Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1: Select 1 real Vietnamese manufacturing firm and provide the following information: [15 marks]: [05 marks] 1. General information a. Company name, company

![Part 1: Select 1 real Vietnamese manufacturing firm and provide the following information: [15 marks]: [05](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/07/62d7fd9cb7588_1658322333272.jpg)

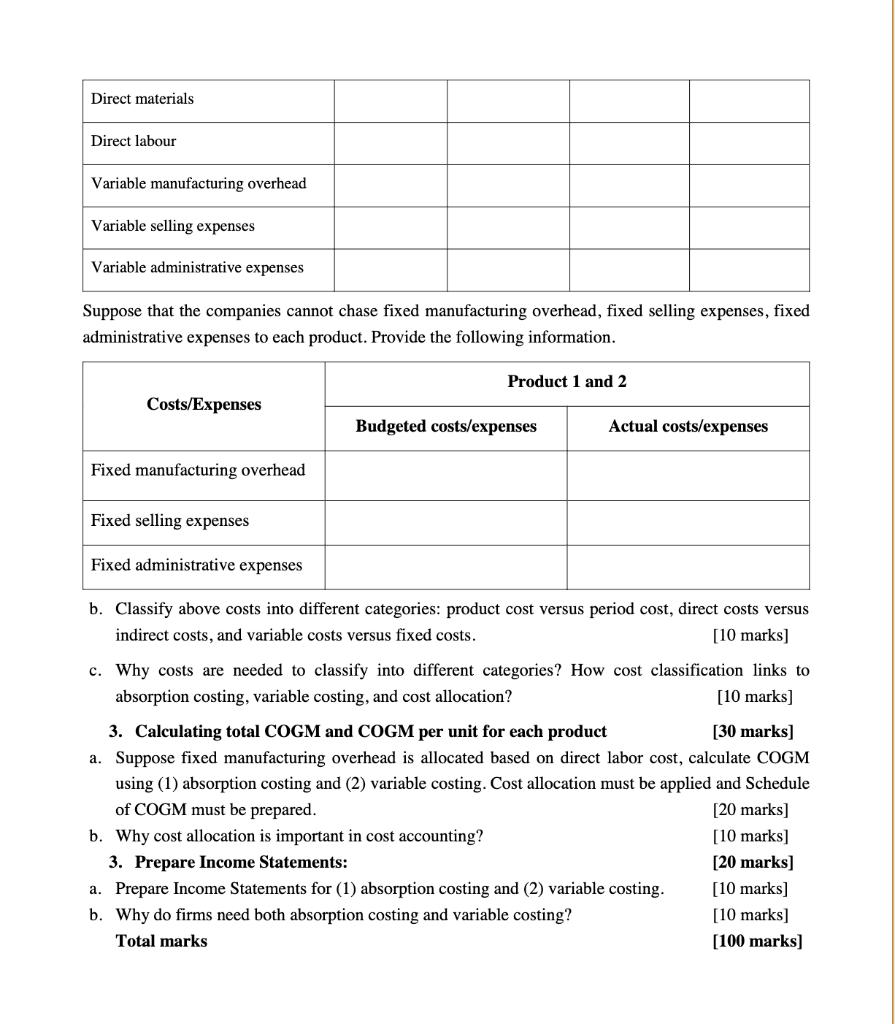

Part 1: Select 1 real Vietnamese manufacturing firm and provide the following information: [15 marks]: [05 marks] 1. General information a. Company name, company tax number, address b. Firm type (corporation, partnership, or proprietorship and so on) c. Company legal presentative d. Industry in which the company is operating e. Main products: the company must produce at least two (02) products. f. Firm size in terms of assets, liability, equity, and number of employees 2. Product, production and others. a. Product features: describe main features of the products b. Production process: describe production process c. Market and customers of the products. Part 2: Based on the above information, suppose the firm produces two products, develop an imaginative case of cost accounting for the year of 2021 as follows: 1. Products: [10 marks] Name two products: names of the products must be aligned with characteristics of the chosen firm in Part 1. For each product: Suppose that there is no beginning inventory of the finished goods, give planned production units, actual units produced, sales volume, and selling prices. Products Product 1 Product 2 Planned production units (units) Costs/Expenses Actual unit produced (units) Product 1 2. Cost, cost category and application of cost classification [25 marks] a. List costs/expenses needed to produce and sell the products as required in the table below. Names of all costs and expenses must be aligned with characteristics of the chosen firm in Part 1. Amount must be specified in Vietnam Dong. Budgeted costs/expenses [10 marks] Sales volume (units) 2 Actual costs/expenses Selling prices (Vietnam Dong) Budgeted costs/expenses [05 marks] Product 2 Actual costs/expenses Direct materials Direct labour Variable manufacturing overhead Variable selling expenses Variable administrative expenses Suppose that the companies cannot chase fixed manufacturing overhead, fixed selling expenses, fixed administrative expenses to each product. Provide the following information. Costs/Expenses Fixed manufacturing overhead Product 1 and 2 Budgeted costs/expenses Actual costs/expenses Fixed selling expenses Fixed administrative expenses b. Classify above costs into different categories: product cost versus period cost, direct costs versus indirect costs, and variable costs versus fixed costs. [10 marks] c. Why costs are needed to classify into different categories? How cost classification links to absorption costing, variable costing, and cost allocation? [10 marks] b. Why cost allocation is important in cost accounting? 3. Prepare Income Statements: 3. Calculating total COGM and COGM per unit for each product [30 marks] a. Suppose fixed manufacturing overhead is allocated based on direct labor cost, calculate COGM using (1) absorption costing and (2) variable costing. Cost allocation must be applied and Schedule of COGM must be prepared. [20 marks] [10 marks] [20 marks] [10 marks] [10 marks] [100 marks] a. Prepare Income Statements for (1) absorption costing and (2) variable costing. b. Why do firms need both absorption costing and variable costing? Total marks

Step by Step Solution

★★★★★

3.46 Rating (188 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 General Information Company Name ABC Manufacturing Co Company Tax Number 123456789 Address 123 Nguyen Van Linh Street Ho Chi Minh City Vietnam ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started