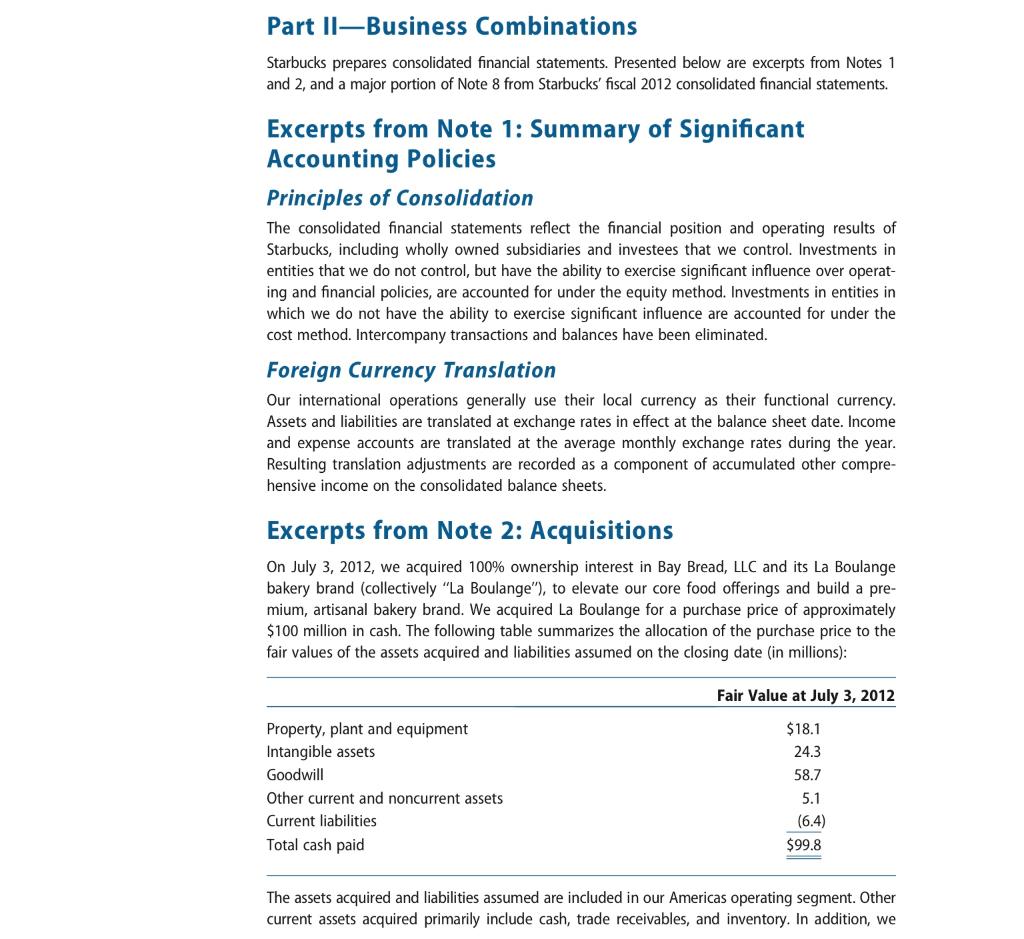

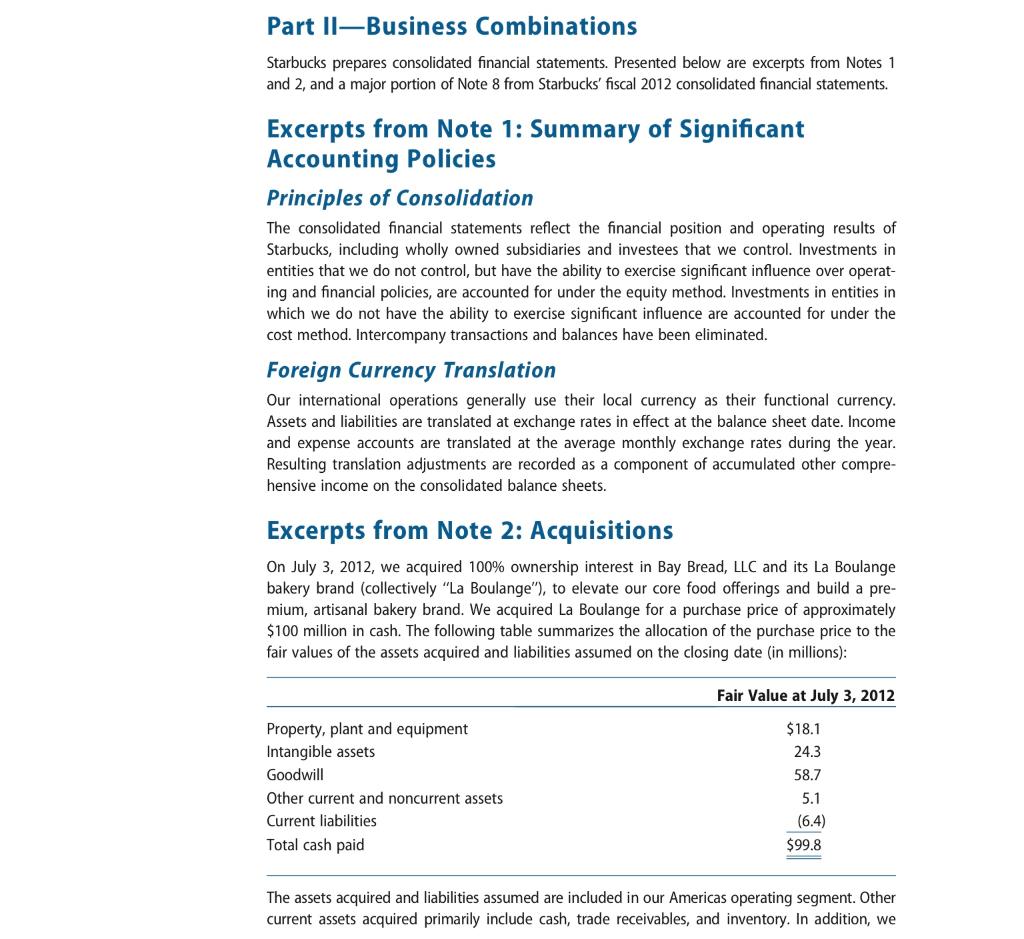

Part 11-Business Combinations Starbucks prepares consolidated financial statements. Presented below are excerpts from Notes 1 and 2, and a major portion of Note 8 from Starbucks' fiscal 2012 consolidated financial statements. Excerpts from Note 1: Summary of Significant Accounting Policies Principles of Consolidation The consolidated financial statements reflect the financial position and operating results of Starbucks, including wholly owned subsidiaries and investees that we control. Investments in entities that we do not control, but have the ability to exercise significant influence over operat- ing and financial policies, are accounted for under the equity method. Investments in entities in which we do not have the ability to exercise significant influence are accounted for under the cost method. Intercompany transactions and balances have been eliminated. Foreign Currency Translation Our international operations generally use their local currency as their functional currency. Assets and liabilities are translated at exchange rates in effect at the balance sheet date. Income and expense accounts are translated at the average monthly exchange rates during the year. Resulting translation adjustments are recorded as a component of accumulated other compre- hensive income on the consolidated balance sheets. Excerpts from Note 2: Acquisitions On July 3, 2012, we acquired 100% ownership interest in Bay Bread, LLC and its La Boulange bakery brand (collectively "La Boulange"), to elevate our core food offerings and build a pre- mium, artisanal bakery brand. We acquired La Boulange for a purchase price of approximately $100 million in cash. The following table summarizes the allocation of the purchase price to the fair values of the assets acquired and liabilities assumed on the closing date (in millions): Fair Value at July 3, 2012 Property, plant and equipment Intangible assets Goodwill Other current and noncurrent assets Current liabilities Total cash paid $18.1 24.3 58.7 5.1 (6.4) $99.8 The assets acquired and liabilities assumed are included in our Americas operating segment. Other current assets acquired primarily include cash, trade receivables, and inventory. In addition, we Starbucks 677 assumed various current liabilities primarily consisting of accounts payable and accrued payroll related liabilities. The intangible assets acquired as part of the transaction