Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part II (30 marks) (Print this page and attach to your answer) Viva Company normally adjusts its books monthly. The Company has already recorded the

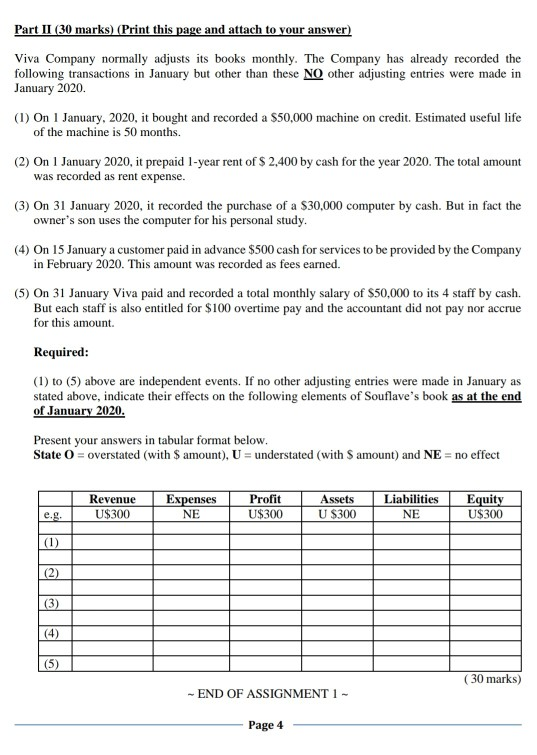

Part II (30 marks) (Print this page and attach to your answer) Viva Company normally adjusts its books monthly. The Company has already recorded the following transactions in January but other than these NO other adjusting entries were made in January 2020. (1) On 1 January, 2020, it bought and recorded a $50,000 machine on credit. Estimated useful life of the machine is 50 months. (2) On 1 January 2020, it prepaid 1-year rent of $ 2,400 by cash for the year 2020. The total amount was recorded as rent expense. (3) On 31 January 2020, it recorded the purchase of a $30,000 computer by cash. But in fact the owner's son uses the computer for his personal study. (4) On 15 January a customer paid in advance $500 cash for services to be provided by the Company in February 2020. This amount was recorded as fees earned. (5) On 31 January Viva paid and recorded a total monthly salary of $50,000 to its 4 staff by cash. But each staff is also entitled for $100 overtime pay and the accountant did not pay nor accrue for this amount Required: (1) to (5) above are independent events. If no other adjusting entries were made in January as stated above, indicate their effects on the following elements of Souflave's book as at the end of January 2020. Present your answers in tabular format below. State 0 = overstated (with $ amount), U = understated (with S amount) and NE = no effect Revenue U$300 Expenses Profit U$300 Assets U $300 Liabilities NE Equity U$300 e.g. NE (1) (2) (3) (4) (5) (30 marks) -END OF ASSIGNMENT 1 - Page 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started