Question

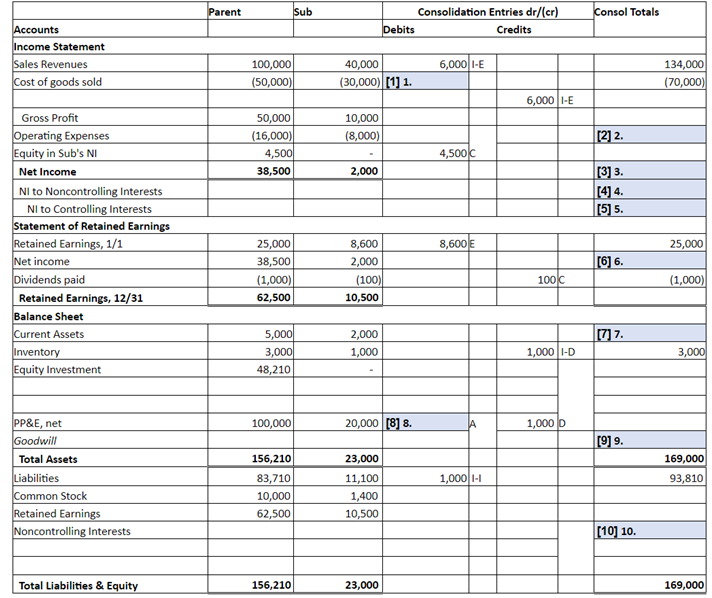

Parent acquired 90% of the Subsidiarys stock for $60,000 in cash on January 1, 2017, when Subsidiarys book value was $20,000. The fair value of

Parent acquired 90% of the Subsidiarys stock for $60,000 in cash on January 1, 2017, when Subsidiarys book value was $20,000. The fair value of the noncontrolling interest was $4,000.

At the time of acquisition, all of Subsidiarys assets and liabilities were reported at fair value, except for PP&E which had a book value of $10,000 and a fair market value of $20,000 and a remaining useful life of 10 years.

Subsidiary continuously sells inventory to Parent.

|

| Inventory Sales | GP on Unsold Inventory @ EOY | I/C AR/AP |

| 2020 | $6,000 | 1,500 | $1,000 |

| 2019 | $8,000 | 5,000 | $2,000 |

Complete the 10 numbered boxes in the consolidation as of December 31, 2010

Do no use $, .xx, OR abbreviated numbers. Be sure to show the proper presentation in the Consolidated Totals. In the Consolidation Entries column do NOT use Dr. or Cr. Or show as negatives.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started