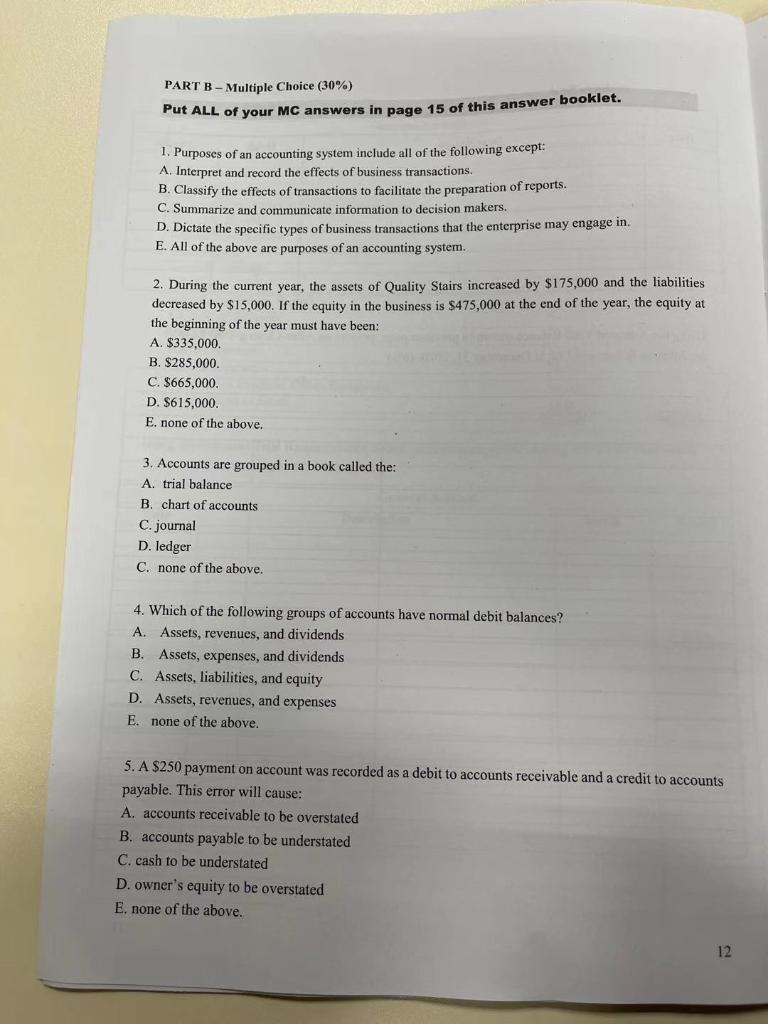

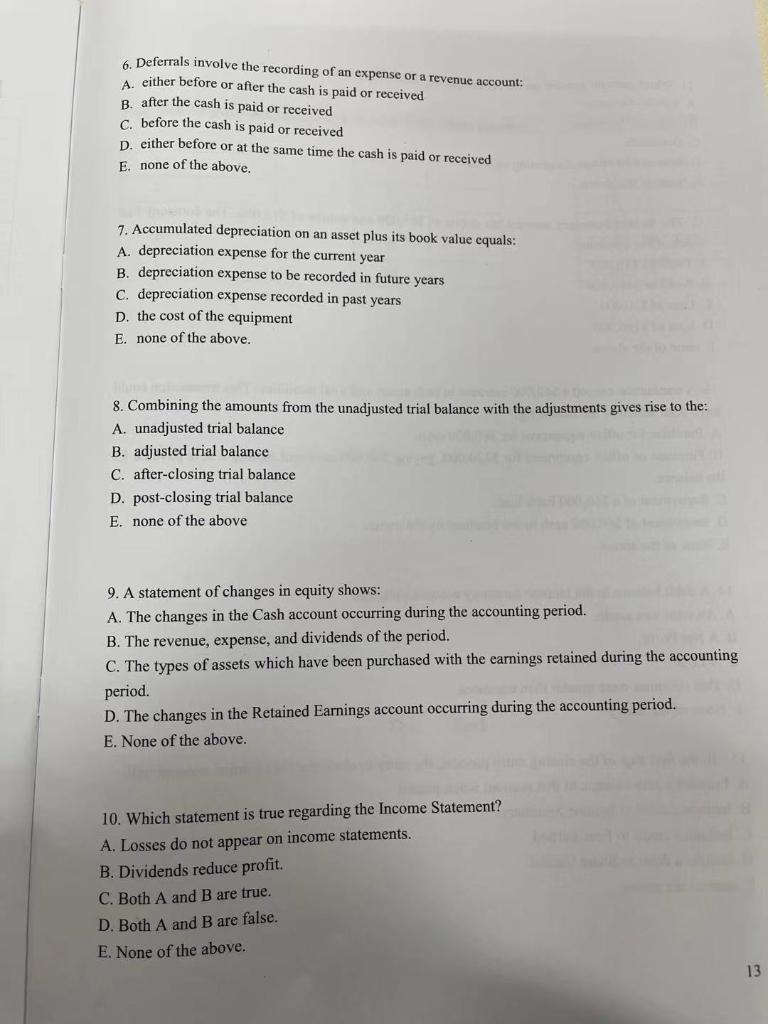

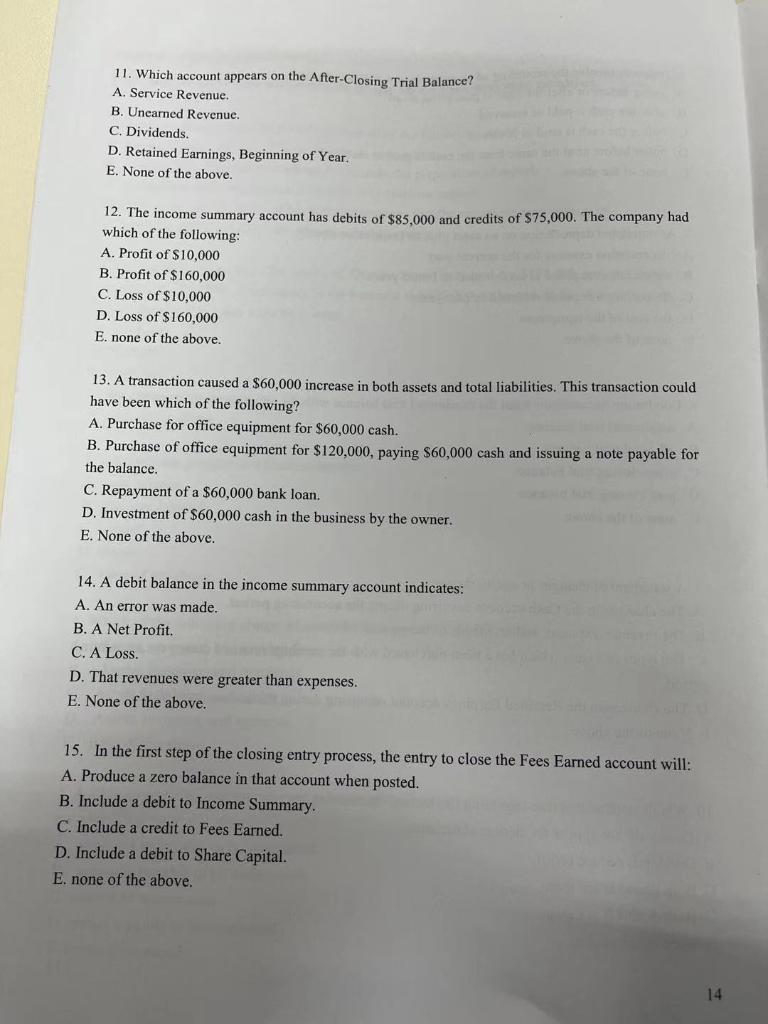

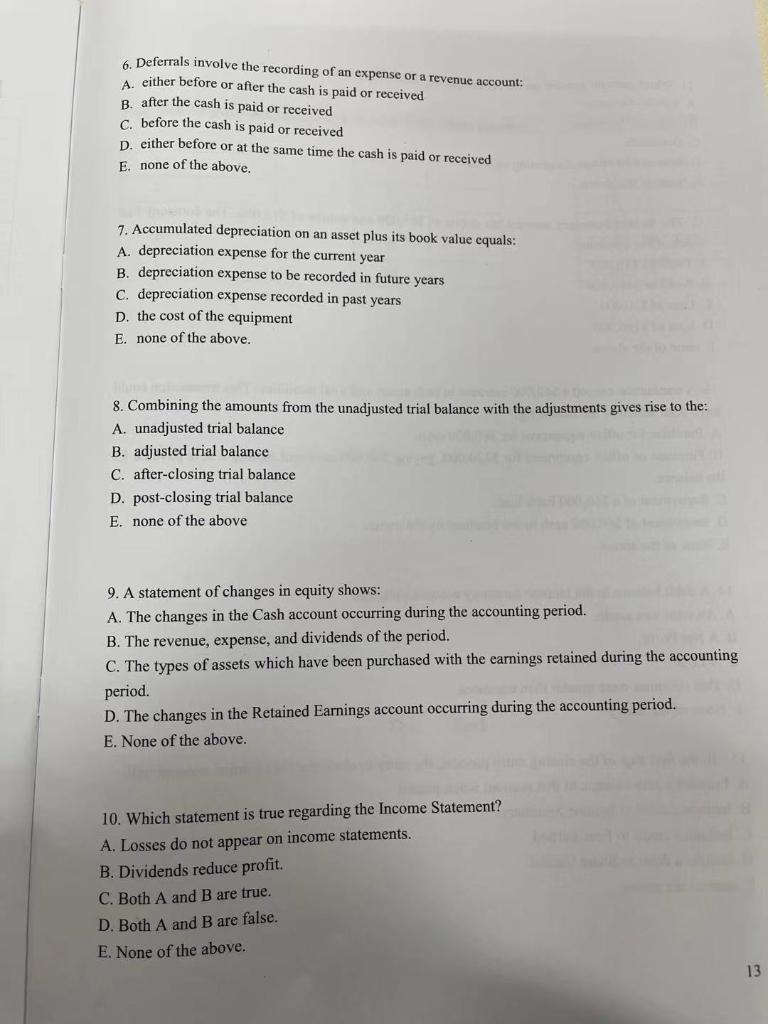

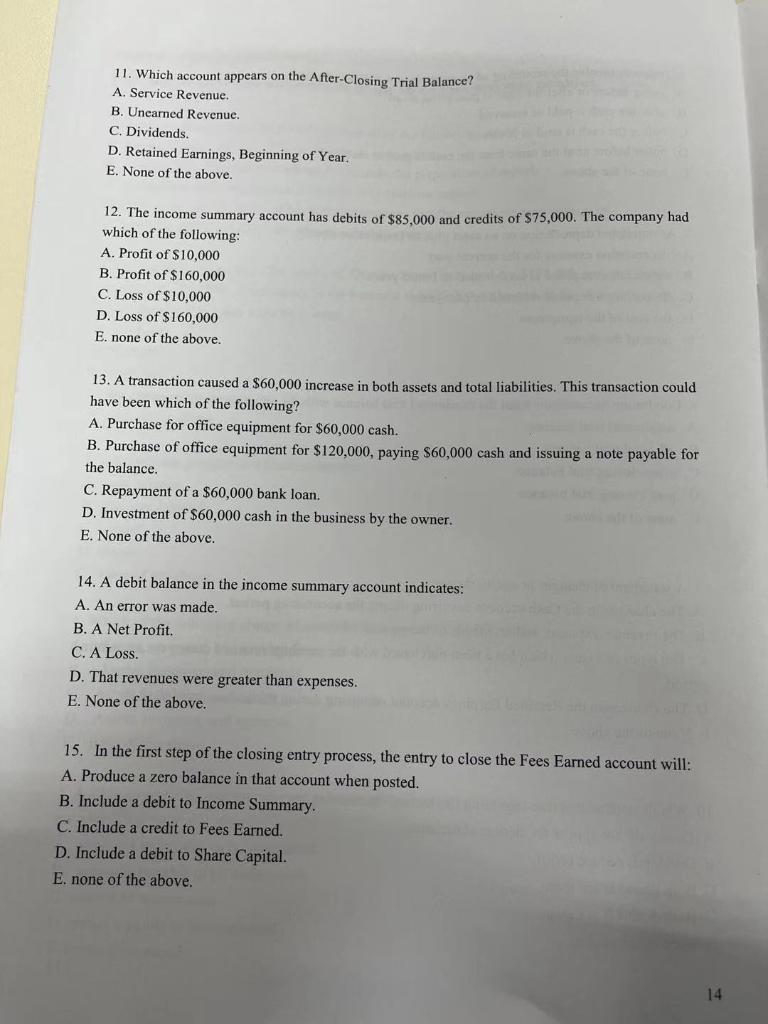

PART B - Multiple Choice (30%) Put ALL of your MC answers in page 15 of this answer booklet. 1. Purposes of an accounting system include all of the following except: A. Interpret and record the effects of business transactions. B. Classify the effects of transactions to facilitate the preparation of reports. C. Summarize and communicate information to decision makers. D. Dictate the specific types of business transactions that the enterprise may engage in. E. All of the above are purposes of an accounting system. 2. During the current year, the assets of Quality Stairs increased by $175,000 and the liabilities decreased by $15,000. If the equity in the business is $475,000 at the end of the year, the equity at the beginning of the year must have been: A. $335.000. B. $285,000. C. $665,000. D. $615,000. E. none of the above. Accounts are grouped in a book called the: A. trial balance B. chart of accounts C. journal D. ledger C. none of the above. 