Answered step by step

Verified Expert Solution

Question

1 Approved Answer

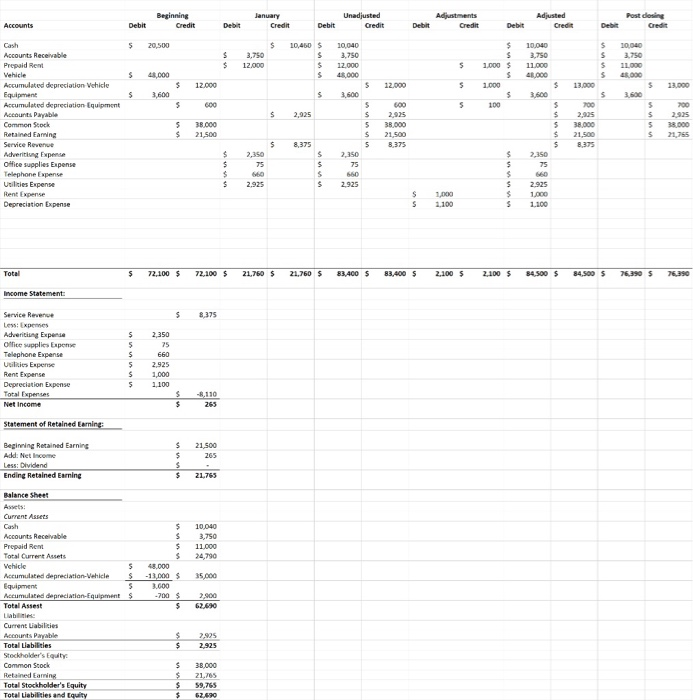

penn foster 061468... I missed 10-12 and wanted to see a solution to help better understand. Sorry. Im used the information from the Adjusted Trial

penn foster 061468... I missed 10-12 and wanted to see a solution to help better understand.  Sorry. Im used the information from the Adjusted Trial Balance to answer 10, 11, and 12

