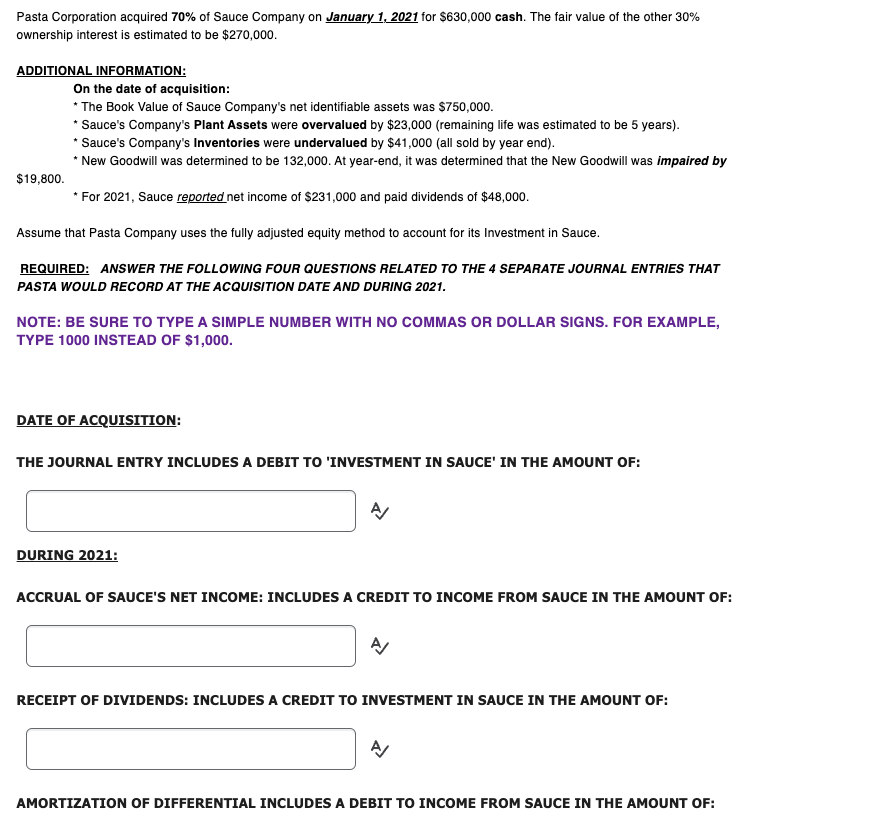

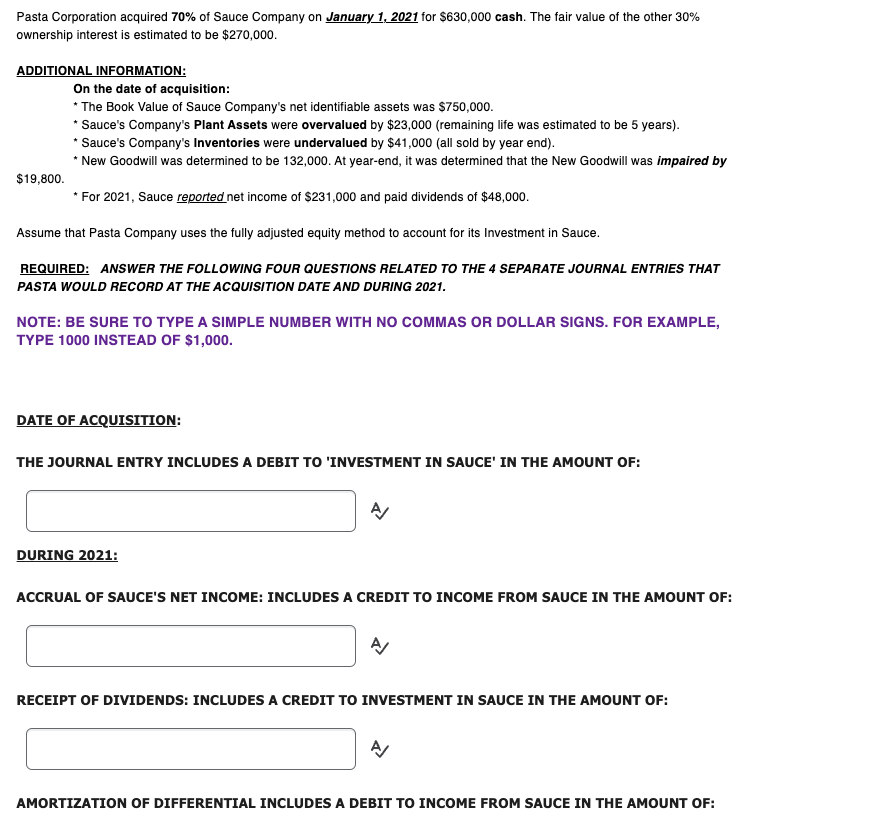

Pasta Corporation acquired 70% of Sauce Company on January 1,2021 for $630,000cash. The fair value of the other 30% ownership interest is estimated to be $270,000. ADDITIONAL INFORMATION: On the date of acquisition: * The Book Value of Sauce Company's net identifiable assets was $750,000. * Sauce's Company's Plant Assets were overvalued by $23,000 (remaining life was estimated to be 5 years). "Sauce's Company's Inventories were undervalued by $41,000 (all sold by year end). * New Goodwill was determined to be 132,000 . At year-end, it was determined that the New Goodwill was impaired by $19,800. "For 2021, Sauce reported net income of $231,000 and paid dividends of $48,000. Assume that Pasta Company uses the fully adjusted equity method to account for its Investment in Sauce. REQUIRED: ANSWER THE FOLLOWING FOUR QUESTIONS RELATED TO THE 4 SEPARATE JOURNAL ENTRIES THAT PASTA WOULD RECORD AT THE ACQUISITION DATE AND DURING 2021. NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. DATE OF ACQUISITION: THE JOURNAL ENTRY INCLUDES A DEBIT TO 'INVESTMENT IN SAUCE' IN THE AMOUNT OF: DURING 2021: ACCRUAL OF SAUCE'S NET INCOME: INCLUDES A CREDIT TO INCOME FROM SAUCE IN THE AMOUNT OF: A RECEIPT OF DIVIDENDS: INCLUDES A CREDIT