Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pare adjusting entries for the year ended December 31, for each of these liabilities 1. (15 Points) Pre separate si lees collected in advance are

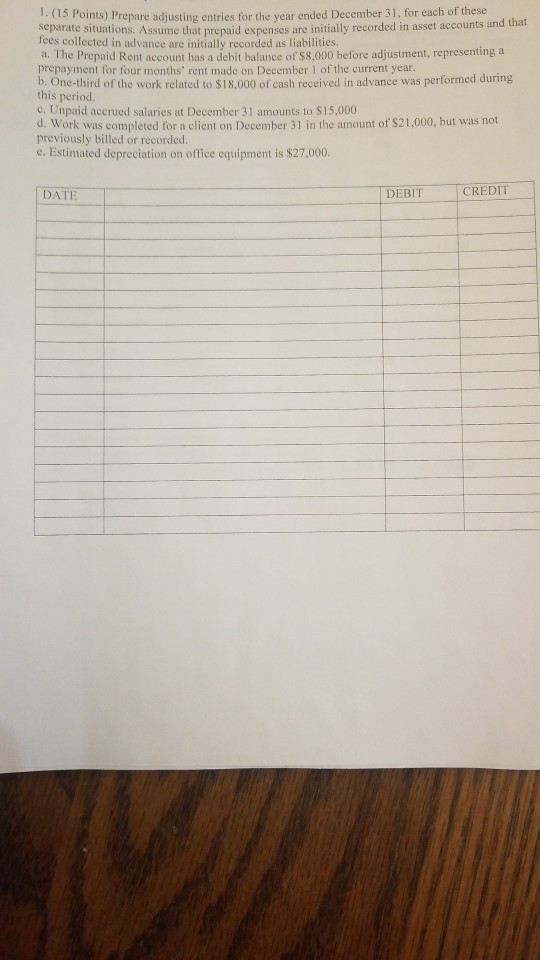

pare adjusting entries for the year ended December 31, for each of these liabilities 1. (15 Points) Pre separate si lees collected in advance are initially recorded as a. The Prepaid Rent account has a debit balance of $8,000 before adjustment, representing a prepayment for four months' rent made on December 1 of the current year b. One-third of the work related to $18,000 of cash received in advance was performed during tuations. Ass ume that prepaid expenses are initially recorded in asset accounts and that this period. c. Unpaid accrued salaries at December 31 amounts to $15,000 d. Work was completed for a client on December 31 in the amount of $21,000, but was not previously billed or recorded. e. Estimated depreciation on office equipment is $27,000 DATE DEBIT CREDIT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started