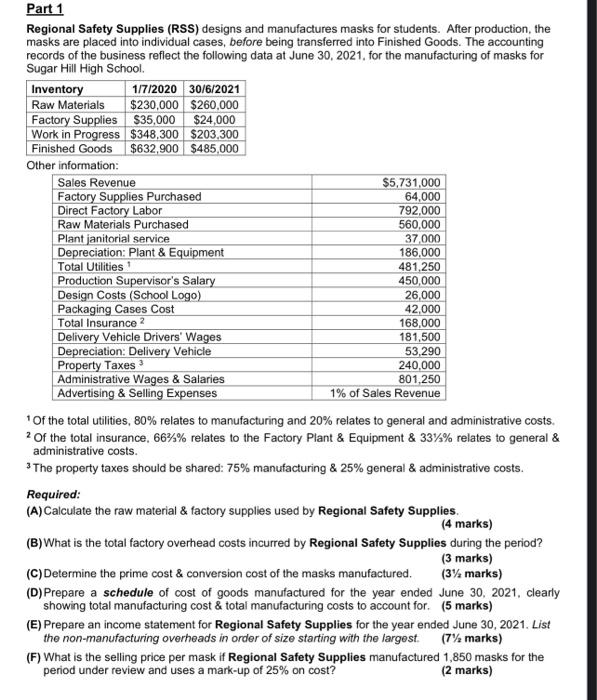

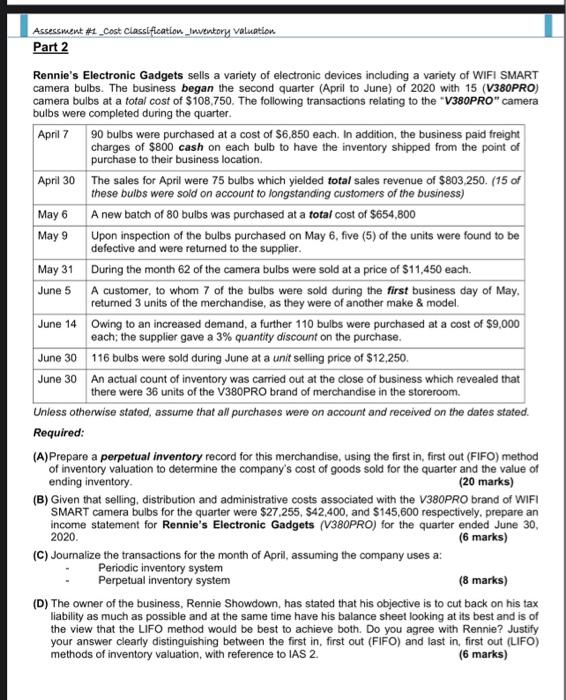

Part 1 Regional Safety Supplies (RSS) designs and manufactures masks for students. After production, the masks are placed into individual cases, before being transferred into Finished Goods. The accounting records of the business reflect the following data at June 30, 2021, for the manufacturing of masks for Sugar Hill High School. Other information: 1 Of the total utilities, 80% relates to manufacturing and 20% relates to general and administrative costs. 2 Of the total insurance, 66%3% relates to the Factory Plant \& Equipment \& 331/3% relates to general \& administrative costs. 3 The property taxes should be shared: 75% manufacturing \& 25% general \& administrative costs. Required: (A) Calculate the raw material \& factory supplies used by Regional Safety Supplies. (4 marks) (B) What is the total factory overhead costs incurred by Regional Safety Supplies during the period? (3 marks) (C) Determine the prime cost \& conversion cost of the masks manufactured. (31/2 marks) (D)Prepare a schedule of cost of goods manufactured for the year ended June 30, 2021, clearly showing total manufacturing cost \& total manufacturing costs to account for. (5 marks) (E) Prepare an income statement for Regional Safety Supplies for the year ended June 30, 2021. List the non-manufacturing overheads in order of size starting with the largest. (7 1/2 marks) (F) What is the selling price per mask if Regional Safety Supplies manufactured 1,850 masks for the period under review and uses a mark-up of 25% on cost? (2 marks) Rennie's Electronic Gadgets sells a variety of electronic devices including a variety of WIFI SMART camera bulbs. The business began the second quarter (April to June) of 2020 with 15 (V380PRO) camera bulbs at a total cost of $108,750. The following transactions relating to the "V380PRO" camera bulbs were completed during the quarter. Unless otherwise stated, assume that all purchases were on account and received on the dates stated. Required: (A)Prepare a perpetual inventory record for this merchandise, using the first in, first out (FIFO) method of inventory valuation to determine the company's cost of goods sold for the quarter and the value of ending inventory. (20 marks) (B) Given that selling, distribution and administrative costs associated with the V380PRO brand of WIFI SMART camera bulbs for the quarter were $27,255,$42,400, and $145,600 respectively, prepare an income statement for Rennie's Electronic Gadgets (V380PRO) for the quarter ended June 30, 2020. (6 marks) (C) Journalize the transactions for the month of April, assuming the company uses a: - Periodic inventory system - Perpetual inventory system (8 marks) (D) The owner of the business, Rennie Showdown, has stated that his objective is to cut back on his tax liability as much as possible and at the same time have his balance sheet looking at its best and is of the view that the LIFO method would be best to achieve both. Do you agree with Rennie? Justify your answer clearly distinguishing between the first in, first out (FIFO) and last in, first out (LIFO) methods of inventory valuation, with reference to IAS 2. (6 marks)