Question

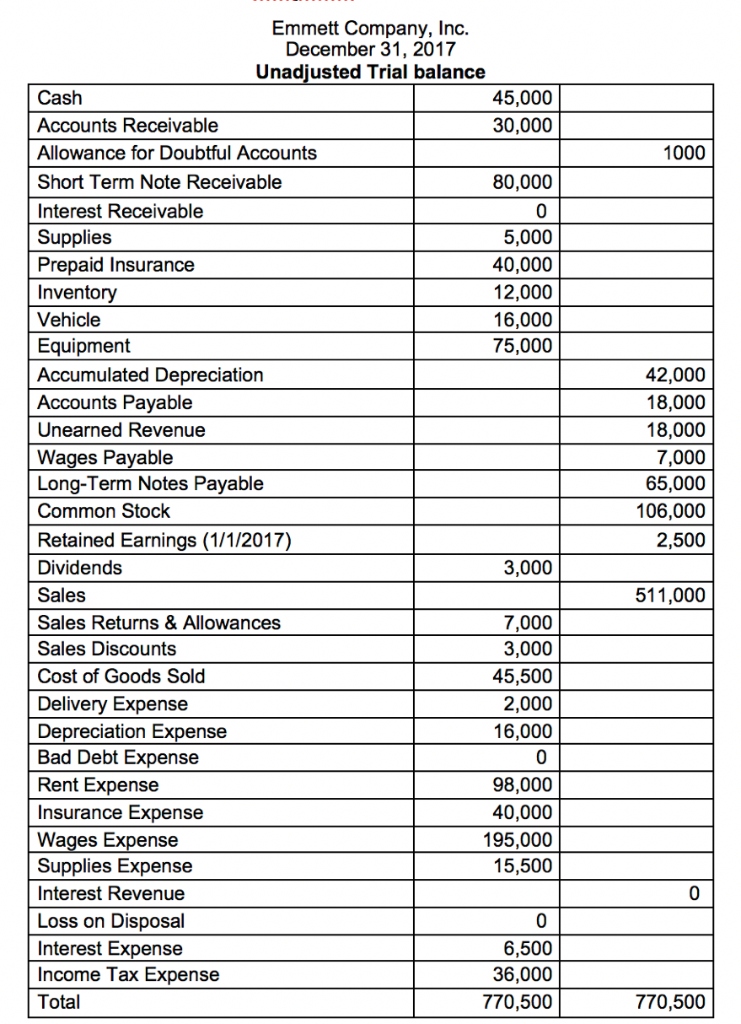

Part 1a: Prepare adjusting journal entries using the unadjusted trial balance on the previous page and the information provided below. Use only the account names

Part 1a: Prepare adjusting journal entries using the unadjusted trial balance on the previous page and the information provided below. Use only the account names provided on the previous page (do not create any new account names).

- On Dec. 31, 2017 merchandise was sold on account for $16,500 with a cost of $5,500 terms 3/10 net 30.

|

| ||

|

|

- The company issued a 6 month, 12% interest note short-term note for the amount listed on the unadjusted trial balance on Oct. 1, 2017. All interest and principal will be paid back at the end of the 6 months. Write the adjusting journal entry required for its financial statements as of Dec. 31, 2017.

- Uncollectable Accounts Receivables of $1,600 need to be written off for the year ended 2017.

- Management estimates that of the remaining accounts receivable balance, $2,000 will be uncollectible. Record the adjustment based on this information. Hint: Use the AFDA balance AFTER the above write off during 2017. Use an AFDA T-account!

- A piece of equipment was retired on Dec. 31, 2017. The equipment originally cost $34,000 and has related A/D of $24,000 as of Jan. 1, 2017. Additional depreciation of $3,000 needs to be recorded on this piece of equipment at Dec. 31, 2017. Update the depreciation below (#5). Then record the retirement (#6).

- Record the retirement of the equipment (from #5) including the gain or loss.

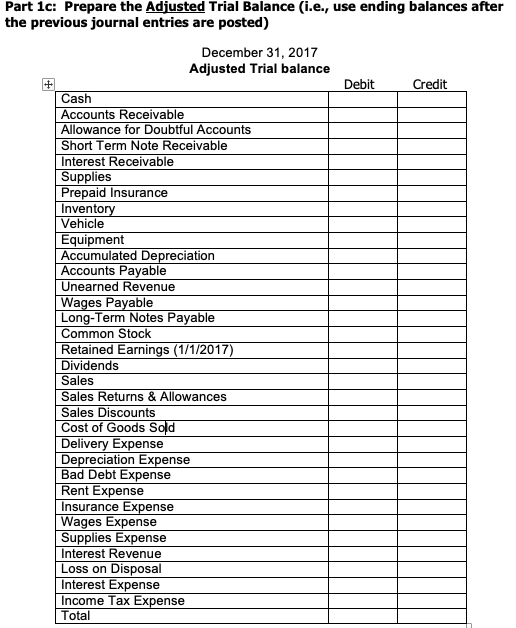

Part 1b: Post the adjusting journal entries to t-accounts:

(Specific instructions: Above each T-account, write the account name of each account affected by a journal entry. Write in the unadjusted balance for each of these accounts (from page 1)the unadjusted balance might be a debit, a credit, or zero balance. Now you are ready to post your journal entries from page 2 onto the corresponding T-accounts and then calculate adjusted balances.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started