Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Personal Finance Question 10 Life insurance proceeds are generally not taxable to the insured. benefactor. administrator. beneficiary. A stock's is a measure of an investment's

Personal Finance

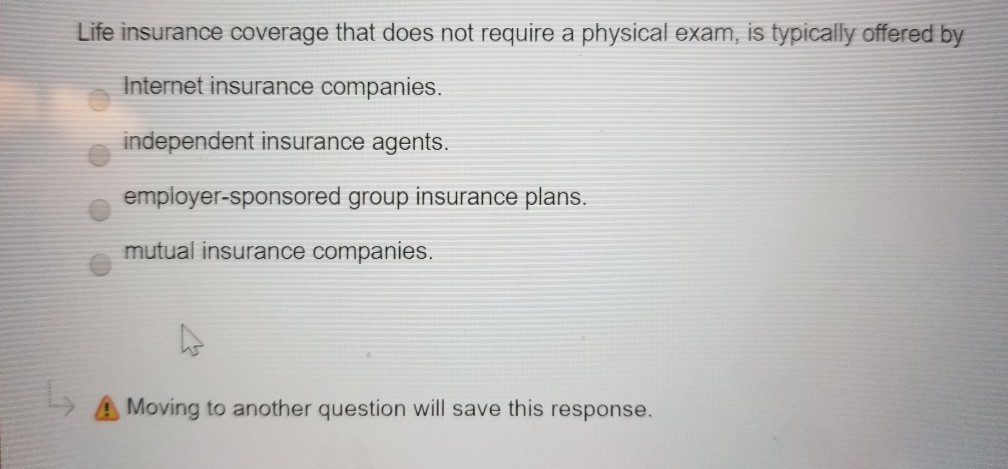

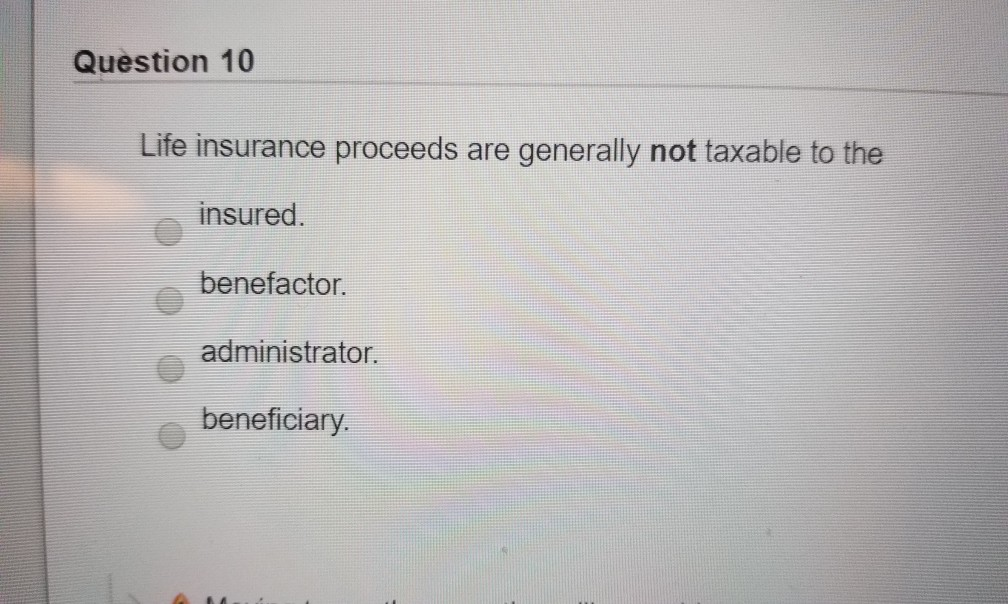

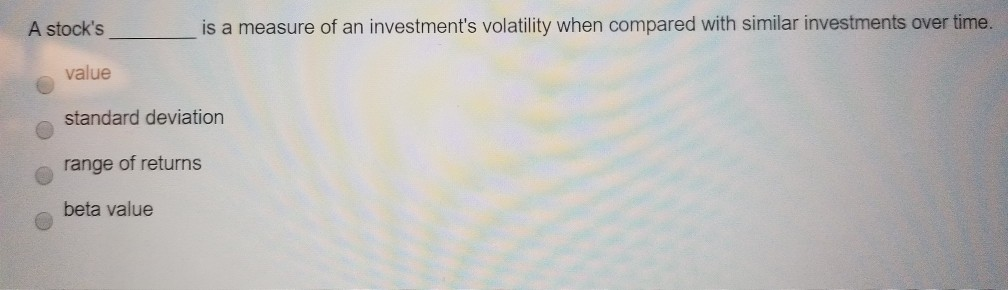

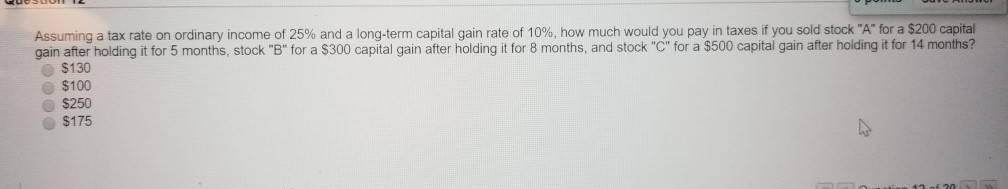

Question 10 Life insurance proceeds are generally not taxable to the insured. benefactor. administrator. beneficiary. A stock's is a measure of an investment's volatility when compared with similar investments over time. value standard deviation range of returns beta value Assuming a tax rate on ordinary income of 25% and a long-term capital gain rate of 10%, how much would you pay in taxes if you sold stock "A" for a $200 capital gain after holding it for 5 months, stock "B" for a $300 capital gain after holding it for 8 months, and stock "C" for a $500 capital gain after holding it for 14 months? $130 $100 $250 $175Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started