Answered step by step

Verified Expert Solution

Question

1 Approved Answer

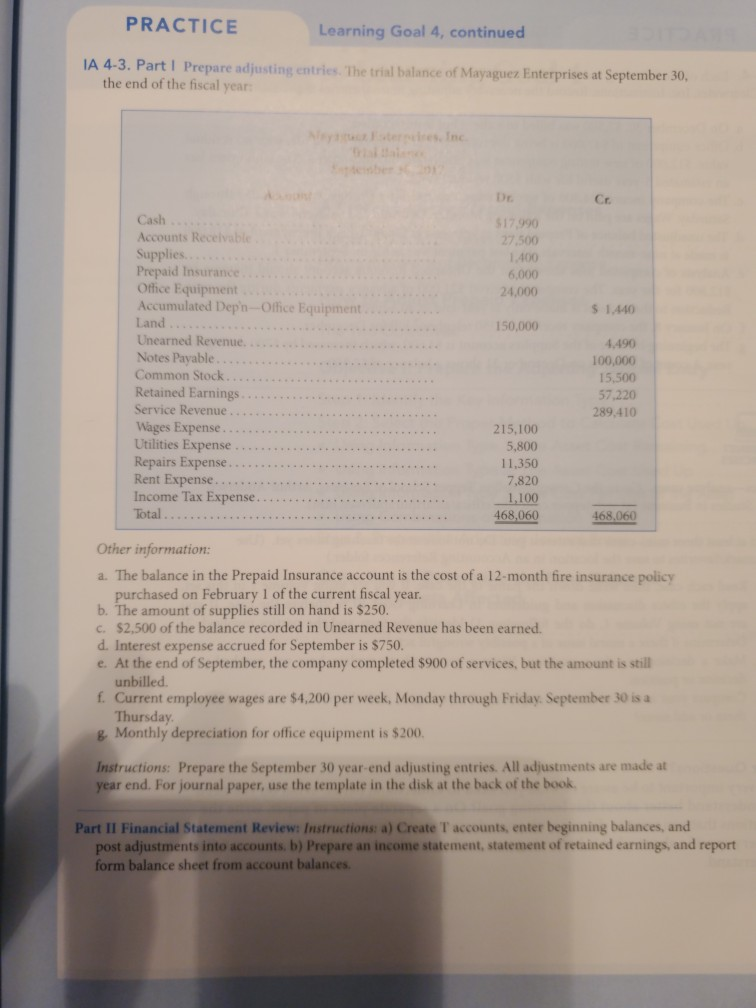

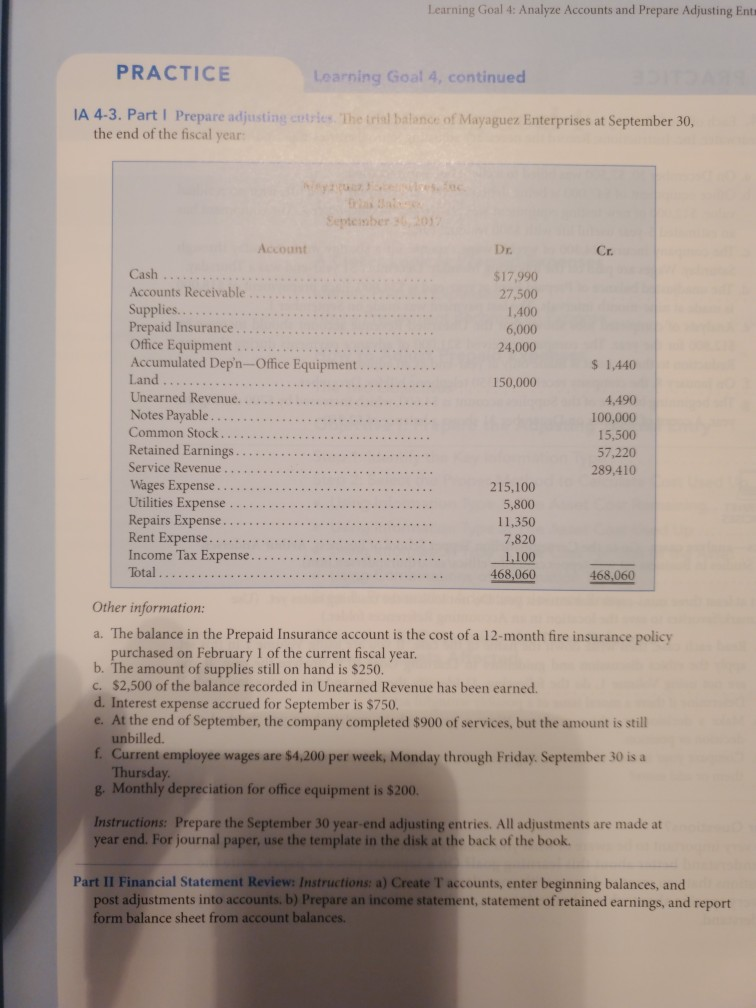

part II help LTe D OK Part II Financial Statement Review: Instructions: a) Create T accounts, enter beginning balances, and post adjustments into accounts. b)

part II help

LTe D OK Part II Financial Statement Review: Instructions: a) Create T accounts, enter beginning balances, and post adjustments into accounts. b) Prepare an income statement, statement of retained earnings, and report form balance sheet from account balances. PRACTICE Learning Goal 4, continued IA 4-3. Part I Prepare adjusting entries. The trial balance of Mayaguez Enterprises at September 30, the end of the fiscal year leytzsteries Inc ale esber Dr Cr Cash $17,990 27,500 Accounts Receivable Supplies Prepaid Insurance Office Equipment Accumulated Dep'n-Office Equipment Land. . Unearned Revenue Notes Payable Common Stock Retained Earnings 1,400 6,000 24,000 S 1.440 150,000 4.490 100,000 15,500 57,220 Service Revenue. 289,410 Wages Expense Utilities Expense Repairs Expense. Rent Expense. Income Tax Expense Total..... 215,100 5,800 11,350 7,820 1,100 468,060 468,060 Other information a. The balance in the Prepaid Insurance account is the cost of a 12-month fire insurance policy purchased on February 1 of the current fiscal year. b. The amount of supplies still on hand is $250. c. $2,500 of the balance recorded in Unearned Revenue has been earned d. Interest expense accrued for September is $750. e. At the end of September, the company completed $900 of services, but the amount is still unbilled f. Current employee wages are $4,200 per week, Monday through Friday. September 30 is a Thursday g Monthly depreciation for office equipment is $200. Instructions: Prepare the September 30 year-end adjusting entries. All adjustments are made at year end. For journal paper, use the template in the disk at the back of the book Part II Financial