Question

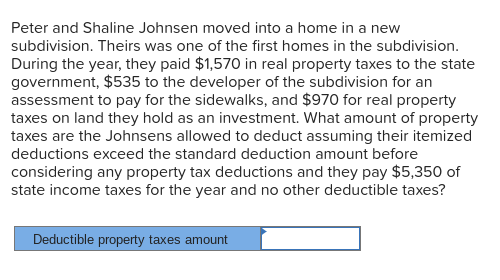

Peter and Shaline Johnsen moved into a home in a new subdivision. Theirs was one of the first homes in the subdivision. During the year,

Peter and Shaline Johnsen moved into a home in a new subdivision. Theirs was one of the first homes in the subdivision. During the year, they paid $1,570 in real property taxes to the state government, $535 to the developer of the subdivision for an assessment to pay for the sidewalks, and $970 for real property taxes on land they hold as an investment. What amount of property taxes are the Johnsens allowed to deduct assuming their itemized deductions exceed the standard deduction amount before considering any property tax deductions and they pay $5,350 of state income taxes for the year and no other deductible taxes?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started