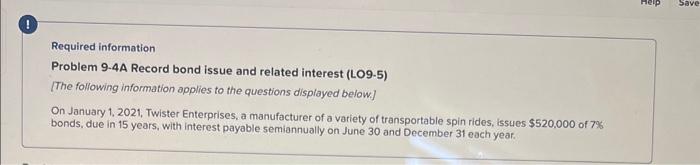

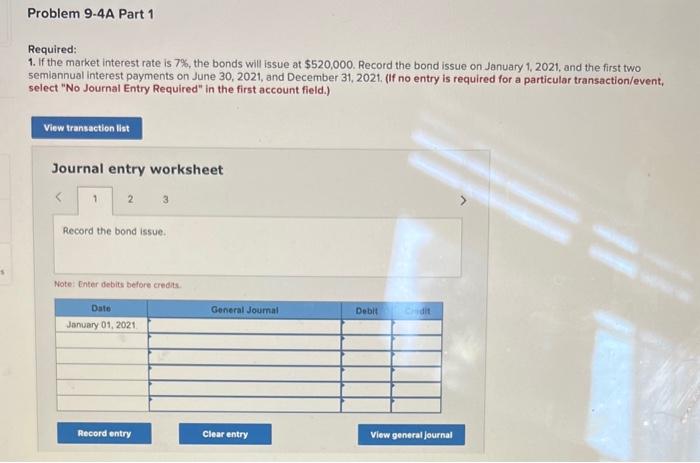

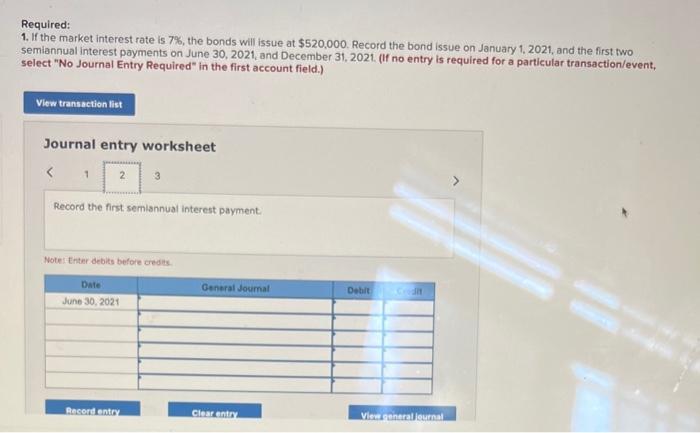

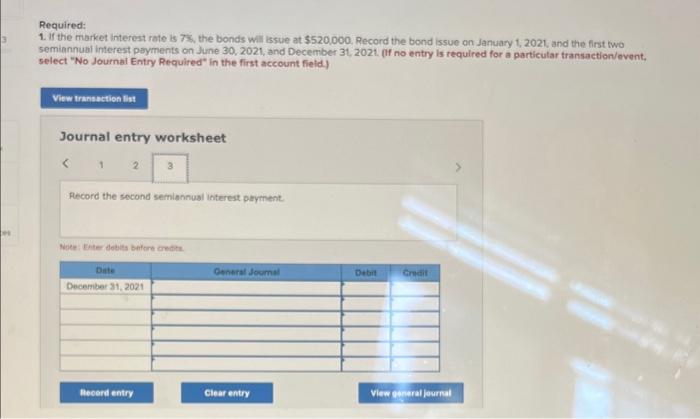

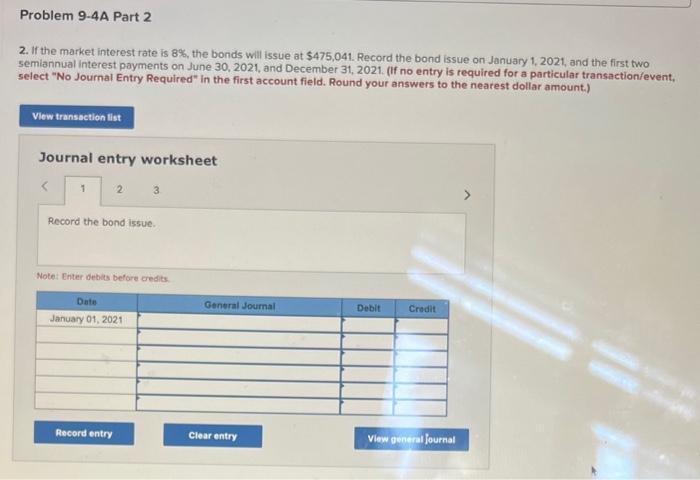

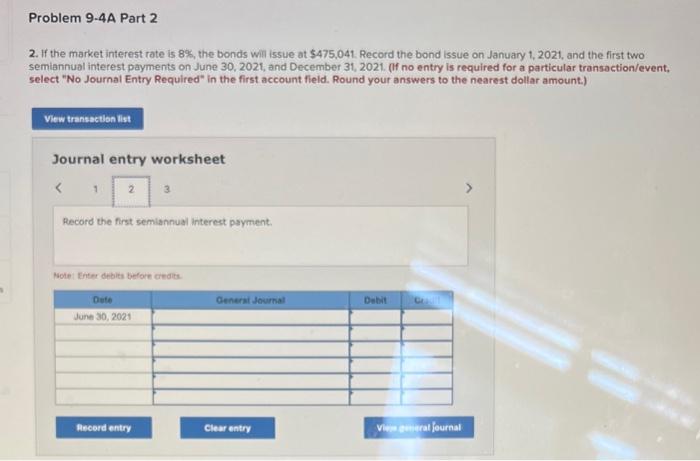

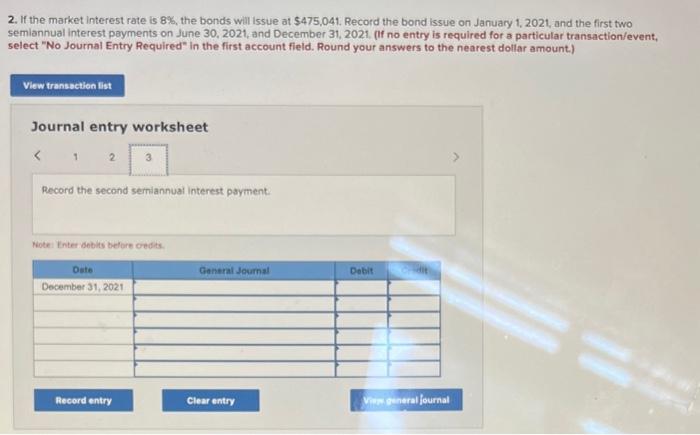

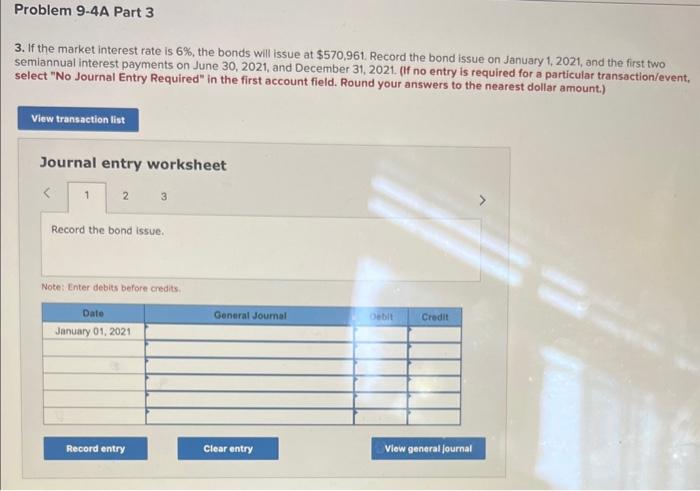

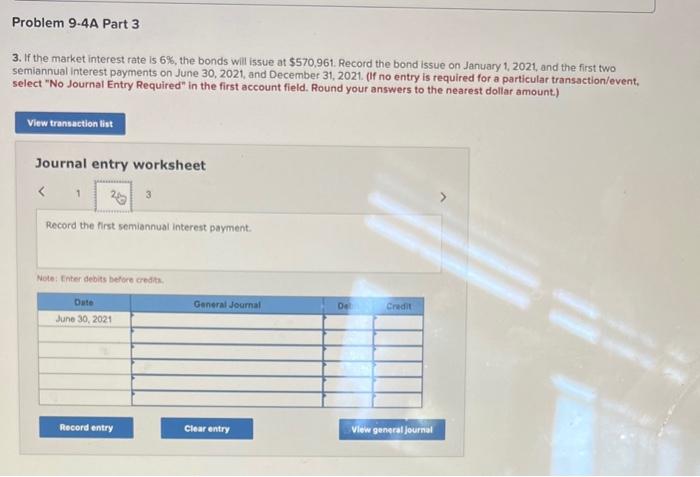

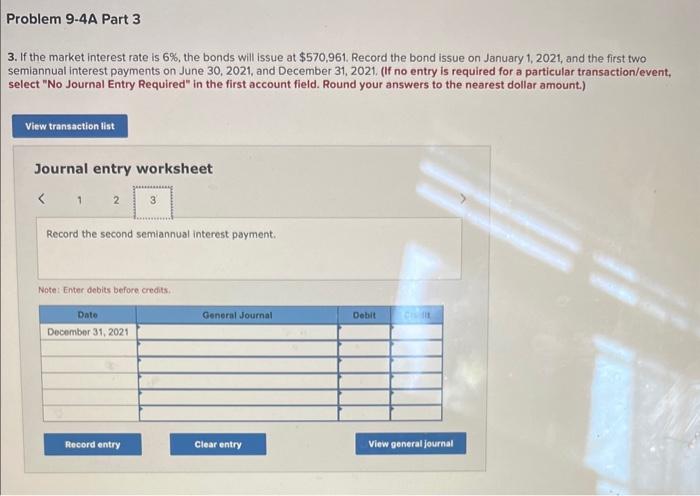

Required information Problem 9-4A Record bond issue and related interest (LO9-5) [The following information applies to the questions displayed below] On January 1, 2021, Twister Enterprises, a manufacturer of a vatiety of transportable spin rides, issues $520,000 of 7% bonds, due in 15 years, with interest payable semiannually on June 30 and December 31 each year. Required: 1. If the market interest rate is 7%, the bonds will issue at $520,000. Record the bond issue on January 1,2021 , and the first two semiannual interest payments on June 30, 2021, and December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 3 Required: 1. If the market interest rate is 7%, the bonds will issue at $520,000. Record the bond issue on January 1, 2021, and the first two semiannual interest payments on June 30, 2021, and December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the first semiannual interest payment. Notes