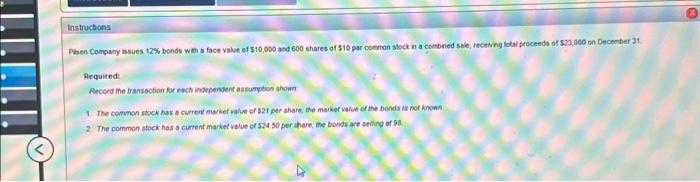

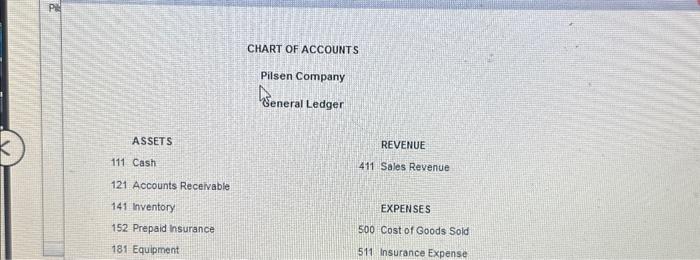

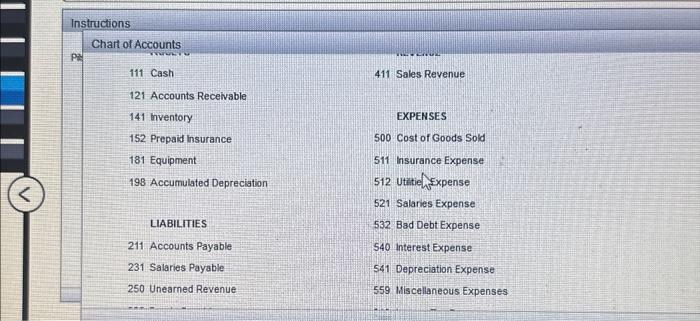

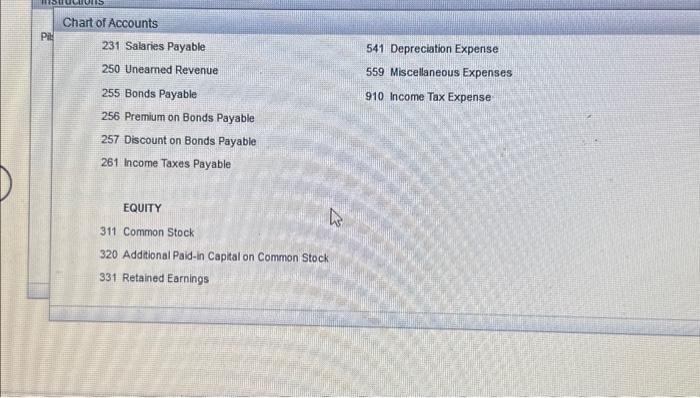

Phen Company insues. 12% bonds w th s face value of $10,600 and 600 shares of 510 par coeman stock n a combined sale, recekng total proceeds of s7a oce on Decenber 31 . Aequired: Record Ehe frassection for each indegendent asturneow shown The common sbock has a current maiket value of s2t per ahare, the mavket vake of the bonds is not knomt The common sfock has a cument market value of 524$0 per thare, ohe bonds are seilng af 98 CHART OF ACCOUNTS Pilsen Company Seneral Ledger ASSETS REVENUE 111 Cash 411 Sales Revenue 121. Accounts Receivable 141 inventory EXPENSES 152. Prepaid insurance 500 Cost of Goods Sold 181 Equipment 511 Insurance Expense Instructions Chart of Accounts 111 Cash 411 Sales Revenue 121 Accounts Receivable 141 inventory EXPENSES 152. Prepaid insurance 500 Cost of Goods Sold 181 Equipment 511 Insurance Expense 198 Accumulated Deprecistion 512 Utitiehsexpense 521 Salaries Expense LIABILITIES 532. Bad Debt Expense 211 Accounts Payable 540 interest Expense 231 Salaries Payable 541 Depreciation Expense 250 Unearned Revenue 559 Miscellaneous Expenses Chart of Accounts 231 Salaries Payable 541 Depreciation Expense 250 Uneamed Revenue 559 Miscellaneous Expenses 255 Bonds Payable 910 Income Tax Expense 256 Premium on Bonds Payable 257 Discount on Bonds Payable 261 Income Taxes Payable EQUITY 311 Common Stock 320 Addational Paid-in Capital on Common Stock 331 Retained Earnings Fecord the transaction for esch independent assumption shown on December 31 . The common sfock has a current market value of 521 per share, the market value of the bonds is nof known The common stock has a current market value of 524.50 per share, the bonds are selling of 98 . Phen Company insues. 12% bonds w th s face value of $10,600 and 600 shares of 510 par coeman stock n a combined sale, recekng total proceeds of s7a oce on Decenber 31 . Aequired: Record Ehe frassection for each indegendent asturneow shown The common sbock has a current maiket value of s2t per ahare, the mavket vake of the bonds is not knomt The common sfock has a cument market value of 524$0 per thare, ohe bonds are seilng af 98 CHART OF ACCOUNTS Pilsen Company Seneral Ledger ASSETS REVENUE 111 Cash 411 Sales Revenue 121. Accounts Receivable 141 inventory EXPENSES 152. Prepaid insurance 500 Cost of Goods Sold 181 Equipment 511 Insurance Expense Instructions Chart of Accounts 111 Cash 411 Sales Revenue 121 Accounts Receivable 141 inventory EXPENSES 152. Prepaid insurance 500 Cost of Goods Sold 181 Equipment 511 Insurance Expense 198 Accumulated Deprecistion 512 Utitiehsexpense 521 Salaries Expense LIABILITIES 532. Bad Debt Expense 211 Accounts Payable 540 interest Expense 231 Salaries Payable 541 Depreciation Expense 250 Unearned Revenue 559 Miscellaneous Expenses Chart of Accounts 231 Salaries Payable 541 Depreciation Expense 250 Uneamed Revenue 559 Miscellaneous Expenses 255 Bonds Payable 910 Income Tax Expense 256 Premium on Bonds Payable 257 Discount on Bonds Payable 261 Income Taxes Payable EQUITY 311 Common Stock 320 Addational Paid-in Capital on Common Stock 331 Retained Earnings Fecord the transaction for esch independent assumption shown on December 31 . The common sfock has a current market value of 521 per share, the market value of the bonds is nof known The common stock has a current market value of 524.50 per share, the bonds are selling of 98