Answered step by step

Verified Expert Solution

Question

1 Approved Answer

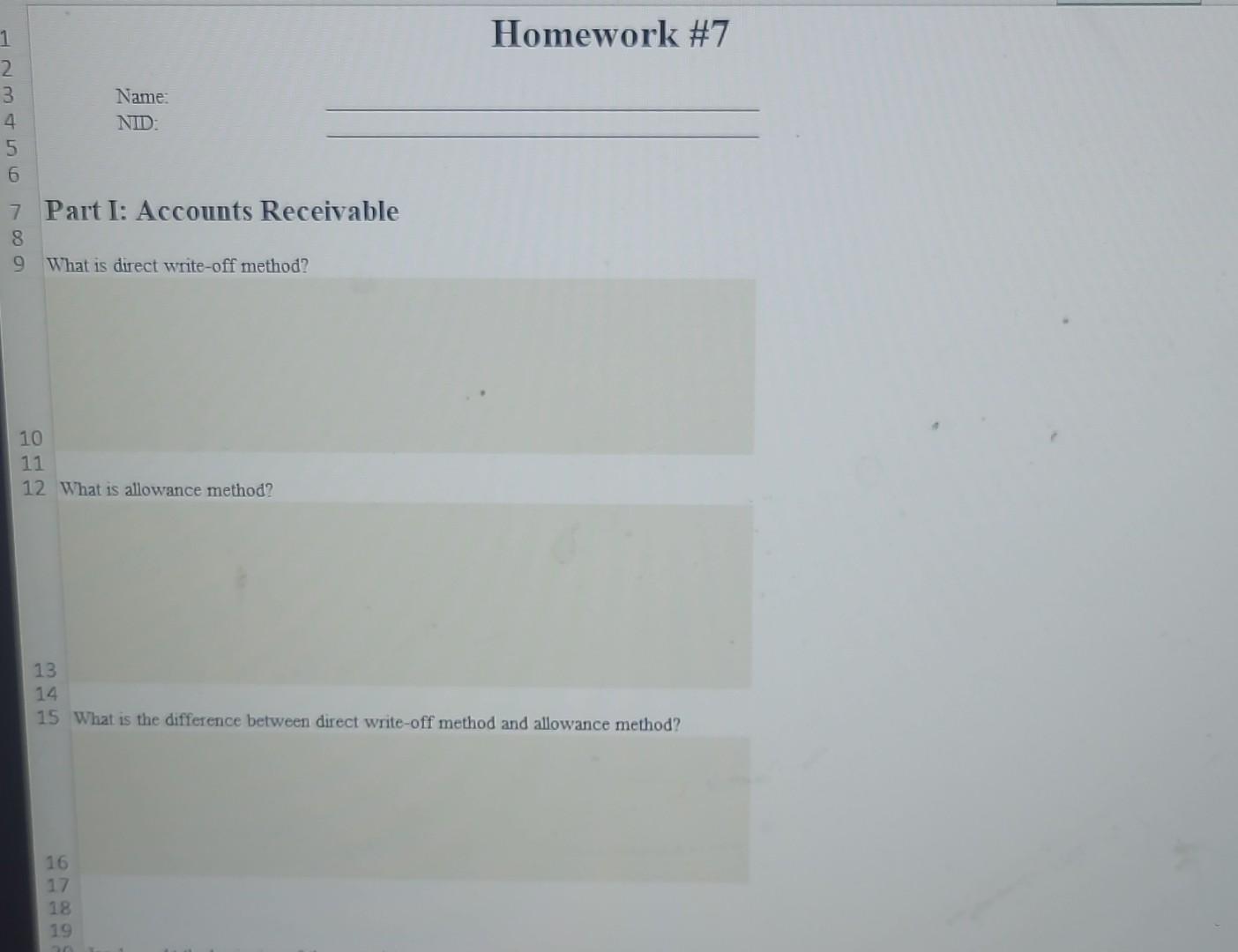

Part I: Accounts Receivable What is direct write-off method? What is allowance method? What is the difference between direct write-off method and allowance method? At