include the La Boulange trade name and proprietary recipes and processes. The La Boulange trade name was valued at $9.7 million and determined to have an indefinite life while the intangible asset relating to the proprietary recipes and processes was valued at $14.6 million and will be amortized over a period of 10 years. The $58.7 million of goodwill is deductible for income tax purposes and was allocated to our Americas operating segment. Source: Starbucks Corporation, Form 10-K for the Fiscal Year ended September 30, 2012. REQUIRED a. How does the concept of fair value drive the accounting for acquisitions? b. What method will Starbucks use to translate its foreign subsidiaries' financial statements so that they can be consolidated? Will Starbucks report gains and losses on the transla- tion in net income? c. At the date of acquisition, it is likely that the La Boulange trade name and proprietary recipes and processes had book values near $0. One year later, what amounts will be shown in Bay Bread's own financial statements for: Trade name . Proprietary recipes and processes Goodwill One year later, what amounts will be shown in Starbucks' consolidated financial state- ments for: Trade name Proprietary recipes and processes Goodwill Depreciation and amortization expense Part 11-Business Combinations Starbucks prepares consolidated financial statements. Presented below are excerpts from Notes 1 and 2, and a major portion of Note 8 from Starbucks' fiscal 2012 consolidated financial statements. Excerpts from Note 1: Summary of Significant Accounting Policies Principles of Consolidation The consolidated financial statements reflect the financial position and operating results of Starbucks, including wholly owned subsidiaries and investees that we control. Investments in entities that we do not control, but have the ability to exercise significant influence over operat- ing and financial policies, are accounted for under the equity method. Investments in entities in which we do not have the ability to exercise significant influence are accounted for under the cost method. Intercompany transactions and balances have been eliminated. Foreign Currency Translation Our international operations generally use their local currency as their functional currency. Assets and liabilities are translated at exchange rates in effect at the balance sheet date. Income and expense accounts are translated at the average monthly exchange rates during the year. Resulting translation