Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 2 - Compute the 2017 return on assets and the return on common stockholders equity for both companies. (Round all ratios to 1 decimal

Part 2 - Compute the 2017 return on assets and the return on common stockholders equity for both companies. (Round all ratios to 1 decimal place, e.g. 2.5%.)

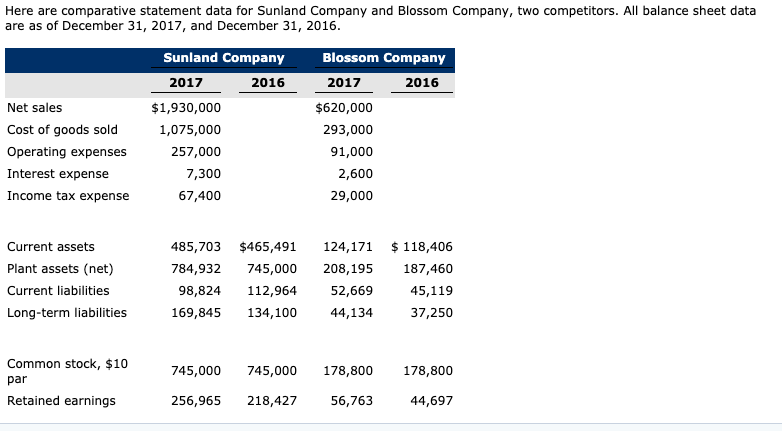

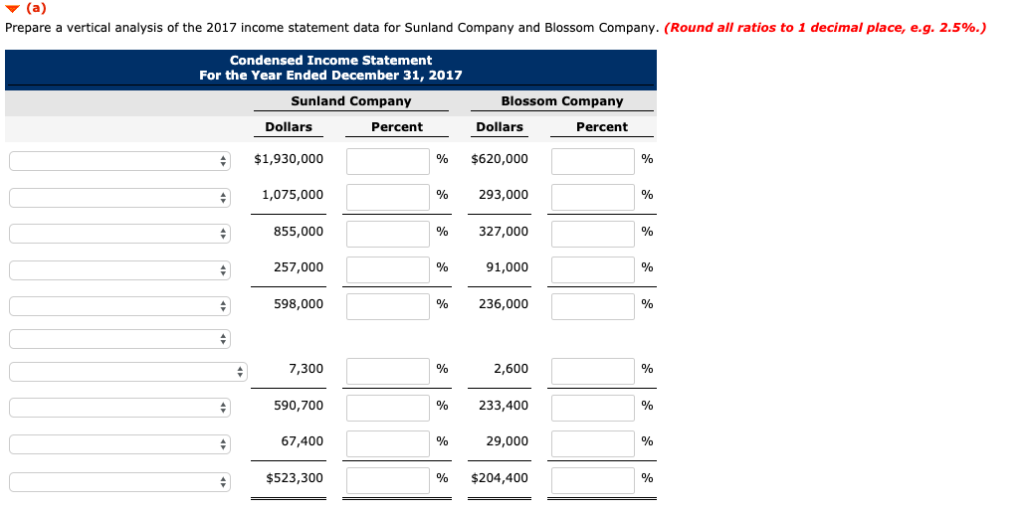

Here are comparative statement data for Sunland Company and Blossom Company, two competitors. All balance sheet data are as of December 31, 2017, and December 31, 2016 Sunland Company Blossom Company 2016 2017 2017 2016 Net sales $1,930,000 $620,000 1,075,000 293,000 Cost of goods sold Operating expenses 257,000 91,000 Interest expense 7,300 2,600 Income tax expense 67,400 29,000 485,703 Current assets $465,491 124,171 $118,406 Plant assets (net) 187,460 784,932 745,000 208,195 Current liabilities 98,824 45,119 112,964 52,669 Long-term liabilities 37,250 169,845 134,100 44,134 Common stock, $10 745,000 178,800 745,000 178,800 par Retained earnings 256,965 218,427 56,763 44,697 (a) Prepare a vertical analysis of the 2017 income statement data for Sunland Company and Blossom Company. (Round all ratios to 1 decimal place, e.g. 2.5%.) Condensed Income Statement For the Year Ended December 31, 2017 Sunland Company Blossom Company Dollars Percent Dollars Percent $1,930,000 $620,000 % 1,075,000 293,000 855,000 % 327,000 % 257,000 91,000 236,000 598,000 % 2,600 7,300 % % 590,700 % 233,400 % % 67,400 % 29,000 $523,300 % $204,400 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started