4. Which of the following groups of accounts have normal debit balances? A. Assets, revenues, and dividends B. Assets, expenses, and dividends C. Assets, liabilities, and equity D. Assets, revenues, and expenses E none of the above. 5. A $250 payment on account was recorded as a debit to accounts receivable and a credit to accounts payable. This error will cause: A. accounts receivable to be overstated B. accounts payable to be understated C. cash to be understated D. owner's equity to be overstated E. none of the above. 12 A. 6. Deferrals involve the recording of an expense or a revenue account: either before or after the cash is paid or received B. after the cash is paid or received C. before the cash is paid or received D. either before or at the same time the cash is paid or received E. none of the above. 7. Accumulated depreciation on an asset plus its book value equals: A. depreciation expense for the current year B. depreciation expense to be recorded in future years c. depreciation expense recorded in past years D. the cost of the equipment E. none of the above. 8. Combining the amounts from the unadjusted trial balance with the adjustments gives rise to the: A. unadjusted trial balance B. adjusted trial balance C. after-closing trial balance D. post-closing trial balance E. none of the above 9. A statement of changes in equity shows: A. The changes in the Cash account occurring during the accounting period. B. The revenue, expense, and dividends of the period. C. The types of assets which have been purchased with the earnings retained during the accounting period. D. The changes in the Retained Earnings account occurring during the accounting period. E. None of the above. 10. Which statement is true regarding the Income Statement? A. Losses do not appear on income statements. B. Dividends reduce profit. C. Both A and B are true. D. Both A and B are false. E. None of the above. 13 11. Which account appears on the After-Closing Trial Balance? A. Service Revenue. B. Unearned Revenue. C. Dividends. D. Retained Earnings, Beginning of Year. E. None of the above. 12. The income summary account has debits of $85,000 and credits of $75,000. The company had which of the following: A. Profit of $10.000 B. Profit of $160,000 C. Loss of $10,000 D. Loss of $160,000 E. none of the above. 13. A transaction caused a $60,000 increase in both assets and total liabilities. This transaction could have been which of the following? A. Purchase for office equipment for $60,000 cash. B. Purchase of office equipment for $120,000, paying $60,000 cash and issuing a note payable for the balance. C. Repayment of a $60,000 bank loan. D. Investment of $60,000 cash in the business by the owner. E. None of the above. 14. A debit balance in the income summary account indicates: A. An error was made. B. A Net Profit C. A Loss. D. That revenues were greater than expenses. E. None of the above. 15. In the first step of the closing entry process, the entry to close the Fees Earned account will: A. Produce a zero balance in that account when posted. B. Include a debit to Income Summary. C. Include a credit to Fees Earned. D. Include a debit to Share Capital. E. none of the above. 14