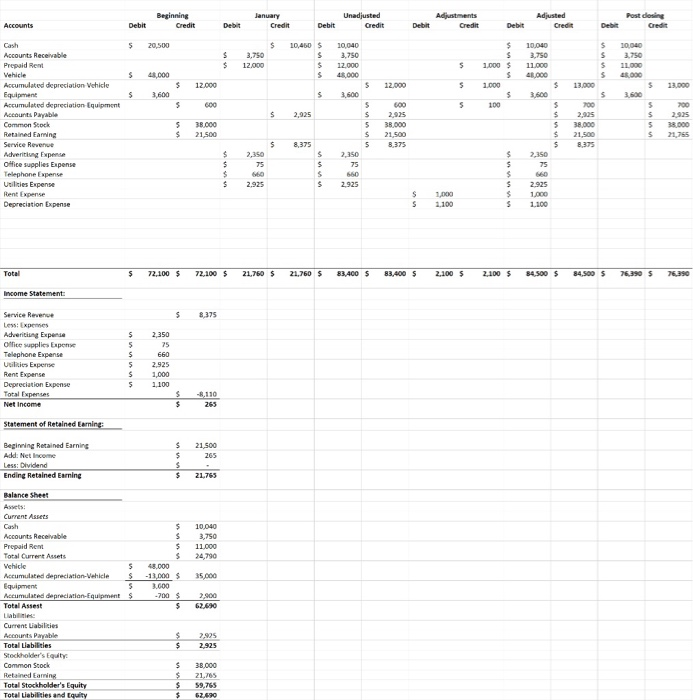

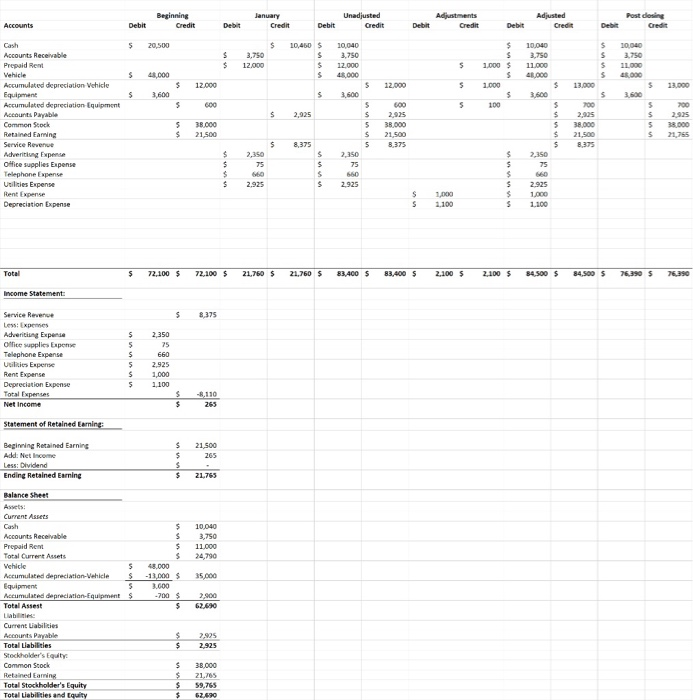

Sorry. Im used the information from the Adjusted Trial Balance to answer 10, 11, and 12  10. Create the closing journal entries in the general journal to close the revenue, expense, and dividend accounts to the retained earnings account, paying attention to debits equaling credits. 11. Post the closing journal entries to the respective general ledger accounts. 12. Calculate the balances in the general ledger accounts. 13. Create a post-closing trial balance from the balances in the general ledger accounts using the same blank form as used for the unadjusted trial balance. Your post-closing trial balance should be in the same format as the post-closing trial bal- ance provided at the beginning of the project for the prior accounting period. Make sure the math is correct and that the debit column is equal to the credit column. If not, don't continue until the error has been found. 14. Create the balance sheet for J & L Accounting, Inc. using the information from the post-closing trial balance. If the debits equal the credits from the previous work and the closing entries were made properly, then the accounting equation should bal- ance on the balance sheet. If the assets don't equal the liabilities plus stockholders' equity, an error has been made that needs to be corrected. The balance of the accounting equation is another fundamental GAAP principle that can't be violated. Use the following form to create the balance sheet. Its format should be the same as that of the statement provided at the beginning of the project. Beginning Credit Unadjusted Credit Post dosing January Credit Adjusted Credes Accounts Debit Adjustments Credit Debit Debit Debit Debit Credit $ 20,500 $ 10,450 $ $ $ $ 3.750 12.000 $ $ $ $ 10,040 3.750 12.000 48.000 10.040 3.750 11000 4000 10,040 3.750 11.000 5 1 .000 45,000 $ $ 12.000 $ 12.000 $ 2.000 $ 13,000 $ 13,000 $ $ ,600 $ 3,600 $ 500 3.600 5 600 5 100 2,925 2.925 Accounts Receivable President Vehicle S Accumulated depreciation Vehicle Equipment Accumulated depreciation Equipment Accounts Payable Common Stock Retained Earning Service Revenue Adveriting Expense office supplies Expense Telephone Expense Utilities Expense Rent Expense Depreciation Expense 5 $ 38.000 21,500 5 2,925 38.000 21,500 8.375 2,925 38.000 21,500 8,375 21,755 8,375 5 $ 2,350 2,350 2,350 $ 2,925 2.925 2.925 S 1.100 $ 1.100 $ 72,100 $ 72,100 $ 21,760 $ 21,760 $ 83,400 S 83,400 $ 2,100 $ 2,100 $ 84,500 $ 84,500 S 76.390 S 76.390 Income Statement: 5 8,375 2.350 660 Service Raven Less: Expres Advertiu Expert Office supplies Expense Telephone Expense Utilities Expense Rent Expense Depreciation Expense Total Expenses Net Income 2.925 1.000 1100 $ 8110 265 Statement of Retained Earning 21,500 Beginning Retained Earning Add: Net Income Less: Dividend Ending Retained Earning 265 $ 21.765 Balance Sheet Assets: Current Assets 10,040 3,750 11.000 24,790 $ 5 $ 48.000 - 13,000 $ 35.000 S -700 $ $ 2,900 62,690 Accounts Receivable Prepaid Rent Total Current Assets Vehicle Accumulated depreciation Vehicle Equipment Accumulated depreciation Equipment Total Assest Liabilities Current abilities Accounts Payable Total Liabilities Stockholder's Equity Common Scock Retained Earning Total Stockholder's Equity Total Liabilities and Equity $ $ 2,925 2,925 $ 38.000 21.765 59,765 62.520

