Question

Paula Sorensen of C&I Capital LLC has hired Bank of America to help her understand her portfolio allocation decision. According to her analysis, both California

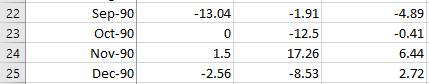

Paula Sorensen of C&I Capital LLC has hired Bank of America to help her understand her

portfolio allocation decision. According to her analysis, both California REIT and The Brown Group are

very risky investments. Both stocks have a much higher standard deviation than the Vanguard

portfolio. Indeed California REIT is the riskiest stock in terms of standard deviation. Paula is puzzled

though. When she forms a portfolio that consists of 10% of California REIT and 90% Vanguard she finds

the portfolio has less risk (standard deviation) than just investing in the Vanguard Index. Moreover,

Paula finds that investing in a portfolio that consists of 10% of The Brown Group and 90% Vanguard

results in more risk than just investing in the Vanguard Index.

You have been asked by your manager at Bank of America, John Travis, to draft a memo addressing

the following points:

?

1) Are Paula Sorensen'ss calculations correct?

- What is the total risk of California REIT and the Brown Group, and how do they compare

to the Vanguard Index Portfolio?

- What is the total portfolio risk associated with the two strategies described by Paula Sorensen?

?2) California has a beta of 0.15 and The Brown Group has a beta of 1.16. What does this mean in terms of market risk?

- Can the results obtained by Paula Sorensen for her two portfolio strategies be explained by levels of market risk? Recall that Paulas invests in either T-Bills or the Vanguard Market Index.

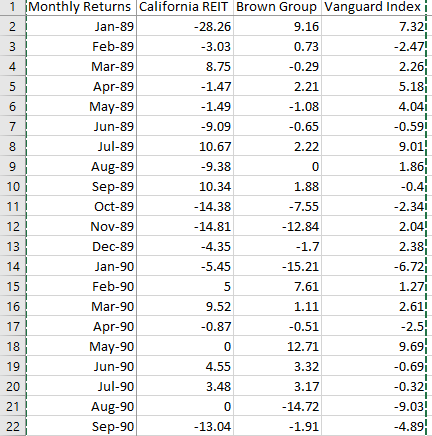

22 23 24 25 Sep-90 Oct-90 Nov-90 Dec-90 -13.04 0 1.5 -2.56 -1.91 -12.5 17.26 -8.53 -4.89 -0.41 6.44 2.72

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Memorandum To John Travis From Gemini Date November 8 2023 Subject Analysis of Paula Sorensens Portfolio Allocation Decision Introduction This memo addresses Paula Sorensens observations regarding the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started