Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer 3. Introduction to option pricing models Aa Aa Vandelay Industries Inc. stock is currently selling for $81.45 per share. Options permit the holder

Please answer

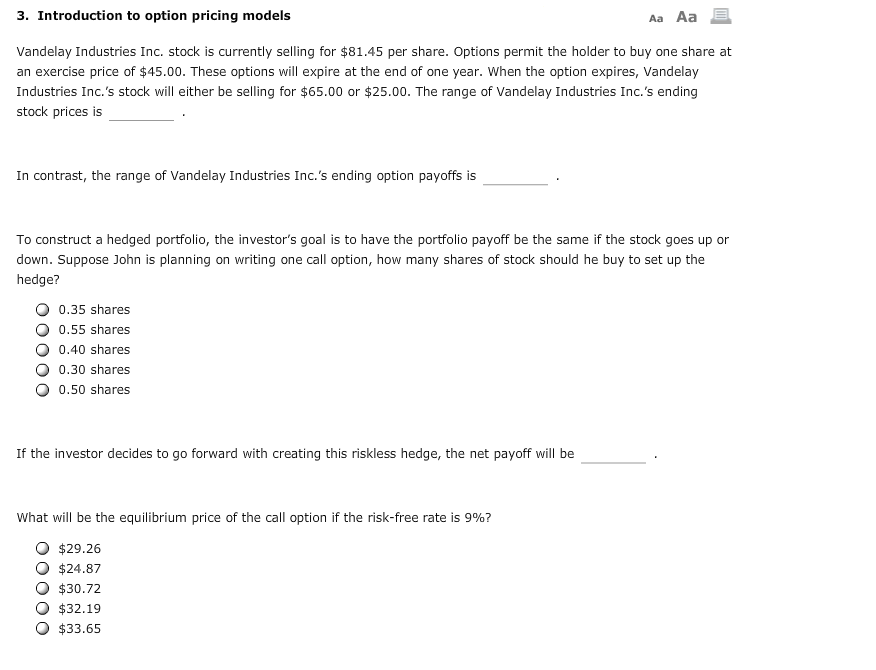

3. Introduction to option pricing models Aa Aa Vandelay Industries Inc. stock is currently selling for $81.45 per share. Options permit the holder to buy one share at an exercise price of $45.00. These options will expire at the end of one year. When the option expires, Vandelay Industries Inc.'s stock will either be selling for $65.00 or $25.00. The range of Vandelay Industries Inc.'s ending stock prices is In contrast, the range of Vandelay Industries Inc.'s ending option payoffs is To construct a hedged portfolio, the investor's goal is to have the portfolio payoff be the same if the stock goes up or down. Suppose John is planning on writing one call option, how many shares of stock should he buy to set up the hedge? O 0.35 shares O 0.55 shares 0.40 shares 0.30 shares 0.50 shares If the investor decides to go forward with creating this riskless hedge, the net payoff will be What will be the equilibrium price of the call option if the risk-free rate is 9%? O $29.26 O $24.87 O $30.72 $32.19 $33.6.5 3. Introduction to option pricing models Aa Aa Vandelay Industries Inc. stock is currently selling for $81.45 per share. Options permit the holder to buy one share at an exercise price of $45.00. These options will expire at the end of one year. When the option expires, Vandelay Industries Inc.'s stock will either be selling for $65.00 or $25.00. The range of Vandelay Industries Inc.'s ending stock prices is In contrast, the range of Vandelay Industries Inc.'s ending option payoffs is To construct a hedged portfolio, the investor's goal is to have the portfolio payoff be the same if the stock goes up or down. Suppose John is planning on writing one call option, how many shares of stock should he buy to set up the hedge? O 0.35 shares O 0.55 shares 0.40 shares 0.30 shares 0.50 shares If the investor decides to go forward with creating this riskless hedge, the net payoff will be What will be the equilibrium price of the call option if the risk-free rate is 9%? O $29.26 O $24.87 O $30.72 $32.19 $33.6.5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started