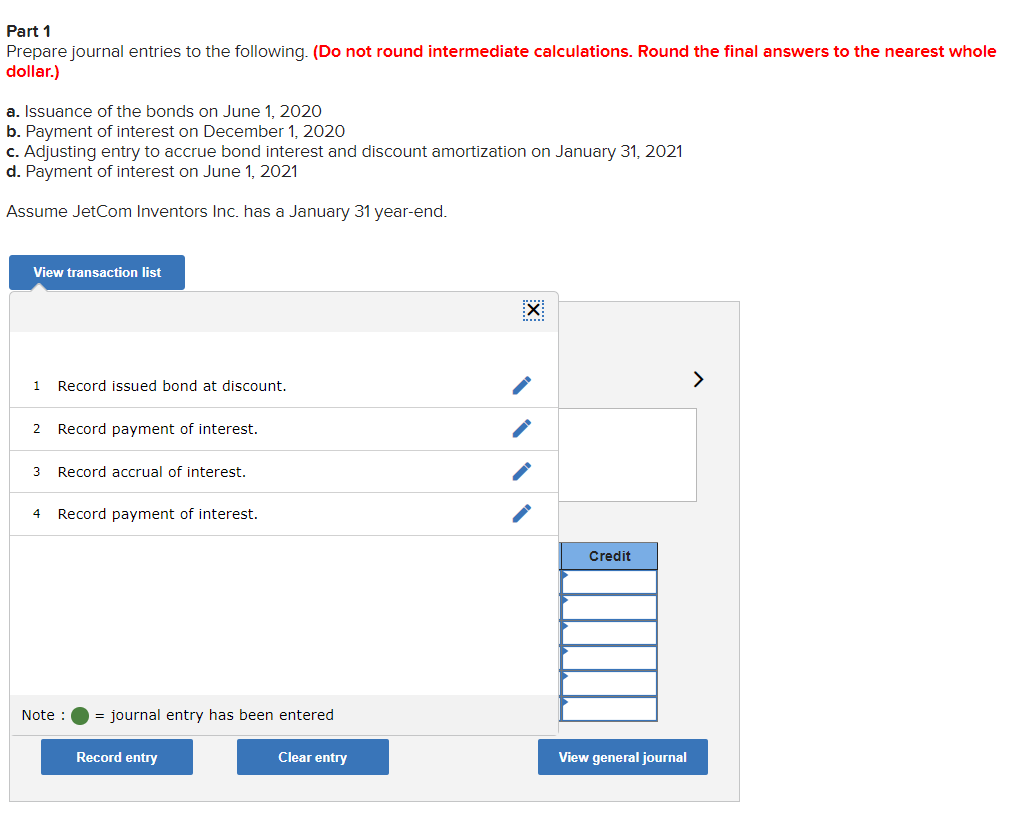

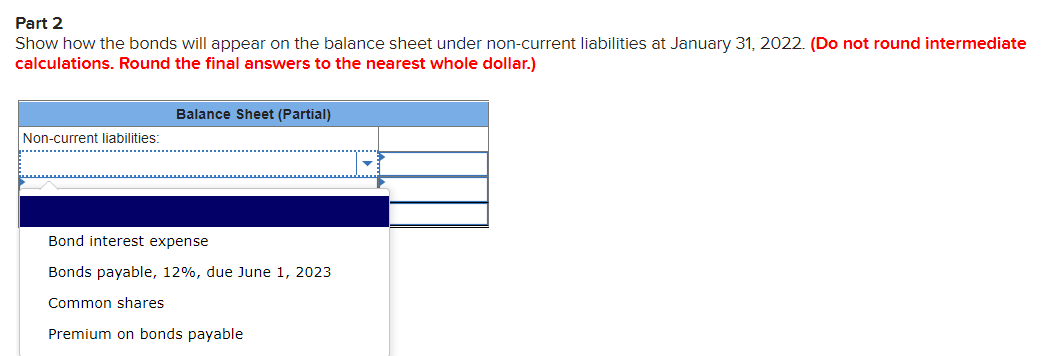

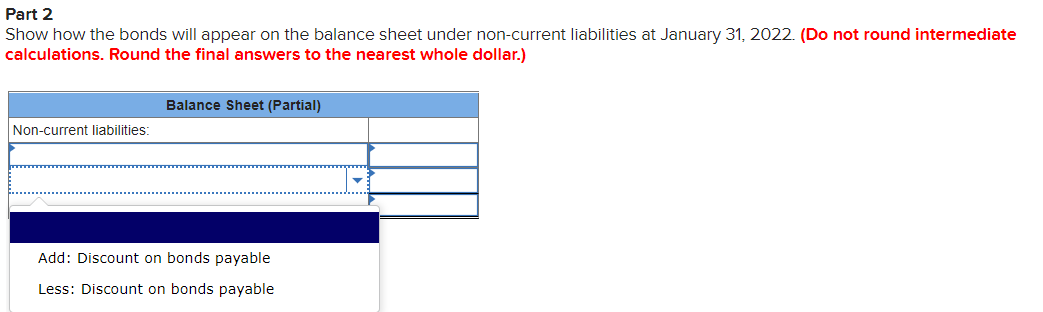

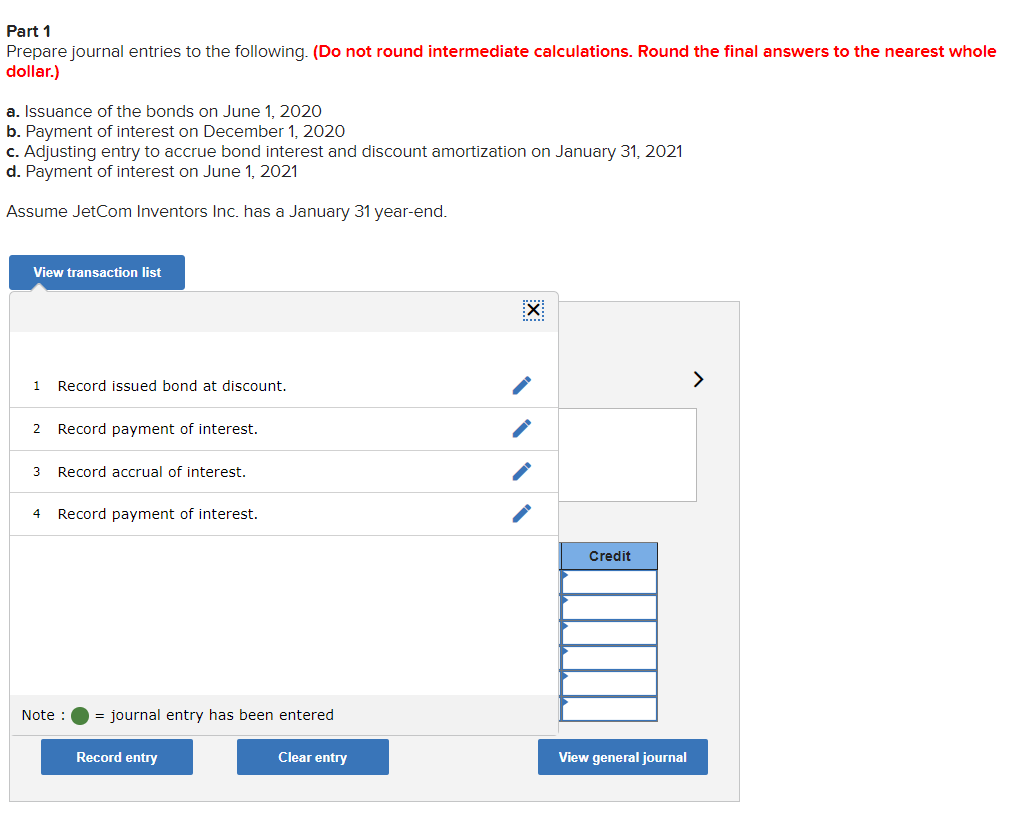

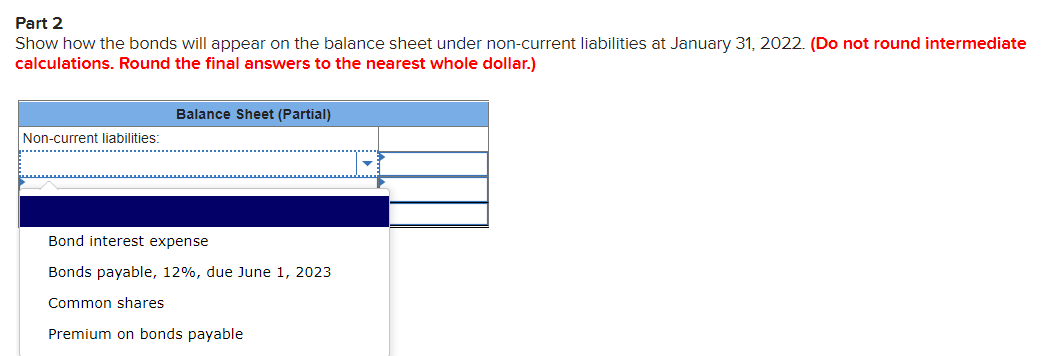

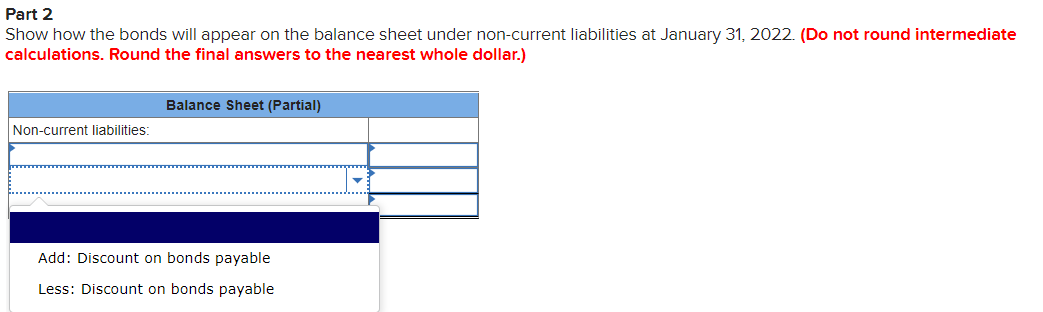

Part 1 Prepare journal entries to the following. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) a. Issuance of the bonds on June 1, 2020 b. Payment of interest on December 1, 2020 c. Adjusting entry to accrue bond interest and discount amortization on January 31, 2021 d. Payment of interest on June 1, 2021 Assume JetCom Inventors Inc. has a January 31 year-end. View transaction list X 1 > Record issued bond at discount. 2 Record payment of interest. 3 Record accrual of interest. 4 Record payment of interest. Credit Note : = journal entry has been entered Record entry Clear entry View general journal Part 2 Show how the bonds will appear on the balance sheet under non-current liabilities at January 31, 2022. