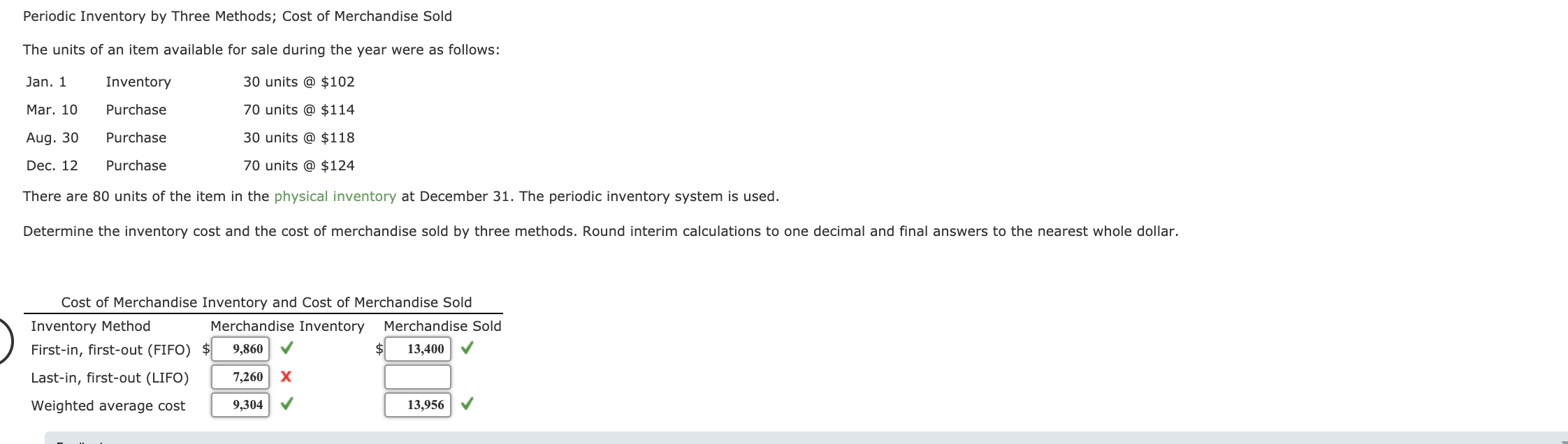

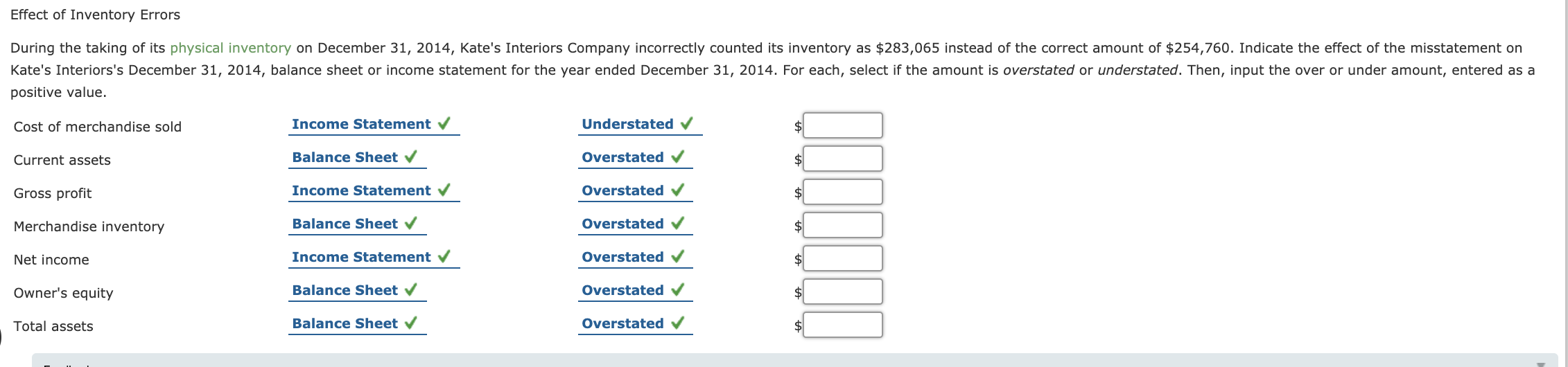

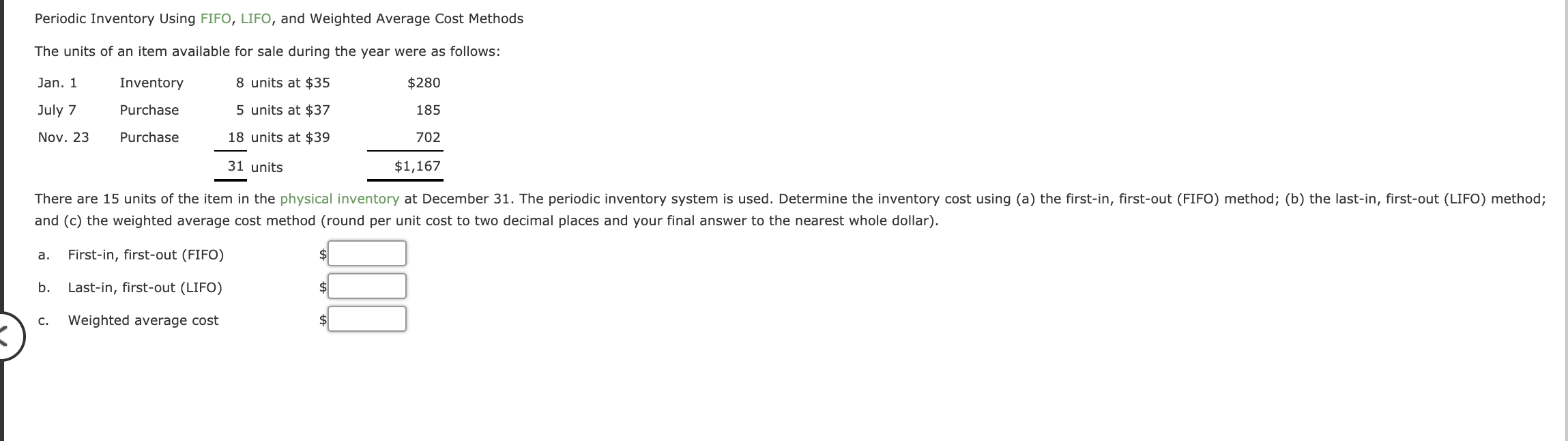

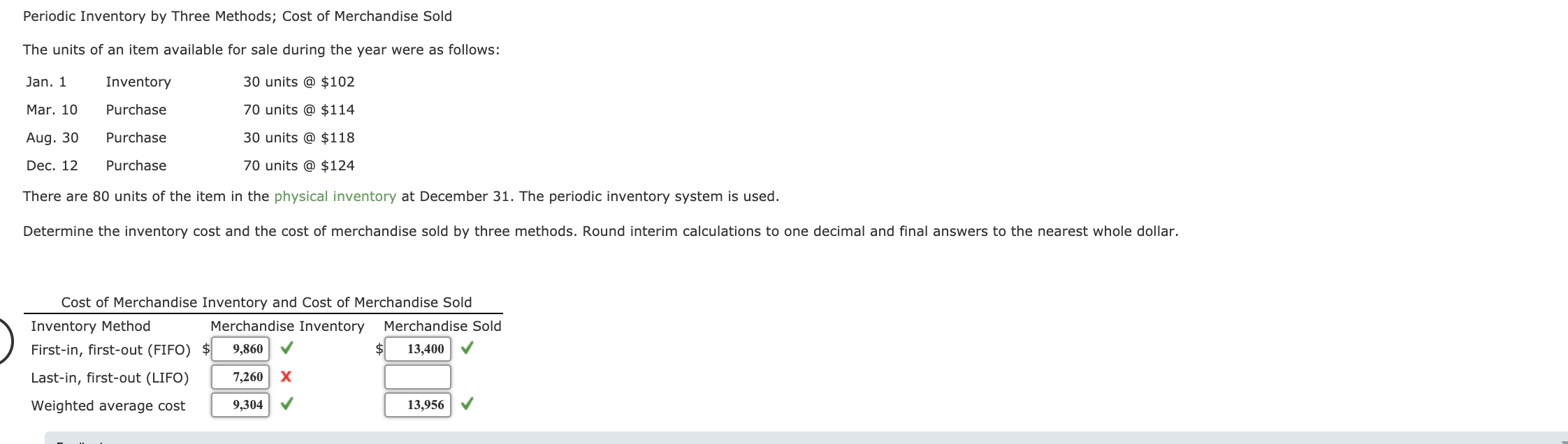

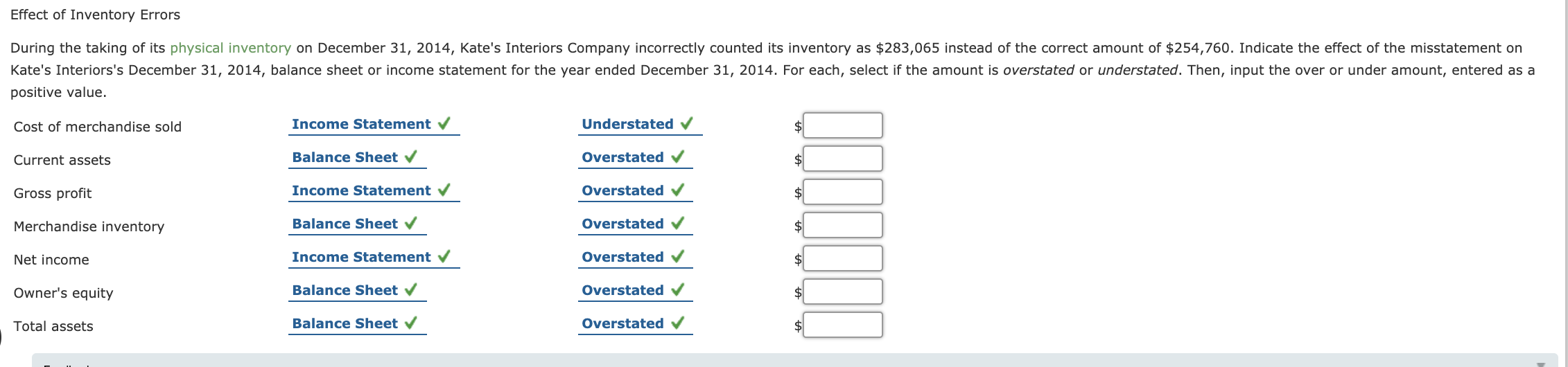

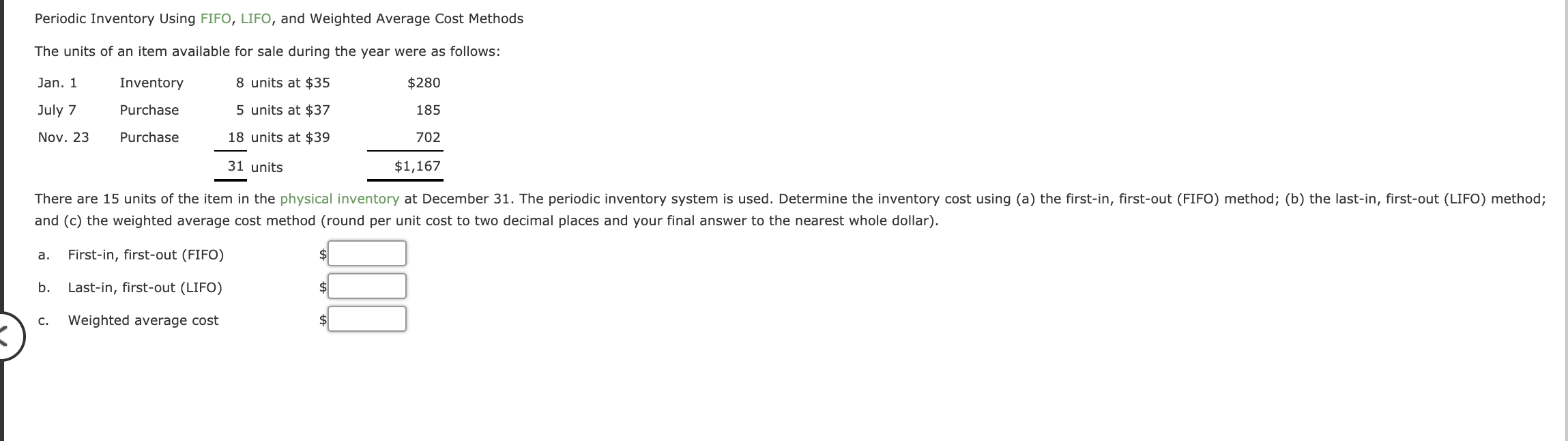

Periodic Inventory by Three Methods; Cost of Merchandise Sold The units of an item available for sale during the year were as follows: Jan. 1 Inventory 30 units @ $102 Mar. 10 Purchase 70 units @ $114 Aug. 30 Purchase 30 units @ $118 Dec. 12 Purchase 70 units @ $124 There are 80 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost and the cost of merchandise sold by three methods. Round interim calculations to one decimal and final answers to the nearest whole dollar. Cost of Merchandise Inventory and Cost of Merchandise