Question

Paul and Michelle are married out of community of property with the inclusion of the accrual system. Michelle is contemplating a divorce, but is concerned

Paul and Michelle are married out of community of property with the inclusion of the accrual system. Michelle is contemplating a divorce, but is concerned about the financial impact this might have on her. She approaches you to determine whether Paul will have an accrual claim against her in the event of a divorce.

Notes:

1. In terms of the ante-nuptial contract, Paul has specifically excluded his Bitcoins and cash from the accrual.

2. Michelle inherited the painting from her mother's estate in 2018.

3. For their 5th wedding anniversary, Paul gifted Michelle jewelry worth R200 000.

4. Paul was awarded R130 000 in respect of non-patrimonial damages in 2019. 5. The CPI at the commencement of their marriage in 2012, was 91.5 and CPI today is 170.9. At the time of the commencement of their marriage Paul had net assets of R1 400 000 and Michelle had liabilities which exceeded her assets by R75 000

REQUIRED: Calculate the accrual claim as well as who is entitled to receive the claim.

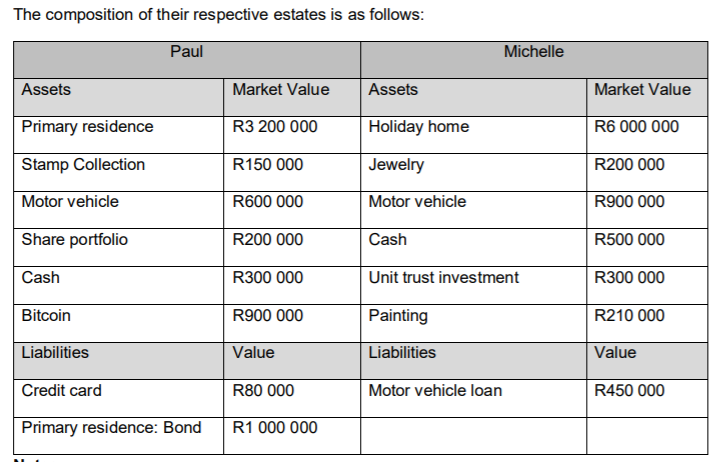

The composition of their respective estates is as follows: Assets Primary residence Stamp Collection Motor vehicle Share portfolio Cash Bitcoin Paul Liabilities Credit card Primary residence: Bond Market Value R3 200 000 R150 000 R600 000 R200 000 R300 000 R900 000 Value R80 000 R1 000 000 Assets Holiday home Jewelry Motor vehicle Cash Michelle Unit trust investment Painting Liabilities Motor vehicle loan Market Value R6 000 000 R200 000 R900 000 R500 000 R300 000 R210 000 Value R450 000

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the accrual claim and determine who is entitled to receive the claim in the event of a divorce we need to follow these steps 1 Calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started