TO INVESTMENT IN SAUCE IN THE AMOUNT OF: A/ Pasta Corporation acquired 70% of Sauce Company on January 1,2021 for $630,000cash. The fair value of the other 30% ownership interest is estimated to be $270,000. ADDITIONAL INFORMATION: On the date of acquisition: * The Book Value of Sauce Company's net identifiable assets was $750,000. * Sauce's Company's Plant Assets were overvalued by $23,000 (remaining life was estimated to be 5 years). "Sauce's Company's Inventories were undervalued by $41,000 (all sold by year end). * New Goodwill was determined to be 132,000 . At year-end, it was determined that the New Goodwill was impaired by $19,800. "For 2021, Sauce reported net income of $231,000 and paid dividends of $48,000. Assume that Pasta Company uses the fully adjusted equity method to account for its Investment in Sauce. REQUIRED: ANSWER THE FOLLOWING FOUR QUESTIONS RELATED TO THE 4 SEPARATE JOURNAL ENTRIES THAT PASTA WOULD RECORD AT THE ACQUISITION DATE AND DURING 2021. NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. DATE OF ACQUISITION: THE JOURNAL ENTRY INCLUDES A DEBIT TO 'INVESTMENT IN SAUCE' IN THE AMOUNT OF: DURING 2021: ACCRUAL OF SAUCE'S NET INCOME: INCLUDES A CREDIT TO INCOME FROM SAUCE IN THE AMOUNT OF: A RECEIPT OF DIVIDENDS: INCLUDES A CREDIT TO INVESTMENT IN SAUCE IN THE AMOUNT OF: A/