adjustments are recorded as a component of accumulated other compre- hensive income on the consolidated balance sheets. Excerpts from Note 2: Acquisitions On July 3, 2012, we acquired 100% ownership interest in Bay Bread, LLC and its La Boulange bakery brand (collectively "La Boulange"), to elevate our core food offerings and build a pre- mium, artisanal bakery brand. We acquired La Boulange for a purchase price of approximately $100 million in cash. The following table summarizes the allocation of the purchase price to the fair values of the assets acquired and liabilities assumed on the closing date (in millions): Fair Value at July 3, 2012 Property, plant and equipment Intangible assets Goodwill Other current and noncurrent assets Current liabilities Total cash paid $18.1 24.3 58.7 5.1 (6.4) $99.8 The assets acquired and liabilities assumed are included in our Americas operating segment. Other current assets acquired primarily include cash, trade receivables, and inventory. In addition, we Starbucks 677 assumed various current liabilities primarily consisting of accounts payable and accrued payroll related liabilities. The intangible assets acquired as part of the transaction include the La Boulange trade name and proprietary recipes and processes. The La Boulange trade name was valued at $9.7 million and determined to have an indefinite life while the intangible asset relating to the proprietary recipes and processes was valued at $14.6 million and will be amortized over a period of 10 years. The $58.7 million of goodwill is deductible for income tax purposes and was allocated to our Americas operating segment. Source: Starbucks Corporation, Form 10-K for the Fiscal Year ended September 30, 2012. REQUIRED a. How does the concept of fair value drive the accounting for acquisitions? b. What method will Starbucks use to translate its foreign subsidiaries' financial statements so that they can be consolidated? Will Starbucks report gains and losses on the transla- tion in net income? c. At the date of acquisition, it is likely that the La Boulange trade name and proprietary recipes and processes had book values near $0. One year later, what amounts will be shown in Bay Bread's own financial statements for: Trade name . Proprietary recipes and processes Goodwill One year later, what amounts will be shown in Starbucks' consolidated financial state- ments for: Trade name Proprietary recipes and processes Goodwill Depreciation and amortization expense