Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts of the question for a big thumbs up and a good rating. Thank you. 21. FICA taxes do not provide workers

Please answer all parts of the question for a big thumbs up and a good rating.

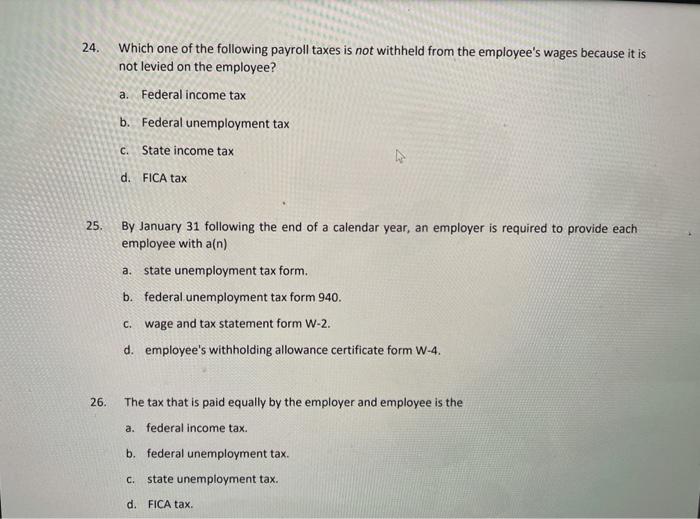

21. FICA taxes do not provide workers with a. life insurance. b. supplemental retirement. c. employment disability. d. medical benefits. 22. Employees claim allowances for income tax withholding on a. Form W-4. b. Form W-2. C. Form 1040 d. Schedule A. 23 The journal entry to record the payroll for a period will include a credit to Wages and Salaries Payable for the gross a. amount less all payroll deductions. b. amount of all paychecks issued. C. pay less taxes payable. d. pay less voluntary deductions, 24. Which one of the following payroll taxes is not withheld from the employee's wages because it is not levied on the employee? a. Federal income tax b. Federal unemployment tax C. State income tax d. FICA tax 25. By January 31 following the end of a calendar year, an employer is required to provide each employee with a(n) a.state unemployment tax form. b. federal unemployment tax form 940. c. wage and tax statement form W-2. d. employee's withholding allowance certificate form W-4. 26. The tax that is paid equally by the employer and employee is the a. federal income tax. b. federal unemployment tax. C state unemployment tax. d. FICA tax 27. The effective federal unemployment tax rate is usually a. 6.2%. b. 0.8%. C. 5.4%. d. 8.0%

Thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started