Answered step by step

Verified Expert Solution

Question

1 Approved Answer

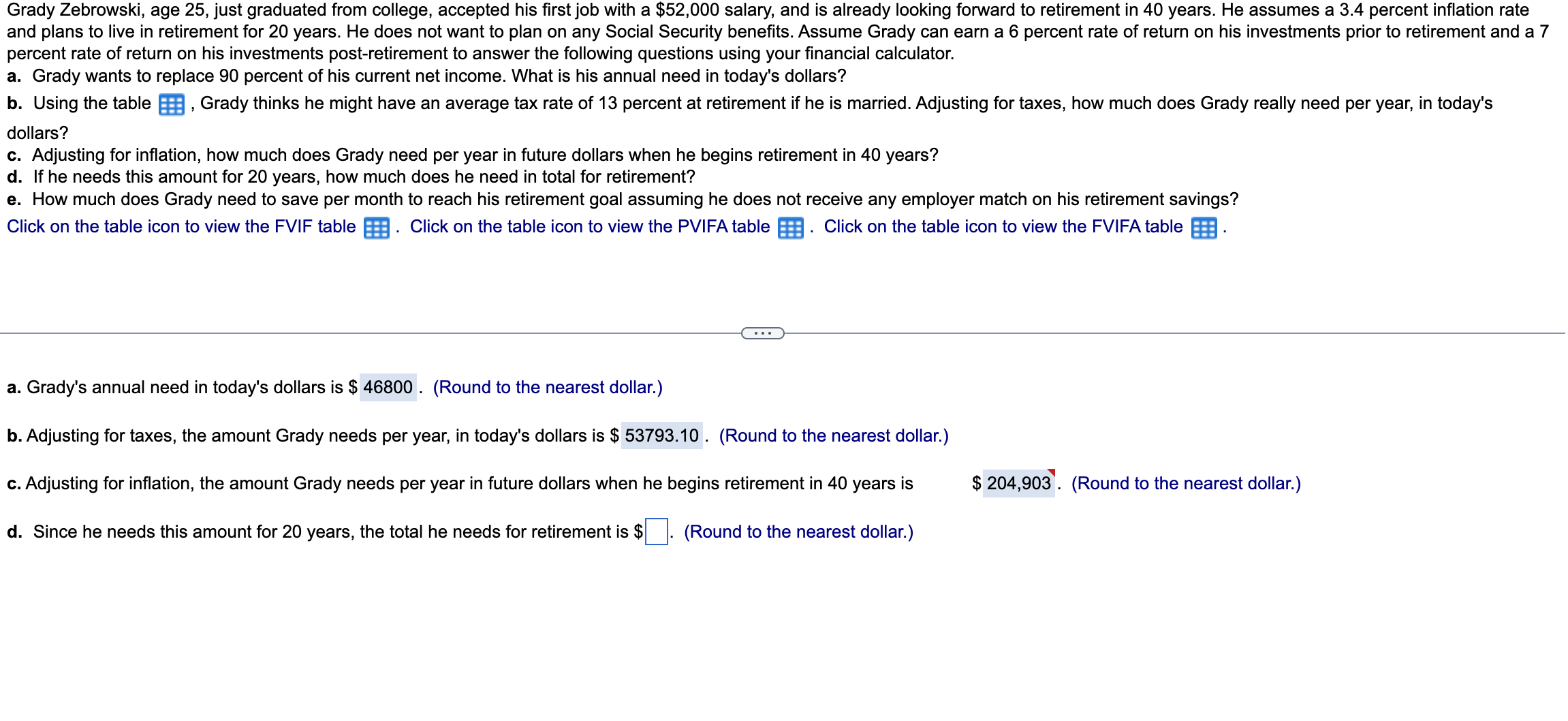

percent rate of return on his investments post-retirement to answer the following questions using your financial calculator. a. Grady wants to replace 90 percent of

percent rate of return on his investments post-retirement to answer the following questions using your financial calculator. a. Grady wants to replace 90 percent of his current net income. What is his annual need in today's dollars? dollars? c. Adjusting for inflation, how much does Grady need per year in future dollars when he begins retirement in 40 years? d. If he needs this amount for 20 years, how much does he need in total for retirement? e. How much does Grady need to save per month to reach his retirement goal assuming he does not receive any employer match on his retirement savings? Click on the table icon to view the FVIF table Click on the table icon to view the PVIFA table Click on the table icon to view the FVIFA table a. Grady's annual need in today's dollars is $ (Round to the nearest dollar.) b. Adjusting for taxes, the amount Grady needs per year, in today's dollars is @ (Round to the nearest dollar.) c. Adjusting for inflation, the amount Grady needs per year in future dollars when he begins retirement in 40 years is (Round to the nearest dollar.) d. Since he needs this amount for 20 years, the total he needs for retirement is $ (Round to the nearest dollar.)

percent rate of return on his investments post-retirement to answer the following questions using your financial calculator. a. Grady wants to replace 90 percent of his current net income. What is his annual need in today's dollars? dollars? c. Adjusting for inflation, how much does Grady need per year in future dollars when he begins retirement in 40 years? d. If he needs this amount for 20 years, how much does he need in total for retirement? e. How much does Grady need to save per month to reach his retirement goal assuming he does not receive any employer match on his retirement savings? Click on the table icon to view the FVIF table Click on the table icon to view the PVIFA table Click on the table icon to view the FVIFA table a. Grady's annual need in today's dollars is $ (Round to the nearest dollar.) b. Adjusting for taxes, the amount Grady needs per year, in today's dollars is @ (Round to the nearest dollar.) c. Adjusting for inflation, the amount Grady needs per year in future dollars when he begins retirement in 40 years is (Round to the nearest dollar.) d. Since he needs this amount for 20 years, the total he needs for retirement is $ (Round to the nearest dollar.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started