Question

Payroll is prepared for the month of January. Paychecks will be issued February 7. Annual salary information is as follows: Bryant, $36,000; Lennox, $40,000;

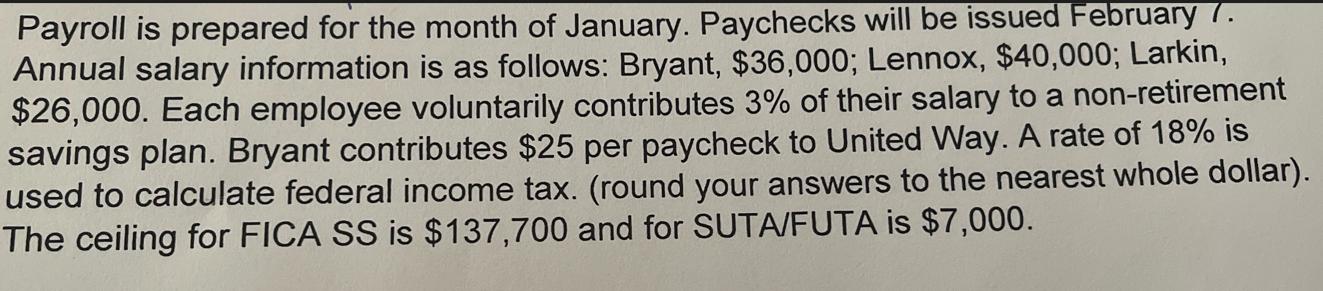

Payroll is prepared for the month of January. Paychecks will be issued February 7. Annual salary information is as follows: Bryant, $36,000; Lennox, $40,000; Larkin, $26,000. Each employee voluntarily contributes 3% of their salary to a non-retirement savings plan. Bryant contributes $25 per paycheck to United Way. A rate of 18% is used to calculate federal income tax. (round your answers to the nearest whole dollar). The ceiling for FICA SS is $137,700 and for SUTA/FUTA is $7,000.

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Contemporary Approach

Authors: David Haddock, John Price, Michael Farina

3rd edition

77639731, 978-0077639730

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App