Answered step by step

Verified Expert Solution

Question

1 Approved Answer

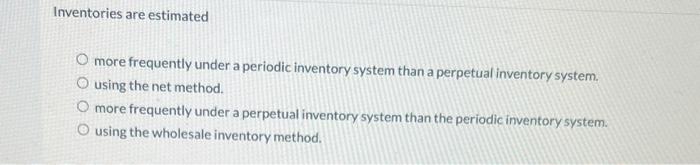

Please and thank you!! Inventories are estimated more frequently under a periodic inventory system than a perpetual inventory system. using the net method. more frequently

Please and thank you!!

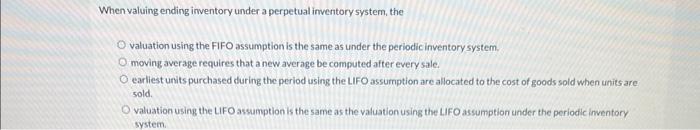

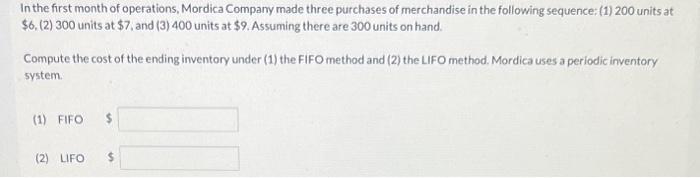

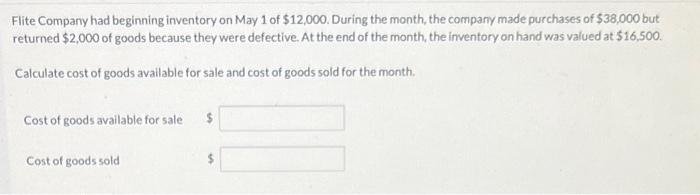

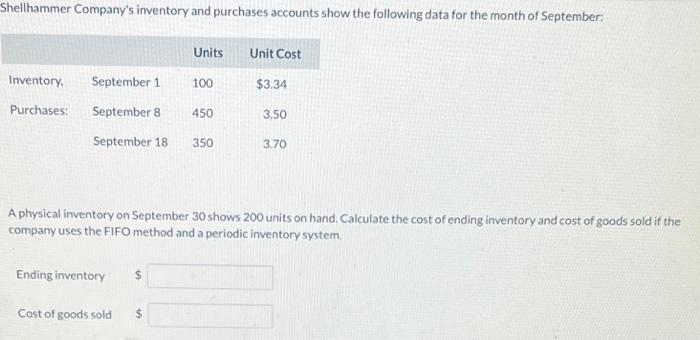

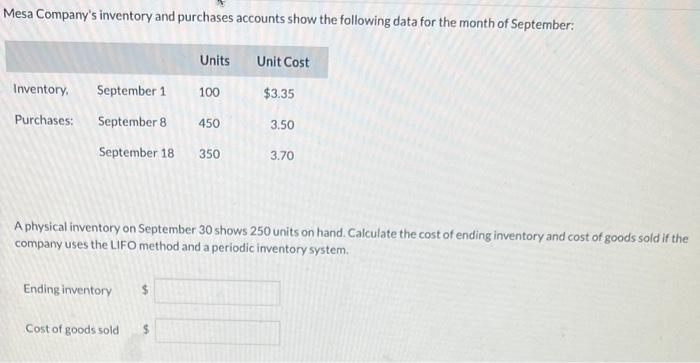

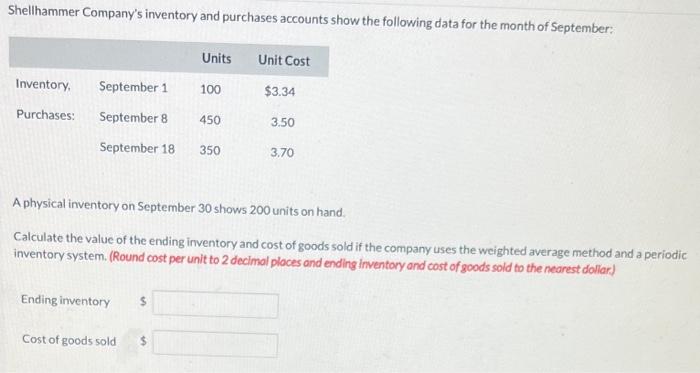

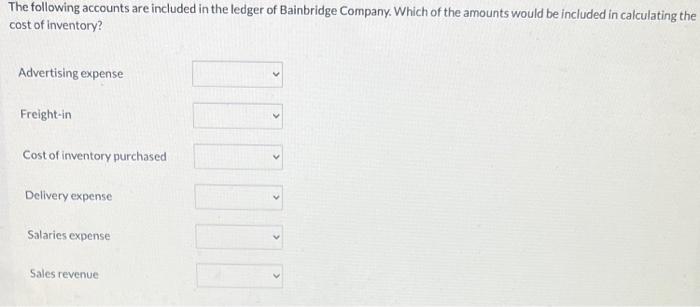

Inventories are estimated more frequently under a periodic inventory system than a perpetual inventory system. using the net method. more frequently under a perpetual inventory system than the periodic inventory system. using the wholesale inventory method. When valuing ending inventory under a perpetual inventory system, the valuation using the FIFO assumption is the same as under the periodic inventory system. moving average requires that a new average be computed after every sale. earliest units purchased during the period using the LIFO assumption are allocated to the cost of goods sold when units are sold. valuation using the LIFO assumptionis the same as the valuation using the LIFO assumption under the periodic imventory system. In the first month of operations, Mordica Company made three purchases of merchandise in the following sequence: (1) 200 units at $6, (2) 300 units at $7, and (3) 400 units at $9. Assuming there are 300 units on hand. Compute the cost of the ending inventory under (1) the FIFO method and (2) the LIFO method. Mordica uses a periodic inventory system. (1) FIFO $ (2) LIFO Flite Company had beginning inventory on May 1 of $12,000. During the month, the company made purchases of $38,000 but returned $2,000 of goods because they were defective. At the end of the month, the inventory on hand was valued at $16,500. Calculate cost of goods available for sale and cost of goods sold for the month. Cost of goods available for sale Cost of goods sold Shellhammer Company's inventory and purchases accounts show the following data for the month of September: A physical inventory on September 30 shows 200 units on hand. Calculate the cost of ending inventory and cost of goods sold if the company uses the FIFO method and a periodic inventory system. Ending inventory Cost of goods soid Mesa Company's inventory and purchases accounts show the following data for the month of September: A physical inventory on September 30 shows 250 units on hand. Calculate the cost of ending inventory and cost of goods sold if the company uses the LIFO method and a periodic inventory system. Ending inventory Cost of goods sold $ Shellhammer Company's inventory and purchases accounts show the following data for the month of September: A physical inventory on September 30 shows 200 units on hand. Calculate the value of the ending inventory and cost of goods sold if the company uses the weighted average method and a periodic inventory system. (Round cost per unit to 2 decimol ploces and ending inventory and cost of goods sold to the nearest dollar) Ending imventory The following accounts are included in the ledger of Bainbridge Company. Which of the amounts would be included in calculating the cost of inventory Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started