Sold Inventory Method Merchandise Inventory Merchandise Sold First-in, first-out (FIFO) $ 9,860 $ 13,400 Last-in, first-out (LIFO) 7,260 Weighted average cost 9,304 13,956 Effect of Inventory Errors During the taking of its physical inventory on December 31, 2014, Kate's Interiors Company incorrectly counted its inventory as $283,065 instead of the correct amount of $254,760. Indicate the effect of the misstatement on Kate's Interiors's December 31, 2014, balance sheet or income statement for the year ended December 31, 2014. For each, select if the amount is overstated or understated. Then, input the over or under amount, entered as a positive value. Cost of merchandise sold Income Statement Understated Current assets Balance Sheet Overstated Gross profit Income Statement Overstated Merchandise inventory Overstated Net income Balance Sheet Income Statement Balance Sheet Overstated Owner's equity Overstated Total assets Balance Sheet Overstated $ Periodic Inventory Using FIFO, LIFO, and Weighted Average Cost Methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory 8 units at $35 $280 July 7 Purchase 5 units at $37 185 Nov. 23 Purchase 18 units at $39 702 31 units $1,167 There are 15 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using (a) the first-in, first-out (FIFO) method; (b) the last-in, first-out (LIFO) method; and (c) the weighted average cost method (round per unit cost to two decimal places and your final answer to the nearest whole dollar). a. First-in, first-out (FIFO) $ b. Last-in, first-out (LIFO) $ C. Weighted average cost