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Balance Sheet (Partial) Non-current liabilities: Bond interest expense Bonds payable, 12%, due June 1, 2023 Common shares Premium on bonds payable Part 2 Show how the bonds will appear on the balance sheet under non-current liabilities at January 31, 2022. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Balance Sheet (Partial) Non-current liabilities: Add: Discount on bonds payable Less: Discount on bonds payable Part 1 Prepare journal entries to the following. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) a. Issuance of the bonds on June 1, 2020 b. Payment of interest on December 1, 2020 c. Adjusting entry to accrue bond interest and discount amortization on January 31, 2021 d. Payment of interest on June 1, 2021 Assume JetCom Inventors Inc. has a January 31 year-end. View transaction list X 1 > Record issued bond at discount. 2 Record payment of interest. 3 Record accrual of interest. 4 Record payment of interest. Credit Note : = journal entry has been entered Record entry Clear entry View general journal Part 2 Show how the bonds will appear on the balance sheet under non-current liabilities at January 31, 2022. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Balance Sheet (Partial) Non-current liabilities: Bond interest expense Bonds payable, 12%, due June 1, 2023 Common shares Premium on bonds payable Part 2 Show how the bonds will appear on the balance sheet under non-current liabilities at January 31, 2022. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Balance Sheet (Partial) Non-current liabilities: Add: Discount on bonds payable Less: Discount on bonds payable