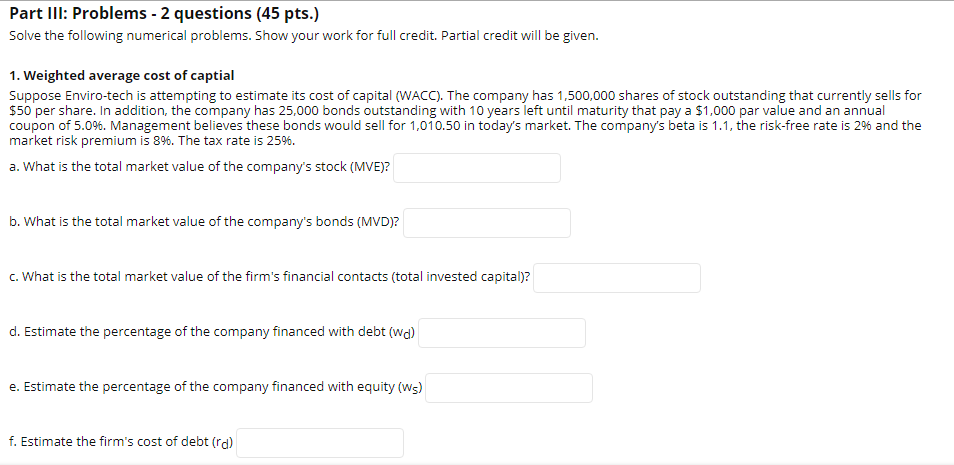

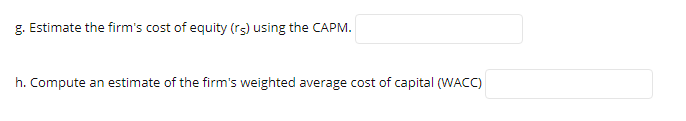

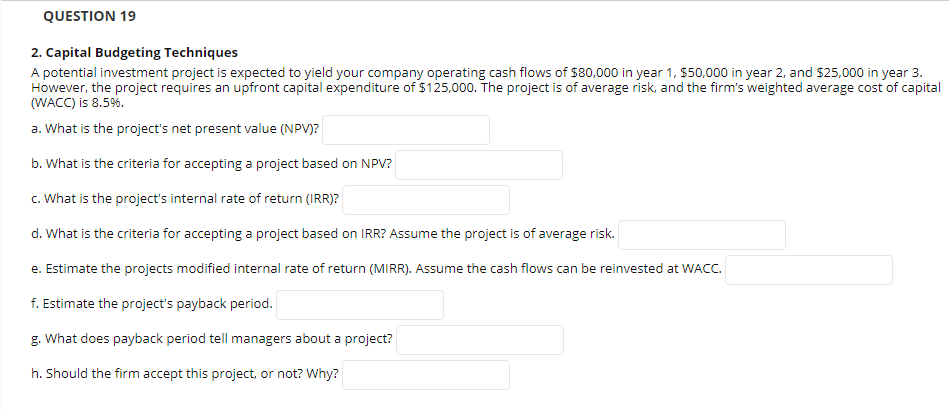

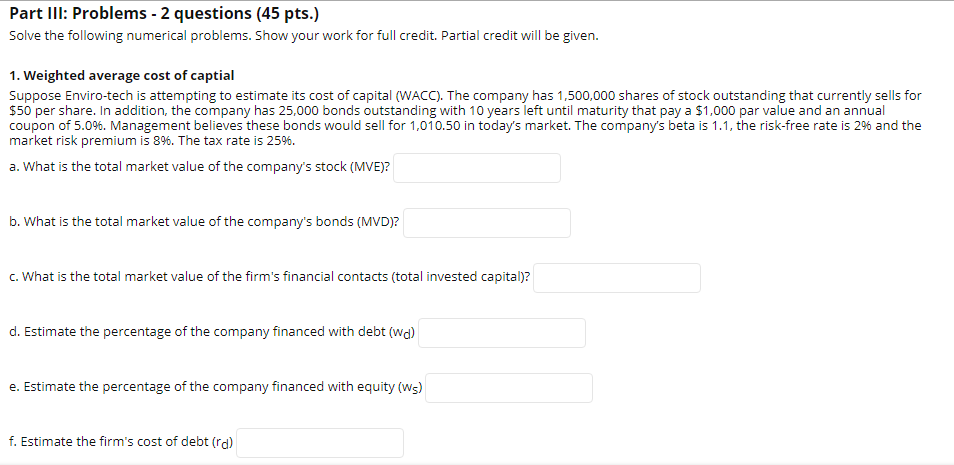

Part III: Problems - 2 questions (45 pts.) Solve the following numerical problems. Show your work for full credit. Partial credit will be given. 1. Weighted average cost of captial Suppose Enviro-tech is attempting to estimate its cost of capital (WACC). The company has 1,500,000 shares of stock outstanding that currently sells for $50 per share. In addition, the company has 25,000 bonds outstanding with 10 years left until maturity that pay a $1,000 par value and an annual coupon of 5.0%. Management believes these bonds would sell for 1,010.50 in today's market. The company's beta is 1.1, the risk-free rate is 29 and the market risk premium is 8%. The tax rate is 25%. a. What is the total market value of the company's stock (MVE)? b. What is the total market value of the company's bonds (MVD)? C. What is the total market value of the firm's financial contacts (total invested capital)? d. Estimate the percentage of the company financed with debt (wd) e. Estimate the percentage of the company financed with equity (ws) f. Estimate the firm's cost of debt (rd) g. Estimate the firm's cost of equity (rs) using the CAPM. h. Compute an estimate of the firm's weighted average cost of capital (WACC) QUESTION 19 2. Capital Budgeting Techniques A potential investment project is expected to yield your company operating cash flows of $80,000 in year 1,550,000 in year 2, and $25,000 in year 3. However, the project requires an upfront capital expenditure of $125,000. The project is of average risk, and the firm's weighted average cost of capital (WACC) is 8.596. a. What is the project's net present value (NPV)? b. What is the criteria for accepting a project based on NPV? c. What is the project's internal rate of return (IRR)? d. What is the criteria for accepting a project based on IRR? Assume the project is of average risk. e. Estimate the projects modified internal rate of return (MIRR). Assume the cash flows can be reinvested at WACC. f. Estimate the project's payback period. g. What does payback period tell managers about a project? h. Should the firm accept this project, or not? Why