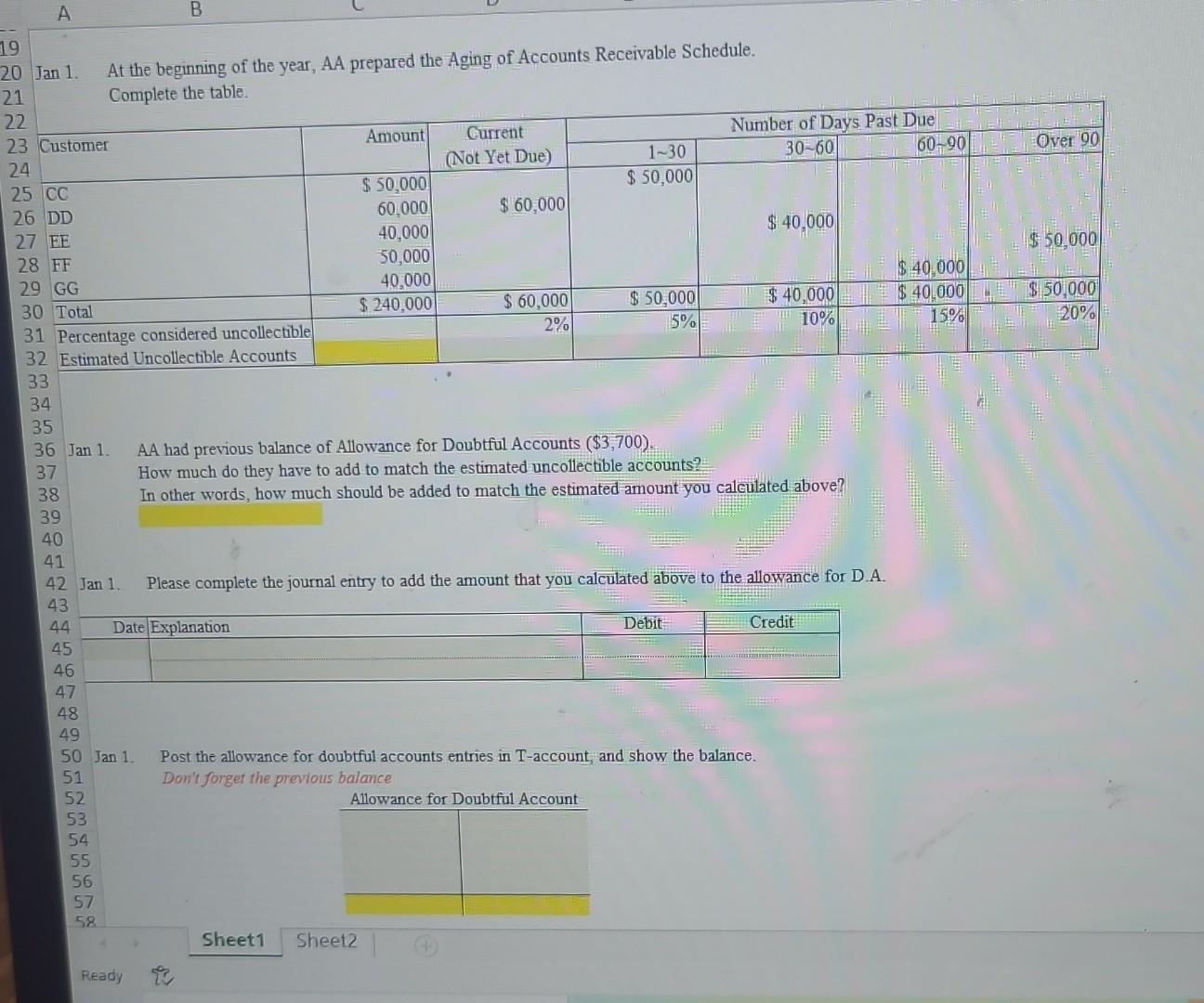

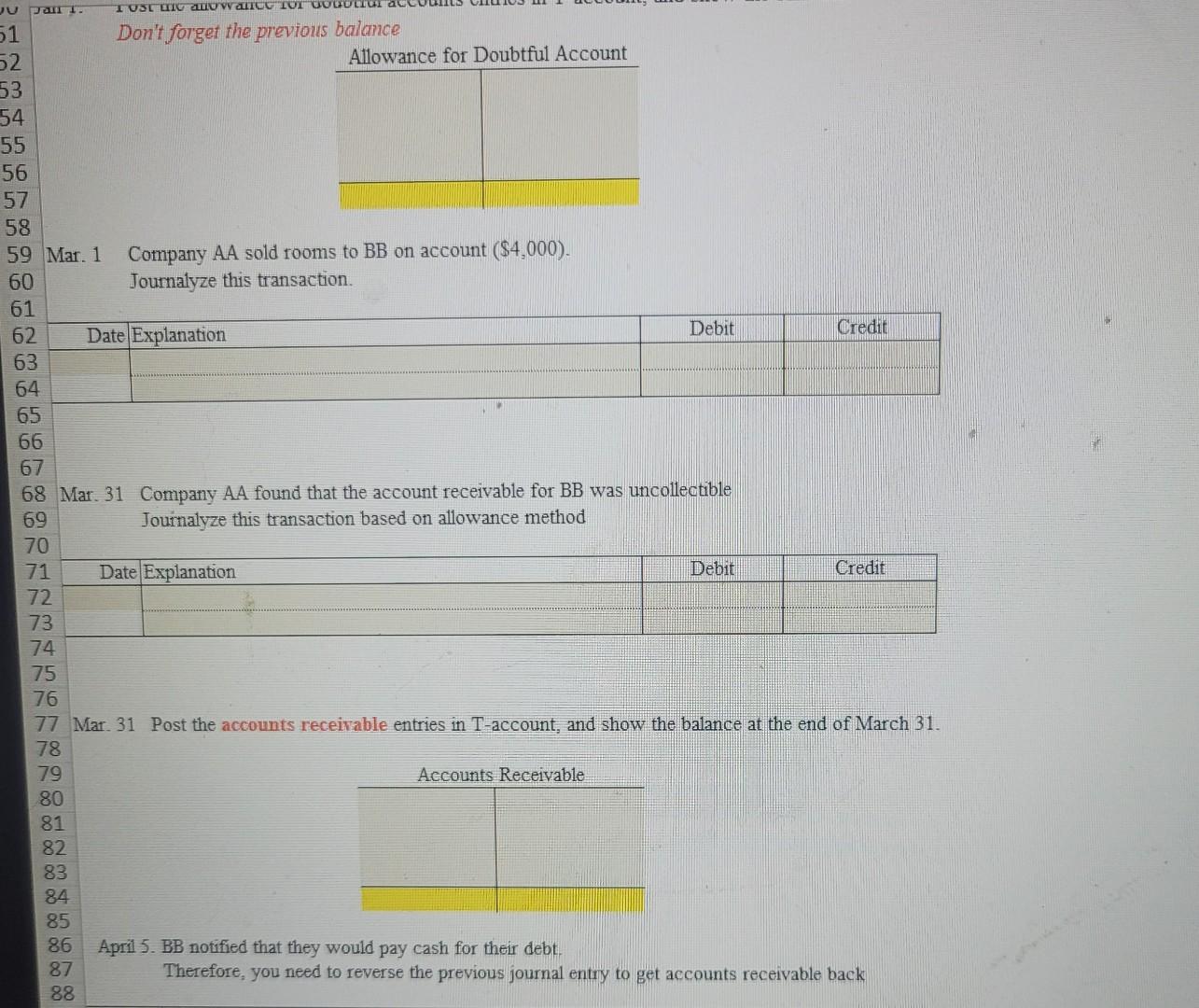

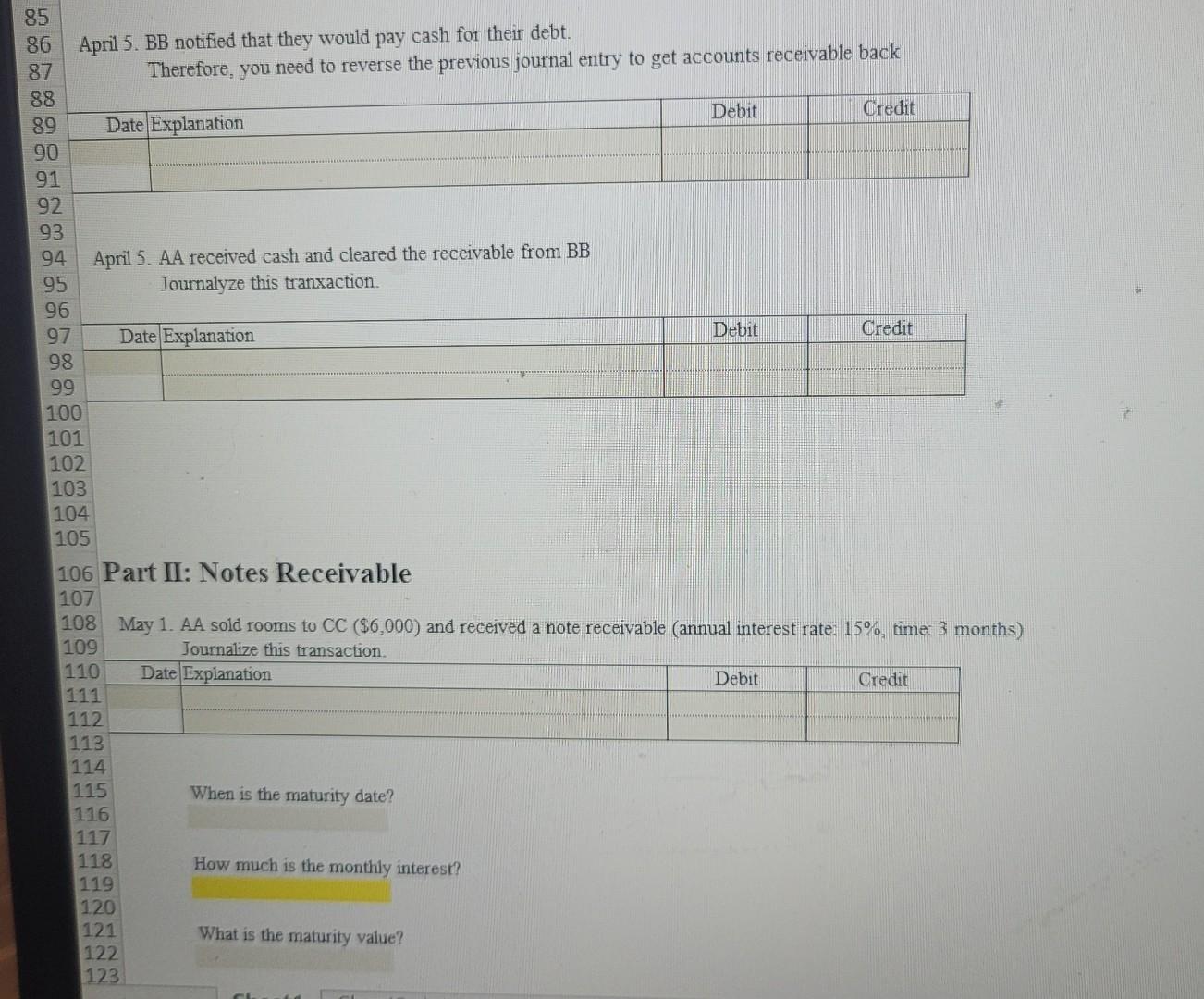

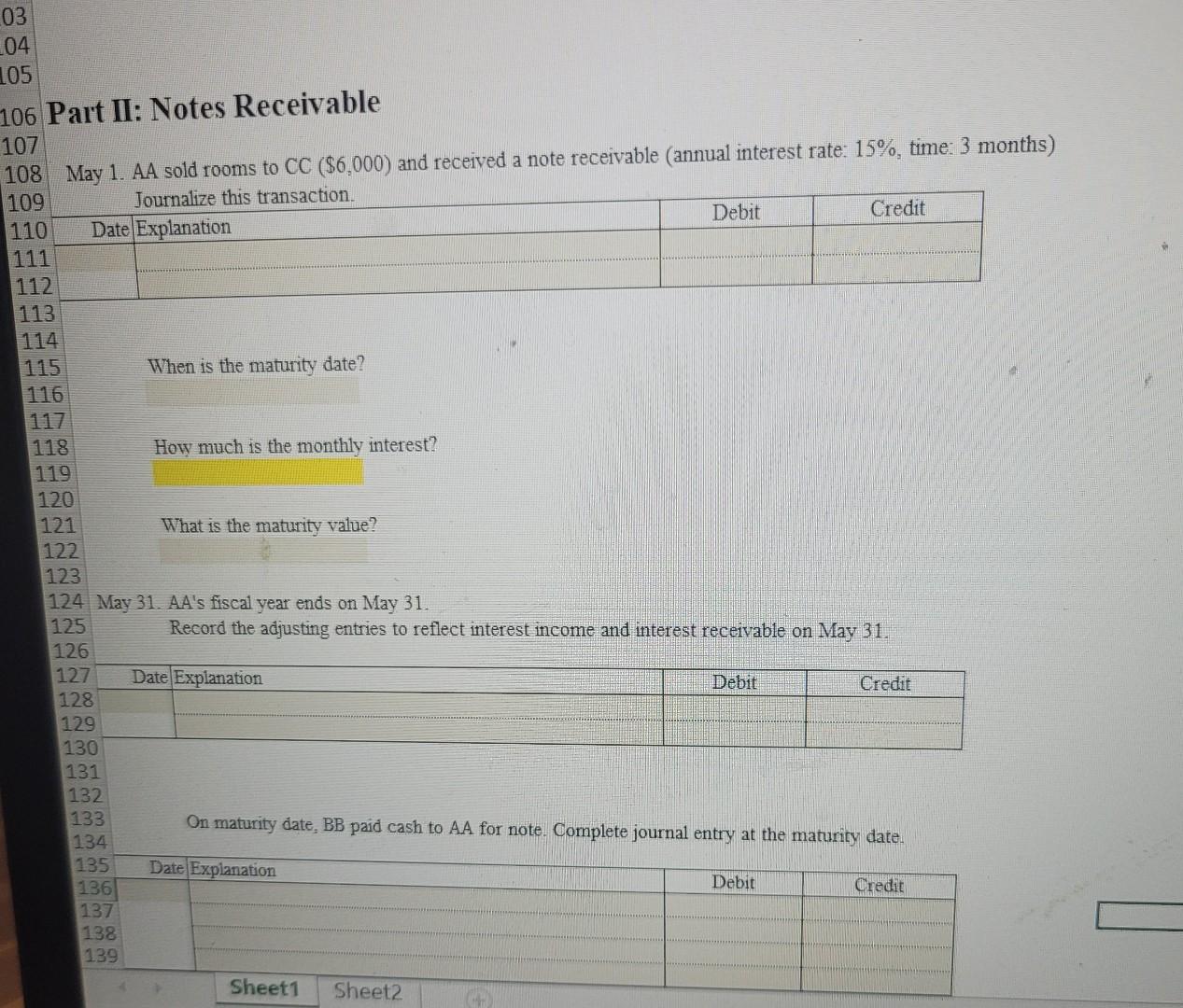

Part I: Accounts Receivable What is direct write-off method? What is allowance method? What is the difference between direct write-off method and allowance method? At the beginning of the year, AA prepared the Aging of Accounts Receivable Schedule. Complete the table. Jan 1. AA had previous balance of Allowance for Doubtful Accounts ($3,700). How much do they have to add to match the estimated