Statement Review: Instructions: a) Create T accounts, enter beginning balances, and post adjustments into accounts. b) Prepare an income statement, statement of retained earnings, and report form balance sheet from account balances. .A Learning Goal 4: Analyze Accounts and Prepare Adjusting Entr PRACTICE Learning Goal 4, continued IA 4-3. Part Prepare adjusting cotries. The trisl balance of Mayaguez Enterprises at September 30, the end of the fiscal year y esoc September 36, 2017 Account Dr. Cr. Cash.. . $17,990 Accounts Receivable Supplies.. Prepaid Insurance. Office Equipment Accumulated Dep'n-Office Equipment Land.. 27,500 1,400 6,000 24,000 $ 1,440 150,000 Unearned Revenue. 4,490 Notes Payable Common Stock. 100,000 15,500 Retained Earnings 57,220 Service Revenue 289,410 Wages Expense Utilities Expense 215,100 5,800 Repairs Expense Rent Expense.. Income Tax Expense. Total 11,350 7,820 001'I 468,060 468,060 Other information: a. The balance in the Prepaid Insurance account is the cost of a 12-month fire insurance policy purchased on February 1 of the current fiscal year. b. The amount of supplies c. $2,500 of the balance recorded in Unearned Revenue has been earned. d. Interest expense accrued for September is $750. e. At the end of September, the company completed $900 of services, but the amount is still unbilled. f. Current employee wages are $4,200 per week, Monday through Friday. September 30 is a Thursday g. Monthly depreciation for office equipment is $200. on hand is $250. Instructions: Prepare the September 30 year-end adjusting entries. All adjustments are made at year end. For journal paper, use the template in the disk at the back of the book. Part II Financial Statement Review: Instructions: a) Create T accounts, enter beginning balances, and post adjustments into accounts. b) Prepare an income statement, statement of retained earnings, and report form balance sheet from account balancesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started