Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paying Off That Dream House When Evelyn and Paul Peters were house hunting five years ago, the mortgage rates were pretty high. The fixed

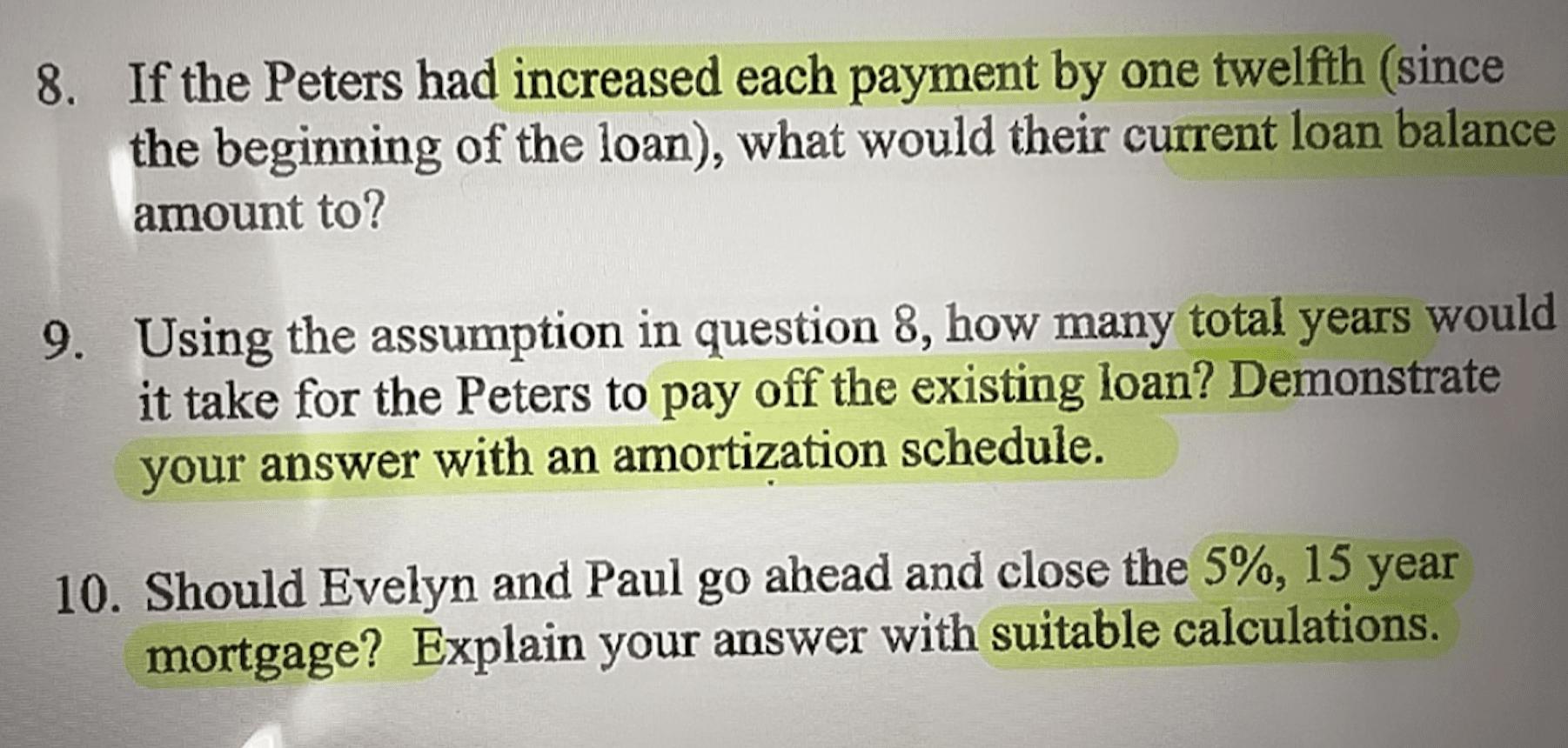

Paying Off That Dream House When Evelyn and Paul Peters were "house hunting" five years ago, the mortgage rates were pretty high. The fixed rate on a 30-year mortgage was 8.75% while the 15-year fixed rate was at 8%. After walking through many homes, they finally reached a consensus and decided to buy a $200,000 two-story house in an up and coming suburban neighborhood in the Midwest. To avoid prepaid mortgage insurance (PMI) the couple had to borrow from family members and come up with the 20% down payment and the additional required closing costs. Since Evelyn and Paul had already accumulated significant credit card debt and were still paying off their college loans, they decided to opt for lower monthly payments by taking on a 30-year mortgage, despite its higher interest rate. Currently, due to a worsening of economic conditions, mortgage rates have come down significantly and the "refinancing" frenzy is under way. Evelyn and Paul have seen 15-year fixed rates (with no closing

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Question 4 The total interest paid over the life of the original 15year 8 mortgage would have been 126000 This is calculated by multiplying the princi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started