Enter debits before credts. Required: 1. If the market interest rate is 75 , the bonds will issue at $520,000. Record the bond issue on January 1,2021; and the first two semiannubl interest poyments on June 30, 2021, and December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Pecord the sacond semiennual interest paryment. Noes thter debits beftore creatiz. 2. If the market interest rate is 8%, the bonds will issue at $475,041. Record the bond issue on January 1,2021 , and the first two semiannual interest payments on June 30, 2021, and December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your answers to the nearest dollar amount.) Journal entry worksheet 3 Record the bond issue. Note: Enter debits before credits. 2. If the market interest rate is 8%, the bonds will issue at $475,041. Record the bond issue on January 1,2021 , and the first two semiannual interest payments on June 30, 2021, and December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account fleld. Round your answers to the nearest dollar amount.) Journal entry worksheet Record the first semiannual interest payment. Notel Enter debles before credits. 2. If the market Interest rate is 8%, the bonds will issue at $475,041. Record the bond issue on January 1,2021 , and the first two semiannual interest payments on June 30, 2021, and December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field. Round your answers to the nearest dollar amount.) Journal entry worksheet Record the second serniannual interest payment: Note: Enter debits before oedits. 3. If the market interest rate is 6%, the bonds will issue at $570,961. Record the bond issue on January 1,2021 , and the first two semiannual interest payments on June 30, 2021, and December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your answers to the nearest dollar amount.) Journal entry worksheet 3. If the market interest rate is 6%, the bonds will issue at $570,961. Record the bond issue on January 1,2021 , and the first two semiannual interest payments on June 30, 2021, and December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your answers to the nearest dollar amount) Journal entry worksheet Record the first semiannual interest payment. Nole: tinter debits before credits. 3. If the market interest rate is 6%, the bonds will issue at $570,961, Record the bond issue on January 1,2021 , and the first two semiannual interest payments on June 30, 2021, and December 31, 2021, (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your answers to the nearest dollar amount.) Journal entry worksheet Record the second semiannual interest payment. Note: Enter debits before credits