Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Panza Corp. (Panza) has been operating since 2008. It is now December 31, 2020 and Panza is about to prepare consolidated financial statements for

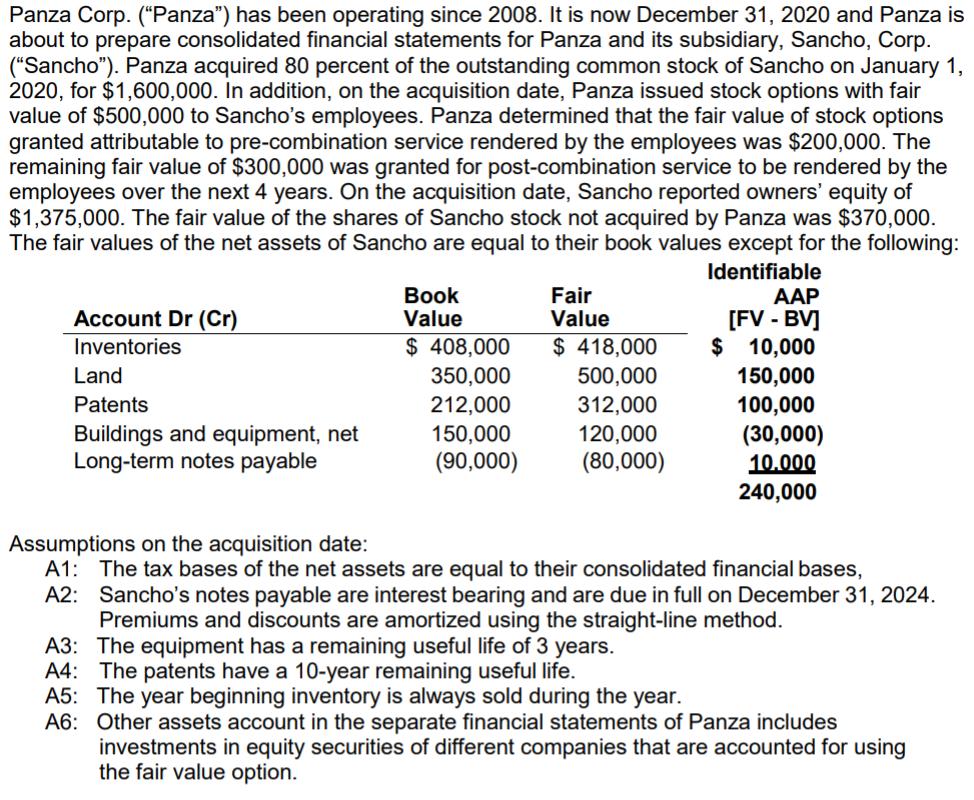

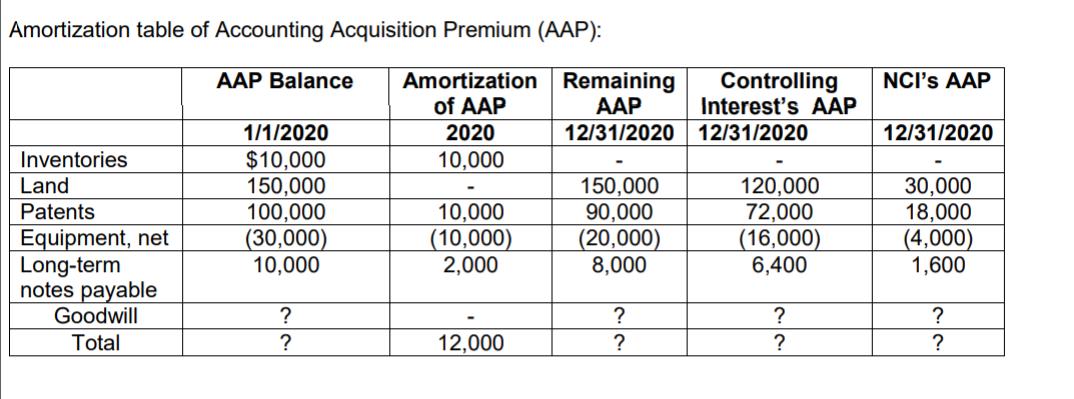

Panza Corp. ("Panza") has been operating since 2008. It is now December 31, 2020 and Panza is about to prepare consolidated financial statements for Panza and its subsidiary, Sancho, Corp. ("Sancho"). Panza acquired 80 percent of the outstanding common stock of Sancho on January 1, 2020, for $1,600,000. In addition, on the acquisition date, Panza issued stock options with fair value of $500,000 to Sancho's employees. Panza determined that the fair value of stock options granted attributable to pre-combination service rendered by the employees was $200,000. The remaining fair value of $300,000 was granted for post-combination service to be rendered by the employees over the next 4 years. On the acquisition date, Sancho reported owners' equity of $1,375,000. The fair value of the shares of Sancho stock not acquired by Panza was $370,000. The fair values of the net assets of Sancho are equal to their book values except for the following: Identifiable AAP [FV - BV] $ 10,000 Account Dr (Cr) Inventories Land Patents Buildings and equipment, net Long-term notes payable Book Value $ 408,000 350,000 212,000 150,000 (90,00 Fair Value $ 418,000 500,000 312,000 120,000 (80 150,000 100,000 (30,000) 10.000 240,000 Assumptions on the acquisition date: A1: The tax bases of the net assets are equal to their consolidated financial bases, A2: Sancho's notes payable are interest bearing and are due in full on December 31, 2024. Premiums and discounts are amortized using the straight-line method. A3: The equipment has a remaining useful life of 3 years. A4: The patents have a 10-year remaining useful life. A5: The year beginning inventory is always sold during the year. A6: Other assets account in the separate financial statements of Panza includes investments in equity securities of different companies that are accounted for using the fair value option. Amortization table of Accounting Acquisition Premium (AAP): Amortization of AAP 2020 10,000 Inventories Land Patents Equipment, net Long-term notes payable Goodwill Total AAP Balance 1/1/2020 $10,000 150,000 100,000 (30,000) 10,000 ? ? 10,000 (10,000) 2,000 12,000 Remaining AAP 12/31/2020 12/31/2020 150,000 90,000 (20,000) 8,000 ? ? Controlling NCI's AAP Interest's AAP 120,000 72,000 (16,000) 6,400 ? ? 12/31/2020 30,000 18,000 (4,000) 1,600 ? ?

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Solution To prepare the consolidated financial statements Panza needs to adjust Sanchos book values to their fair values and eliminate intercompany tr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started