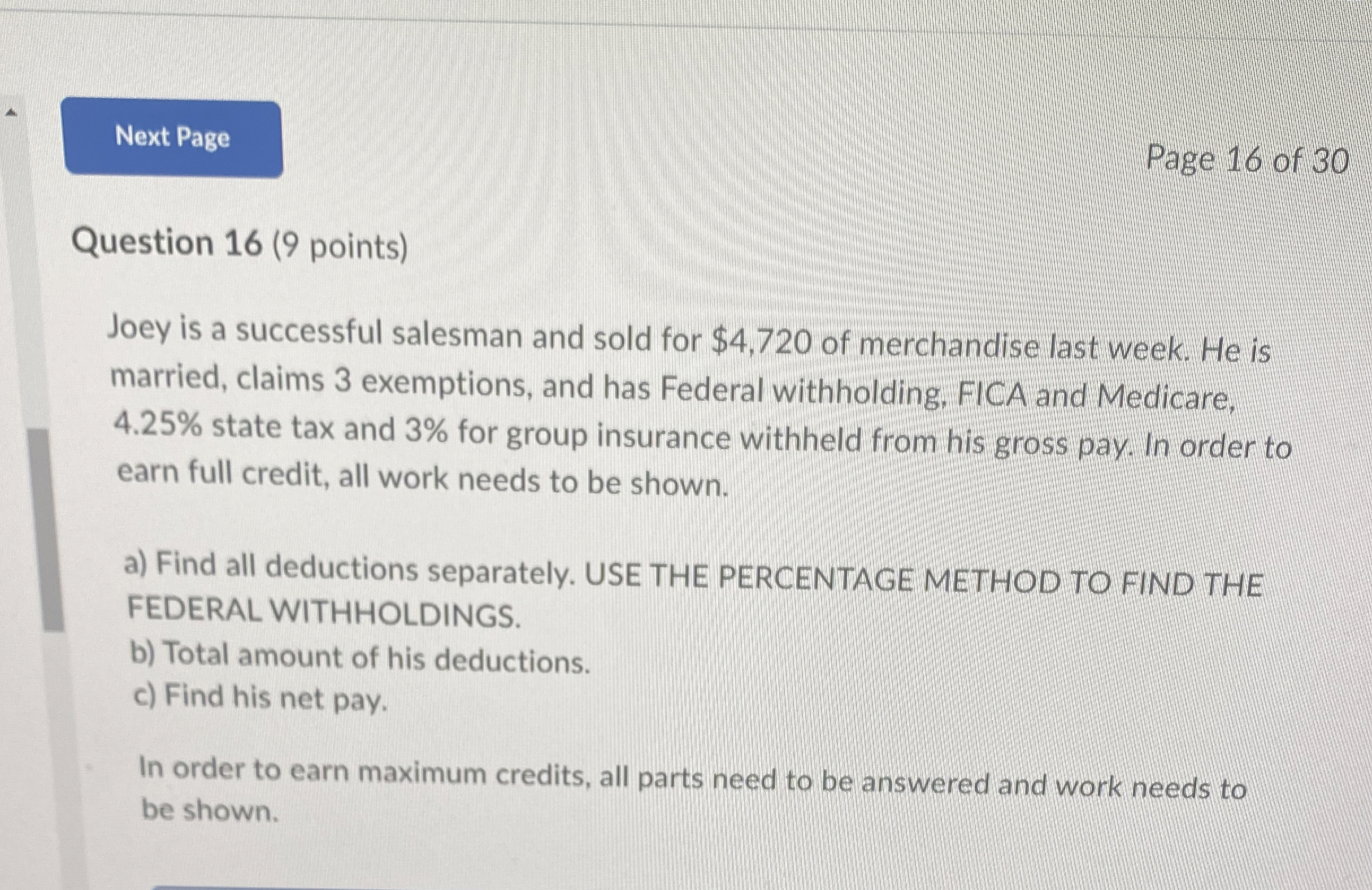

Joey is a successful salesman and sold for $ of merchandise last week. He is married, claims exemptions, and has Federal withholding, FICA and Medicare, state tax and for group insurance withheld from his gross pay. In order to earn full credit, all work needs to be shown.

a Find all deductions separately. USE THE PERCENTAGE METHOD TO FIND THE FEDERAL WITHHOLDINGS.

b Total amount of his deductions.

c Find his net pay.

In order to earn maximum credits, all parts need to be answered and work needs to be shown.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started