uncollectible accounts? In other words. how much should be added to match the estimated amount you calculated above? Jan 1. Please complete the journal entry to add the amount that you calculated above to the allowance for D.A. Jan 1. Post the allowance for doubtful accounts entries in T-account, and show the balance. Don't forget the previous balance ir. 1 Company AA sold rooms to BB on account ($4,000). Journalyze this transaction. Aar. 31 Company AA found that the account receivable for BB was uncollectible Journalyze this transaction based on allowance method Mar. 31 Post the accounts receivable entries in T-account, and show the balance at the end of March 31. April 5. BB notified that they would pay cash for their debt. Therefore, you need to reverse the previous journal entry to get accounts receivable back April 5. BB notified that they would pay cash for their debt. Therefore, you need to reverse the previous journal entry to get accounts receivable back April 5. AA received cash and cleared the receivable from BB Iournalyze this tranxaction. Part II: Notes Receivable May 1. AA sold rooms to CC ($6,000) and received a note receivable (annual interest rate: 15%, time: 3 months) Part II: Notes Receivable May 1. AA sold rooms to CC($6,000) and received a note receivable (annual interest rate: 15%, time: 3 months) When is the maturity date? How much is the monthly interest? What is the maturity value? May 31. AA's fiscal year ends on May 31. Record the adjusting entries to reflect interest income and interest receivable on May 31. On maturity date, BB paid cash to AA for note. Complete journal entry at the maturity date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started