Question

Part 2a: Prepare a Multi-stepIncome Statement (Be sure to include all the necessary headings, totals and subtotals as outlined in Chapter 5. You may not

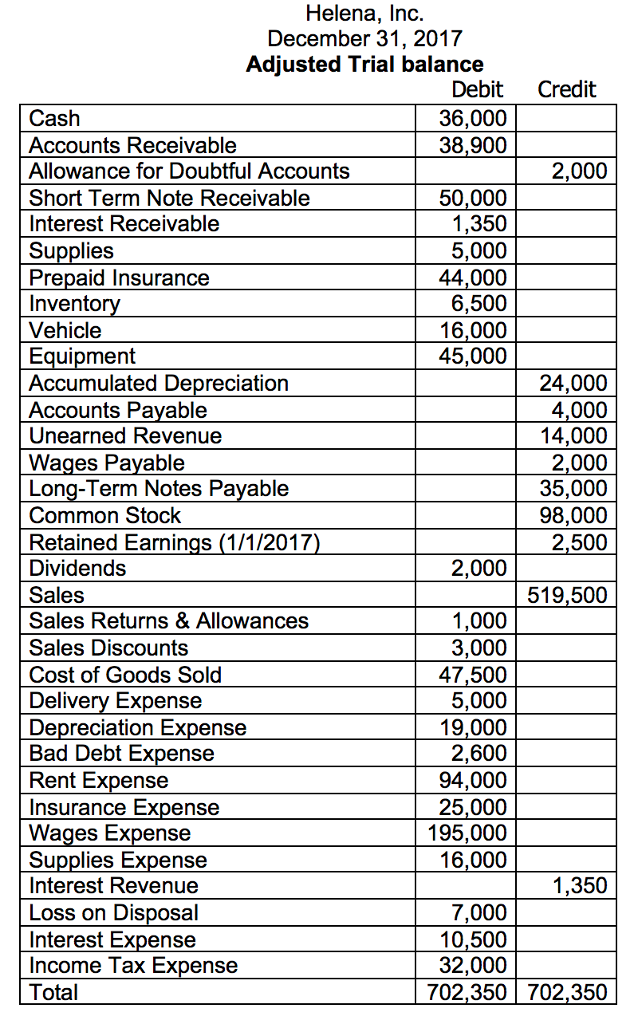

Part 2a: Prepare a Multi-stepIncome Statement

(Be sure to include all the necessary headings, totals and subtotals as outlined in Chapter 5. You may not need to use all the lines provided. Note: The two columns below do not represent debit and credit balances like they do on a trial balance. On the Income Statement, use the right column for subtotals and totals.)

__________, Inc.

Income Statement

Year Ended Dec. 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2b: Prepare a Statement of Retained Earnings.

__________, Inc.

Statement of Retained Earnings

Year Ended Dec. 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2c: Prepare a ClassifiedBalance Sheet (Be sure to include all the necessary subtotals and totals as outlined in Chapter 2. You may not need to use all of the lines provided. Note: The two columns below do not represent debit and credit balances like they do on a trial balance. On the Balance Sheet, use the right column for subtotals and totals.)

__________, Inc.

Balance Sheet

As of Dec. 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Helena, Inc December 31, 2017 Adiusted Trial balance Debit Credit Cash Accounts Receivable Allowance for Doubtful Accounts Short Term Note Receivable Interest Receivable Supplies Prepaid Insurance Invento Vehicle Equipment Accumulated Depreciation Accounts Pavable Unearned Revenue Wages Pavable Long-Term Notes Pavable Common Stock Retained Earnings (1/1/2017 Dividends Sales Sales Returns & Allowances Sales Discounts Cost of Goods Sold Delivery Expense Depreciation Expense Bad Debt Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Revenue Loss on Disposal Interest Expense Income Tax Expense Total 36,000 38,900 2,000 50,000 1,350 5,000 44,000 6,500 16,000 45,000 24,000 4,000 14,000 2,000 35,000 98,000 2,500 2,000 519,500 1,000 3,000 47,500 5,000 19,000 2,600 94,000 25,000 195,000 16,000 1,350 7,000 10,500 32,000 702,350702,350

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started