Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plase explain and solve step by step Schaffer Corporation issued $560,000 of 6%, 12-year bonds payable on March 31, 2019. The market interest rate at

Plase explain and solve step by step

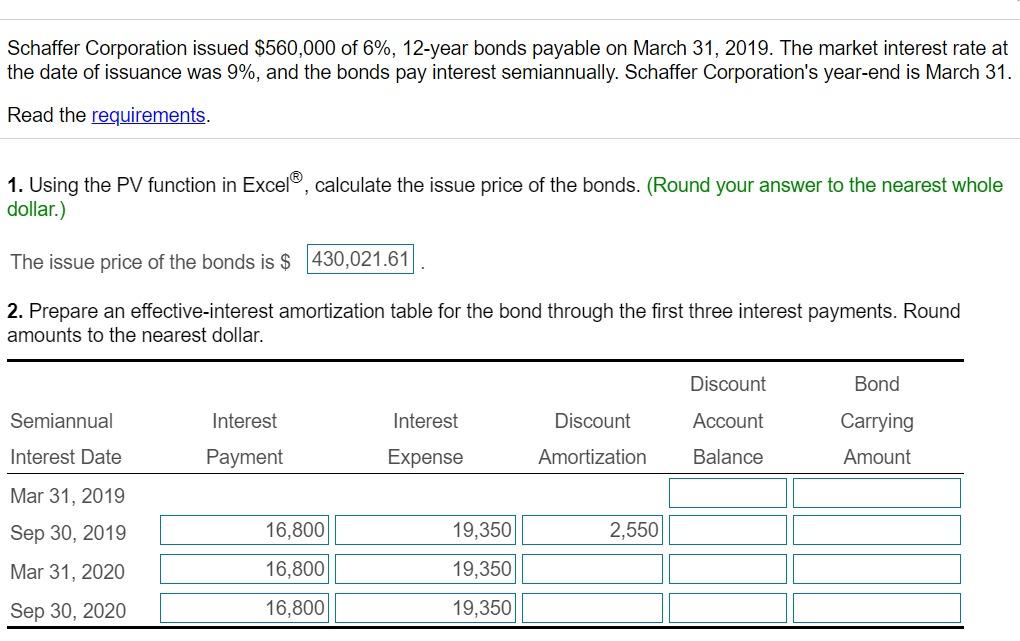

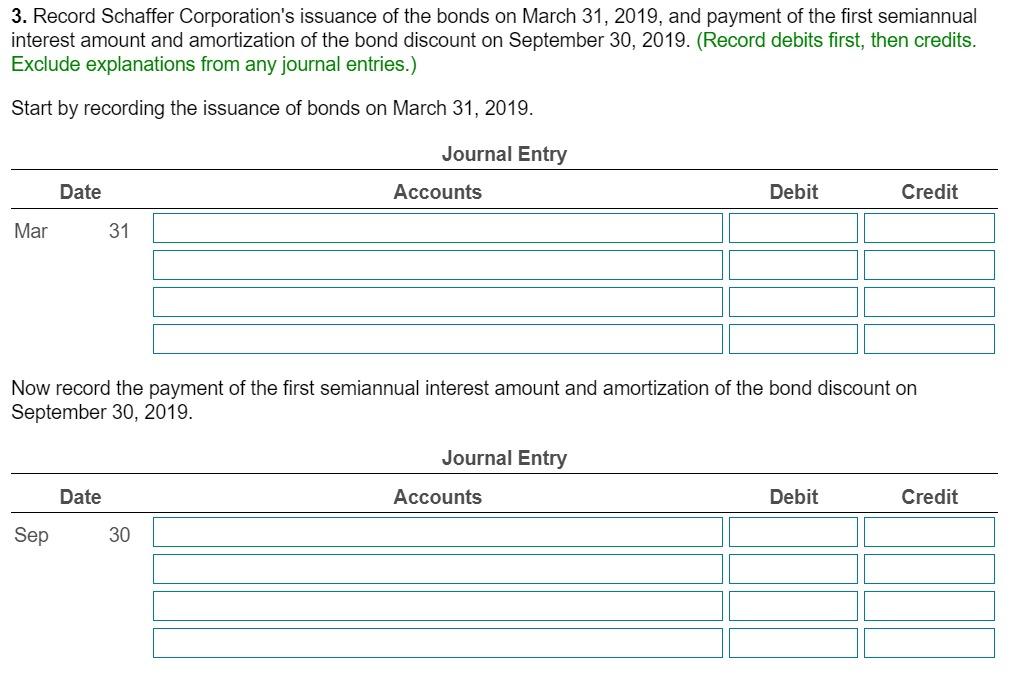

Schaffer Corporation issued $560,000 of 6%, 12-year bonds payable on March 31, 2019. The market interest rate at the date of issuance was 9%, and the bonds pay interest semiannually. Schaffer Corporation's year-end is March 31. Read the requirements. 1. Using the PV function in Excel, calculate the issue price of the bonds. (Round your answer to the nearest whole dollar.) The issue price of the bonds is $ 430,021.61 2. Prepare an effective-interest amortization table for the bond through the first three interest payments. Round amounts to the nearest dollar. Discount Bond Interest Interest Discount Account Semiannual Interest Date Carrying Amount Payment Expense Amortization Balance Mar 31, 2019 Sep 30, 2019 16,800 19,350 2,550 16,800 19,350 Mar 31, 2020 Sep 30, 2020 16,800 19,350 3. Record Schaffer Corporation's issuance of the bonds on March 31, 2019, and payment of the first semiannual interest amount and amortization of the bond discount on September 30, 2019. (Record debits first, then credits. Exclude explanations from any journal entries.) Start by recording the issuance of bonds on March 31, 2019. Journal Entry Date Accounts Debit Credit Mar 31 Now record the payment of the first semiannual interest amount and amortization of the bond discount on September 30, 2019. Journal Entry Date Accounts Debit Credit Sep 30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started