Answered step by step

Verified Expert Solution

Question

1 Approved Answer

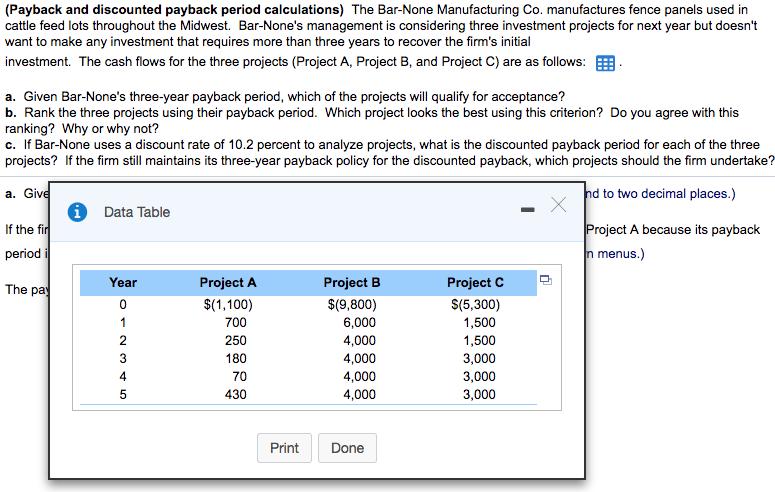

(Payback and discounted payback period calculations) The Bar-None Manufacturing Co. manufactures fence panels used in cattle feed lots throughout the Midwest. Bar-None's management is

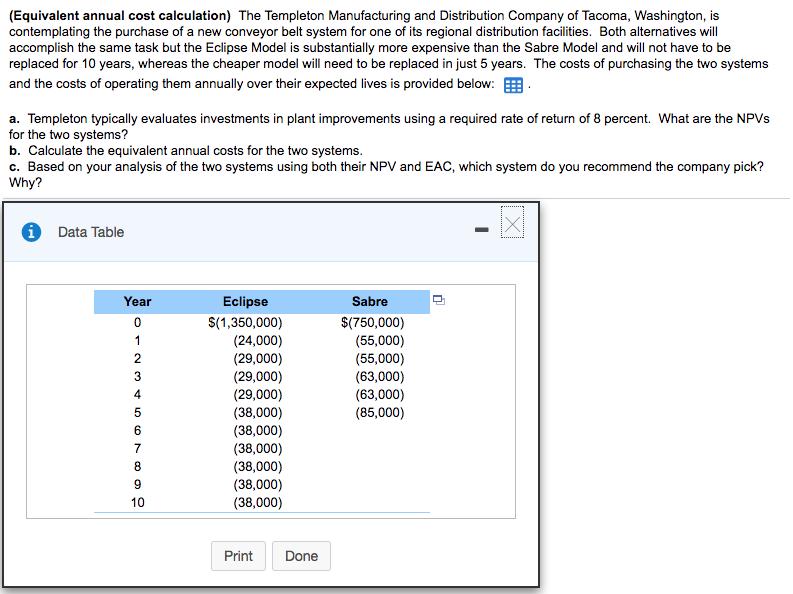

(Payback and discounted payback period calculations) The Bar-None Manufacturing Co. manufactures fence panels used in cattle feed lots throughout the Midwest. Bar-None's management is considering three investment projects for next year but doesn't want to make any investment that requires more than three years to recover the firm's initial investment. The cash flows for the three projects (Project A, Project B, and Project C) are as follows: a. Given Bar-None's three-year payback period, which of the projects will qualify for acceptance? b. Rank the three projects using their payback period. Which project looks the best using this criterion? Do you agree with this ranking? Why or why not? c. If Bar-None uses a discount rate of 10.2 percent to analyze projects, what is the discounted payback period for each of the three projects? If the firm still maintains its three-year payback policy for the discounted payback, which projects should the firm undertake? a. Give i Data Table - nd to two decimal places.) If the fir period i Project A because its payback n menus.) Year The pay Project A Project B Project C 0 $(1,100) $(9,800) $(5,300) 12345 700 6,000 1,500 250 4,000 1,500 180 4,000 3,000 70 4,000 3,000 430 4,000 3,000 Print Done (Equivalent annual cost calculation) The Templeton Manufacturing and Distribution Company of Tacoma, Washington, is contemplating the purchase of a new conveyor belt system for one of its regional distribution facilities. Both alternatives will accomplish the same task but the Eclipse Model is substantially more expensive than the Sabre Model and will not have to be replaced for 10 years, whereas the cheaper model will need to be replaced in just 5 years. The costs of purchasing the two systems and the costs of operating them annually over their expected lives is provided below: a. Templeton typically evaluates investments in plant improvements using a required rate of return of 8 percent. What are the NPVs for the two systems? b. Calculate the equivalent annual costs for the two systems. c. Based on your analysis of the two systems using both their NPV and EAC, which system do you recommend the company pick? Why? Data Table Year 0723456781 Eclipse $(1,350,000) Sabre $(750,000) (24,000) (55,000) (29,000) (55,000) (29,000) (63,000) (29,000) (63,000) (38,000) (85,000) (38,000) (38,000) (38,000) 9 (38,000) 10 (38,000) Print Done -

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started