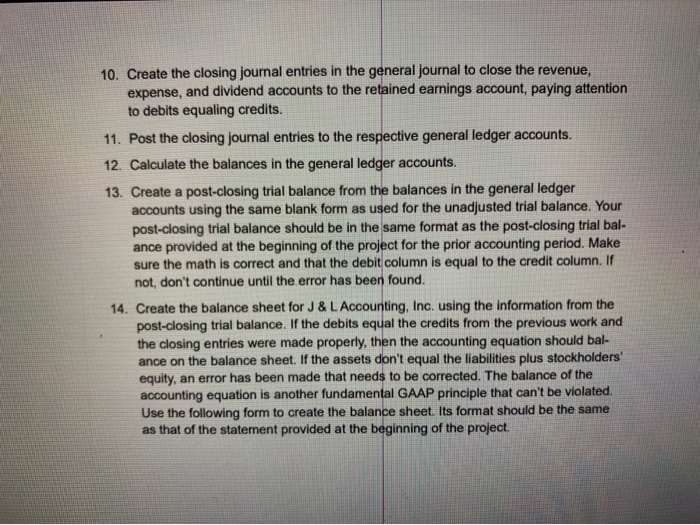

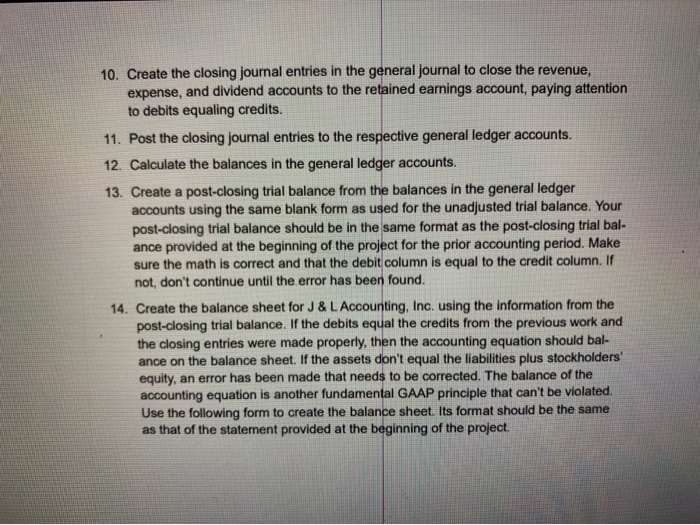

10. Create the closing journal entries in the general journal to close the revenue, expense, and dividend accounts to the retained earnings account, paying attention to debits equaling credits. 11. Post the closing journal entries to the respective general ledger accounts. 12. Calculate the balances in the general ledger accounts. 13. Create a post-closing trial balance from the balances in the general ledger accounts using the same blank form as used for the unadjusted trial balance. Your post-closing trial balance should be in the same format as the post-closing trial bal- ance provided at the beginning of the project for the prior accounting period. Make sure the math is correct and that the debit column is equal to the credit column. If not, don't continue until the error has been found. 14. Create the balance sheet for J & L Accounting, Inc. using the information from the post-closing trial balance. If the debits equal the credits from the previous work and the closing entries were made properly, then the accounting equation should bal- ance on the balance sheet. If the assets don't equal the liabilities plus stockholders' equity, an error has been made that needs to be corrected. The balance of the accounting equation is another fundamental GAAP principle that can't be violated. Use the following form to create the balance sheet. Its format should be the same as that of the statement provided at the beginning of the project. Beginning Credit Unadjusted Credit Post dosing January Credit Adjusted Credes Accounts Debit Adjustments Credit Debit Debit Debit Debit Credit $ 20,500 $ 10,450 $ $ $ $ 3.750 12.000 $ $ $ $ 10,040 3.750 12.000 48.000 10.040 3.750 11000 4000 10,040 3.750 11.000 5 1 .000 45,000 $ $ 12.000 $ 12.000 $ 2.000 $ 13,000 $ 13,000 $ $ ,600 $ 3,600 $ 500 3.600 5 600 5 100 2,925 2.925 Accounts Receivable President Vehicle S Accumulated depreciation Vehicle Equipment Accumulated depreciation Equipment Accounts Payable Common Stock Retained Earning Service Revenue Adveriting Expense office supplies Expense Telephone Expense Utilities Expense Rent Expense Depreciation Expense 5 $ 38.000 21,500 5 2,925 38.000 21,500 8.375 2,925 38.000 21,500 8,375 21,755 8,375 5 $ 2,350 2,350 2,350 $ 2,925 2.925 2.925 S 1.100 $ 1.100 $ 72,100 $ 72,100 $ 21,760 $ 21,760 $ 83,400 S 83,400 $ 2,100 $ 2,100 $ 84,500 $ 84,500 S 76.390 S 76.390 Income Statement: 5 8,375 2.350 660 Service Raven Less: Expres Advertiu Expert Office supplies Expense Telephone Expense Utilities Expense Rent Expense Depreciation Expense Total Expenses Net Income 2.925 1.000 1100 $ 8110 265 Statement of Retained Earning 21,500 Beginning Retained Earning Add: Net Income Less: Dividend Ending Retained Earning 265 $ 21.765 Balance Sheet Assets: Current Assets 10,040 3,750 11.000 24,790 $ 5 $ 48.000 - 13,000 $ 35.000 S -700 $ $ 2,900 62,690 Accounts Receivable Prepaid Rent Total Current Assets Vehicle Accumulated depreciation Vehicle Equipment Accumulated depreciation Equipment Total Assest Liabilities Current abilities Accounts Payable Total Liabilities Stockholder's Equity Common Scock Retained Earning Total Stockholder's Equity Total Liabilities and Equity $ $ 2,925 2,925 $ 38.000 21.765 59,765 62.520

penn foster 061468... I missed 10-12 and wanted to see a solution to help better understand.

Sorry. Im used the information from the Adjusted Trial Balance to answer 10, 11, and 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started