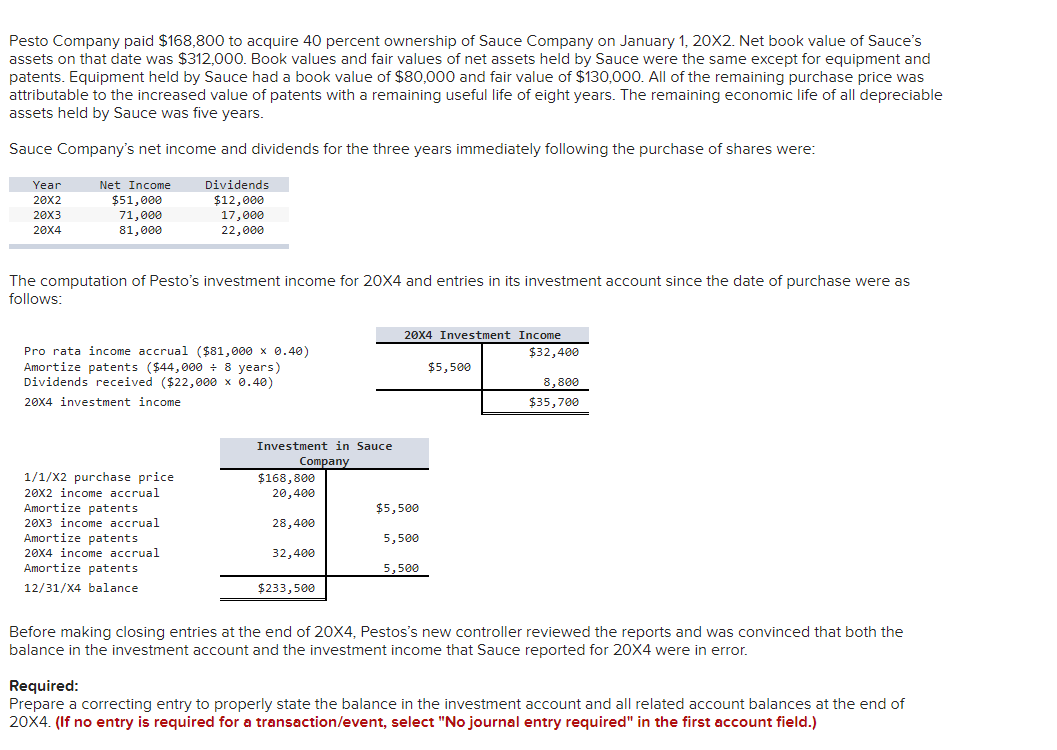

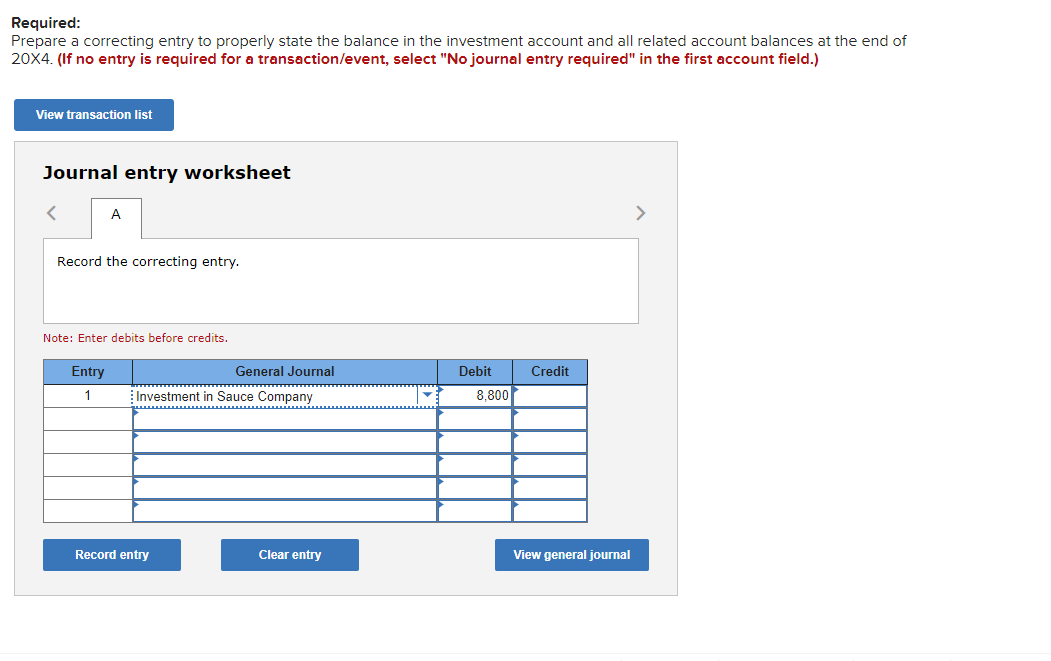

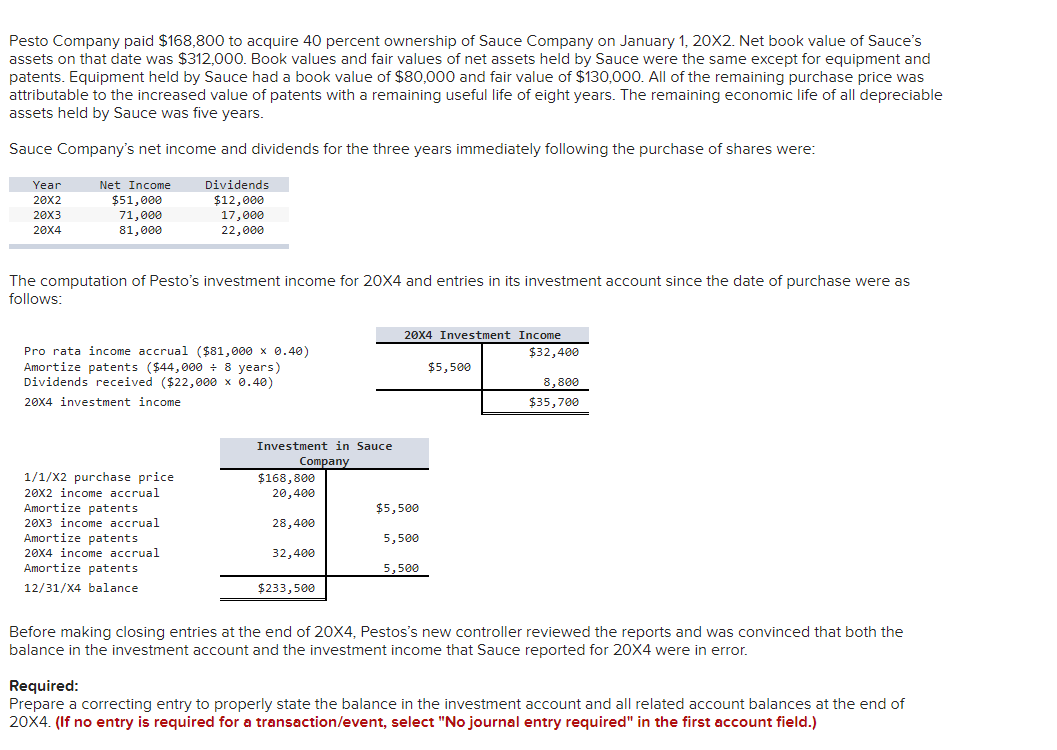

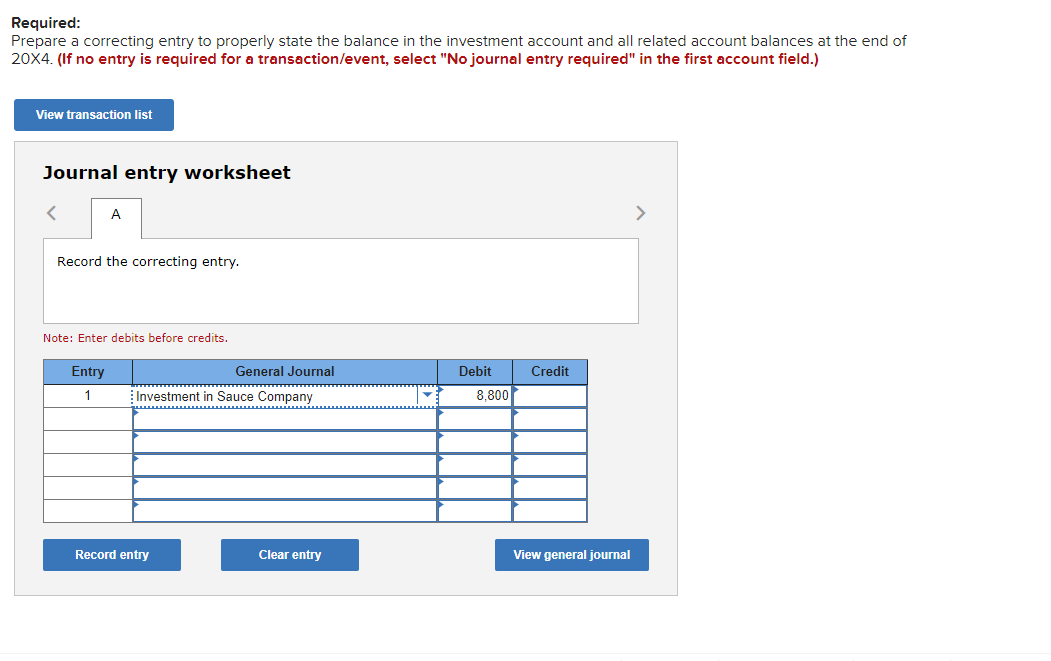

Pesto Company paid $168,800 to acquire 40 percent ownership of Sauce Company on January 1, 20X2. Net book value of Sauce's assets on that date was $312,000. Book values and fair values of net assets held by Sauce were the same except for equipment and patents. Equipment held by Sauce had a book value of $80,000 and fair value of $130,000. All of the remaining purchase price was attributable to the increased value of patents with a remaining useful life of eight years. The remaining economic life of all depreciable assets held by Sauce was five years. Sauce Company's net income and dividends for the three years immediately following the purchase of shares were: Year 20X2 20X3 20X4 Net Income $51,000 71,000 81,000 Dividends $12,000 17,000 22,000 The computation of Pesto's investment income for 20X4 and entries in its investment account since the date of purchase were as follows: Pro rata income accrual ($81,000 x 0.40) Amortize patents ($44,000 = 8 years) Dividends received ($22,000 X 0.40) 20x4 investment income 20X4 Investment Income $32,400 $5,500 8,800 $35,700 1/1/X2 purchase price 20x2 income accrual Amortize patents 20x3 income accrual Amortize patents 20x4 income accrual Amortize patents 12/31/X4 balance Investment in Sauce Company $168,800 20,400 $5,500 28,400 5,500 32,400 5,500 $233,500 Before making closing entries at the end of 20X4, Pestos's new controller reviewed the reports and was convinced that both the balance in the investment account and the investment income that Sauce reported for 20X4 were in error. Required: Prepare a correcting entry to properly state the balance in the investment account and all related account balances at the end of 20X4. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: Prepare a correcting entry to properly state the balance in the investment account and all related account balances at the end of 20X4. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record the correcting entry. Note: Enter debits before credits. Entry Credit General Journal Investment in Sauce Company Debit 8,800 1 Record entry Clear entry View general journal